VOF downward streak continues in early 2020

|

According to the latest data from Bloomberg and The Financial Times, Vietnam Opportunity Fund’s (VOF) investment profit ratio incurred a negative 5.36 per cent in January, the worst month for the fund since 2016.

The figure was a negative 5.8 per cent as of February 3. On January 31 the net asset value (NAV) of VOF’s certificates reached $4.84 per unit, down 2.81 per cent compared to the beginning of this year.

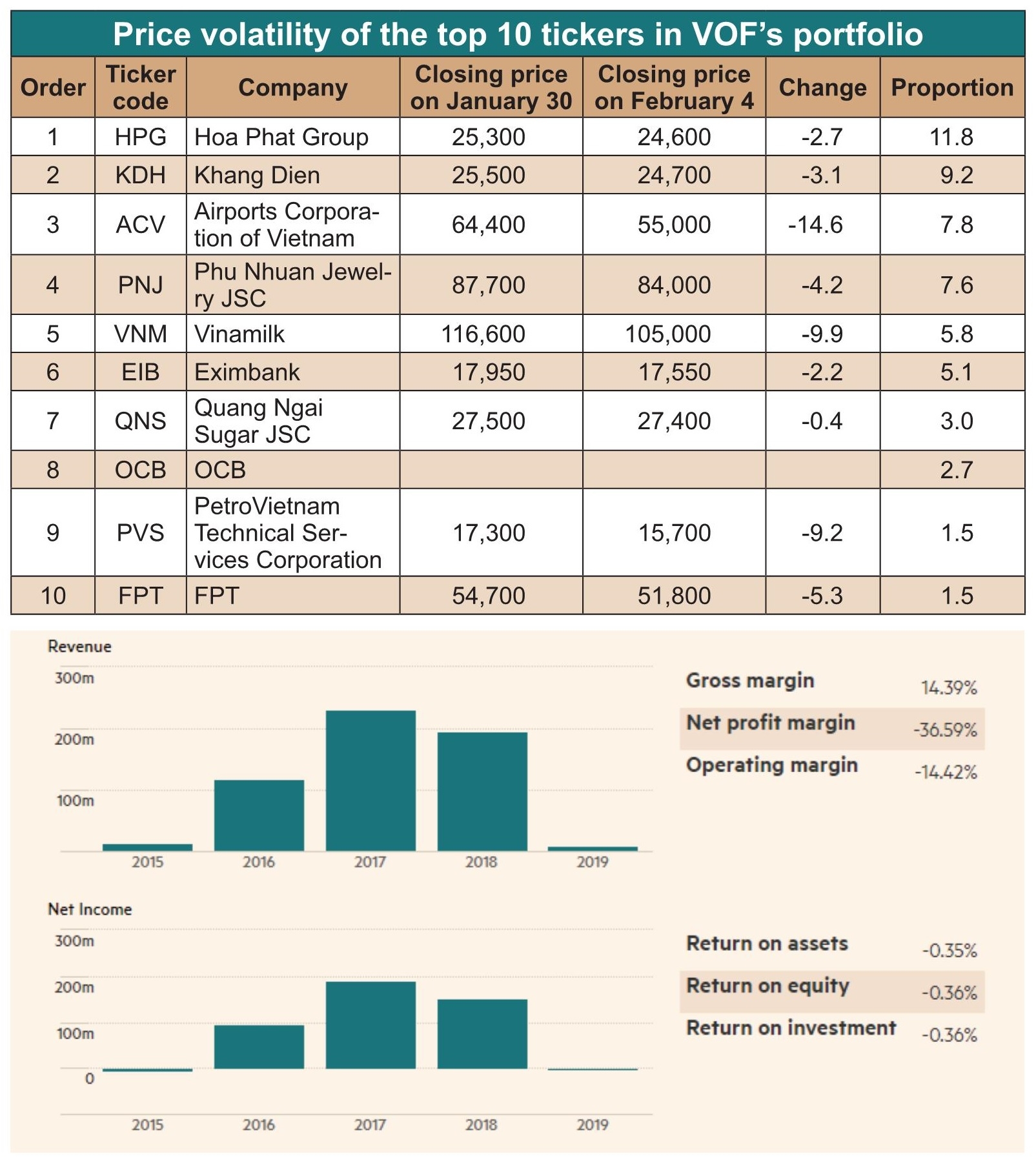

The top 10 tickers in VOF’s portfolio, according to the fund’s latest report published in late December, remained unchanged since the last report, with the HPG ticker of leading steel maker Hoa Phat Group accounting for the largest proportion of 11.8 per cent, followed by KDH, ACV, PNJ, and VNM.

In the recent volatile trading sessions, the top 10 tickers, which hold up to 56 per cent of VOF’s total net asset value, were all on a downtrend, with ACV, VNM, and PVS tumbling the most.

Financial Times figures show that VOF’s revenue had plummeted 94.9 per cent last year, falling from $195.37 million to $9.96 million by the end of 2019.

The drop in the revenue, coupled with rising expenses, has resulted in VOF’s net profit being minus $3.64 million last year from a profit of $152.74 million in 2018.

As of December 31, VOF’s NAV approximated $915.2 million, equalling $5 for each certificate, down 0.4 per cent compared to a month ago. On an annual basis, VOF’s per-share NAV growth was negative 2.7 per cent in 2019, something of an improvement against the negative 9 per cent NAV growth in 2018.

VOF’s performance is disappointing as the VN-Index jumped 7.7 per cent in 2019 based on the value of the US dollar.

In the last weeks of 2019, VOF had approached its fourth equity investment deal in the year when it intended to put $25 million into one of Vietnam’s top performers in the hospitality industry. In return, VOF will secure a seat on the firm’s board of management.

Often, only modest information was released about VOF’s equity investment deals. One of the fund’s eminent investment deals last year was a $17 million capital contribution in Ngoc Nghia Plastics.

In the past year, VOF has changed its business strategy by retrenching its investment portfolio in the capital market and venturing into promising private firms.

The shift was assessed by industry experts as a smart move in the current context of wobbling stock markets.

By the end of last year, private equity investment in VOF’s portfolio rose from 12.6 per cent in the beginning of the year to 17.1 per cent. The scale of its bond investment had also scaled up to 3.4 per cent by the end of the year, whereas cash holdings also reached 9.1 per cent. Significantly, VOF is lagging behind its peers in terms of 2019 growth rate, far behind leading players like VFMVF4 and VFMVF1.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version