Vietnam’s yields of local currency bonds outstanding declined

|

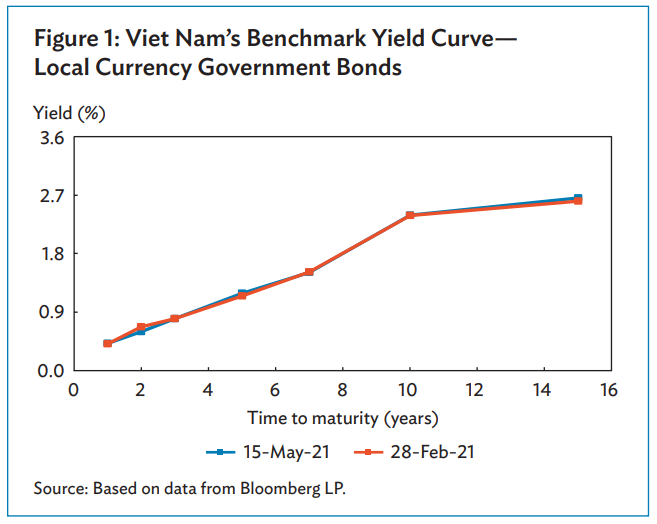

| Local currency yields of government securities rose for most tenors between February 28 and May 15 |

Vietnam’s total yields of local currency (LCY) bonds outstanding slightly declined 0.3 per cent on-quarter to VND1.6373 quadrillion($71.2 billion) at the end of Q1/2021, reversing the previous quarter’s expansion of 8.1 per cent on-quarter.

The market contraction was due to lower outstanding government debt even as corporate bonds outstanding increased.

Government bonds accounted for a dominant share of Vietnam’s bond market at 82.1 per cent versus corporate bonds with a 17.9 per cent share. On an annual basis, the bond market expanded 19.0 per cent on-year in Q1/2021, led by corporate bonds, which grew more than double during the quarter.

The government bond market contracted 1.1 per cent on-quarter in Q1/2021, reducing the government’s outstanding debt to VND1.3435 quadrillion ($58.4 billion). A large volume of maturities was seen in government securities during the quarter, which was accompanied by low or no issuance across government bond segments.

LCY government securities in Vietnam rose for most tenors between February 28 and May 15, signalling that ample liquidity remained in the system and that risk aversion is sustaining the demand for government securities, thereby limiting the increases in rates.

Beyond the region, yields on short-term (2-year) government bonds from February 28 to May 21 largely declined on the back of accommodative liquidity conditions. Uneven recovery paths and market-specific economic fundamentals, meanwhile, caused long-term (10-year) government bond yields to diverge across the region.

The People’s Republic of China (PRC); Hong Kong, China; Indonesia; and Vietnam posted declines in yields on both short-term and long-term government bonds while the Republic of Korea, Malaysia, and the Philippines posted increases.

Emerging East Asia’s local currency bond market expanded to $20.3 trillion at the end of March this year. The bond market growth moderated in the period ended March 31, slipping to 2.2 per cent from 3.1 per cent in the previous quarter, as governments in the region sought to balance fiscal policy and the private sector remained cautious amid renewed outbreaks and uneven vaccine rollouts.

“Persistent uncertainty surrounding the COVID-19 pandemic and looming inflationary pressure have put a dent in emerging East Asia’s bond markets, leading to volatility and mixed performances in the region’s financial and equity markets,” said ADB Chief Economist Yasuyuki Sawada. “The region’s fast-expanding sustainable bond markets, underpinned by a growing interest in a green and inclusive recovery and conducive public policies, will be key to the region’s efforts to rebuild smarter after the pandemic.”

Emerging East Asia comprises the PRC; Hong Kong, China; Indonesia; the Republic of Korea; Malaysia; the Philippines; Singapore; Thailand; and Vietnam.

The COVID-19 pandemic remains the biggest risk to the region’s bond markets. Renewed outbreaks, the emergence of new virus variants, and slower-than-expected vaccine rollouts in some markets may hamper economic activity. Concerns that the US Federal Reserve might tighten monetary policy in response to growing inflationary pressure are weighing on financial conditions in the region.

Emerging East Asia’s bond market was equivalent to 96.4 per cent of the region’s economic output in the first quarter of 2021. Government bonds in emerging East Asia totalled $12.6 trillion at the end of March, representing 61.8 per cent of the region’s total bond stock. The PRC remained the region’s largest bond market, accounting for 77.8 per cent of emerging East Asia’s bonds outstanding.

Sustainable bond markets in the ASEAN region plus the PRC; Hong Kong, China; Japan; and the Republic of Korea totalled $301.3 billion at the end of the first quarter, growing 13.2 per cent from the previous quarter and 44.5 per cent from a year earlier. The region’s market now accounts for about 20 per cent of the global sustainable bond market, making it the largest after Europe’s.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banks roll out God of Wealth Day promotions (February 26, 2026 | 17:10)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

Tag:

Tag:

Mobile Version

Mobile Version