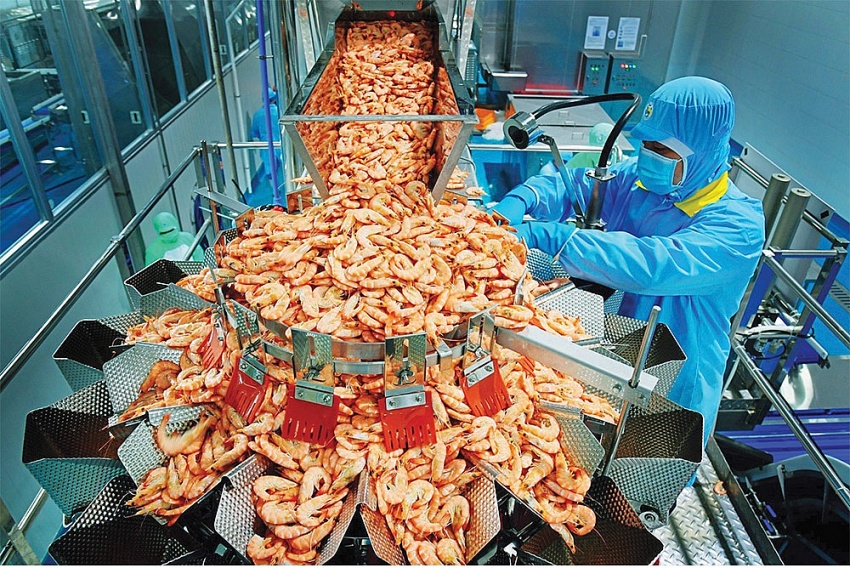

Vietnamese shrimp a gateway to EU market

According to Vietnam Association of Seafood Exporters and Producers (VASEP) data, the country’s shrimp export turnover in the first quarter of 2024 is estimated to have exceeded $620 million, up 24 per cent compared to the same period in 2023.

|

| Vietnamese shrimp a gateway to EU market, Photo: Le Toan |

Vietnam’s competitors in the EU market include Ecuador and India. Despite this, Vietnam still maintains its advantage in the high-end segment of the market.

In its quarterly report, VASEP predicts a positive outlook for shrimp exports this year. Global shrimp supply continues to grow steadily.

Shrimp from Ecuador, Vietnam’s top competitor in the EU market, is expected to decrease slightly in 2024 due to escalating tensions in the Red Sea, leading to significant increases in maritime transportation costs and security instability. In a speech on April 4, Houthi leader Abdul Malik al-Houthi stated that his forces had carried out 34 attacks in the past month and would continue to target vessels in the Red Sea.

Meanwhile, Vietnam’s shrimp exports are forecasted to recover and increase by 10-15 per cent this year. Demand is expected to rebound in the last six months of the year as inflationary pressures ease and importer inventories decline. This presents an opportunity for shrimp prices to rise again.

“Comparing tariffs allows us to see how advantageous it is for us if we can leverage the EU-Vietnam Free Trade Agreement when exporting shrimp to the EU,” said trade counsellor Nguyen Hoang Thuy of the Vietnam trade office in Sweden. “Currently, our catfish products are tariff-free, while Indonesia still faces a 5.5 per cent tariff and China 9 per cent. Similarly, for shrimp products, countries without tariffs face a 12 per cent duty, while those enjoying preferences receive a 4.2 per cent tariff. Many of our shrimp products are already tariff-free.”

The EU eliminated tariffs immediately upon the effectiveness of the EVFTA for 50 per cent of tariff lines, with the remaining half gradually reducing to zero within 3-7 years for seafood products.

Vietnam still has significant potential for shrimp exports to the EU as it has only focused on seven traditional EU members, while the others remain open for exploration, Thuy said.

“In Denmark, we have only accessed 45 per cent of the shrimp market, leaving 55 per cent of potential export opportunities. Similarly, for frozen shrimp, we have only tapped into half of the potential market. Additionally, there is considerable untapped potential in various other seafood products,” added Thuy.

Despite the promising outlook, Vietnam’s seafood products still face challenges due to illegal, unreported, and unregulated yellow card issues, hindering the traceability of exported seafood and requiring significant efforts from enterprises to secure transparent sourcing, both domestically and through imports.

Currently, the EU has introduced additional regulations such as food safety certificates and social compliance certificates where EU supermarkets often require their suppliers to have third-party social compliance certification, primarily related to processing facilities. The most widely accepted social compliance certification programme is the SA8000 standard and the Business Social Compliance Initiative.

“There are some recommendations for enterprises to maximise Vietnam’s shrimp exploitation in the EU market in the future. Firstly, continue to strengthen and build sustainable seafood supply chains with clear traceability, reduce production costs, enhance product quality, and leverage strengths in deep processing,” said Le Dinh Huynh, secretary-general, Vietnam Clean and Sustainable Shrimp Alliance.

“Along with that is to promote green development and the circular economy; fulfilling social responsibilities to meet the EU market’s mandatory requirements; promoting international sustainable certifications adapted to climate change preferred by the EU market, such as organic products; and connecting deeper within the market, especially for enterprises to stay updated on EU market changes, technical barriers, and preferential tariff conditions,” Huynh added.

| Bui Ngoc To Nga, deputy quality management director, Southern Shrimp JSC The new regulations stipulate that ingredient suppliers must have collection facilities listed on the EU’s updated food safety list. In reality, very few facilities meet these requirements. Therefore, to ensure a stable supply of ingredients, companies must allocate manpower. Additionally, efforts to self-collect in farming areas leads to additional costs. Many customers in each EU country have different certification standards, leading to additional operating expenses and costs associated with working with independent assessment entities, including some certifications with similar systems that still need to be individually implemented. Current labour laws in Vietnam are not suitable for the seafood industry, causing issues when implementing Social Responsibility Standards. The seafood processing industry does not allow seasonal labour, while shrimp harvesting is seasonal, leading to labour shortages during peak seasons. Consequently, at certain times, we cannot optimise the raw materials for production expansion. Nguyen Thi Thu Sac, chairwoman, VASEP For the seafood industry’s strategic development direction to 203 and beyond, there are several major projects that concern me. Seedlings, planned land, feed, aquaculture technology, and product costs are eco-systemically linked to production, processing, and export. Currently, processing plants, production, and export are receiving significant support from government agencies. However, there are still many issues to be addressed and improved in feed, seedlings, and aquaculture technology. This is a significant factor contributing to high product costs and reduced competitiveness with major shrimp-exporting countries such as Ecuador and India. Therefore, I hope that we will invest more in science and technology, with more participation from top experts with proper scientific qualifications to develop our shrimp industry to the right level and compete with other major shrimp-exporting countries. The government and relevant ministries should also support enterprises in importing suitable raw materials for production and export. Currently, many proactive enterprises have seized and implemented processing for goods for EU countries. This is a way for us to learn from them in terms of management, production, and business practices. Now, is not a time to stand still. From there, these enterprises can procure raw materials for production. Over the next 5-10 years, we can utilise this opportunity to regenerate seafood resources and rebuild the supporting infrastructure onshore. Fishermen are also gradually transitioning to aquaculture or changing their scale. Like Norway, when transitioning, the government repurchased small boats and provided financial support to fishermen to acquire larger vessels. This is a necessary strategy for developing the seafood industry. |

| Vietnamese shrimp exporters enjoy zero taxes to US The US Department of Commerce (DOC) on August 22 released the final results of the 13th period of review (POR 13), officially imposing zero percent tariffs on 31 Vietnamese shrimp exporters. |

| Rising shrimp exports require responsibility Vietnamese shrimp is among the most-favoured agricultural products in overseas markets. However, with increasing exports also come more complications as domestic producers must comply with high standards set forth by foreign importers and their governments to avoid trade remedies. |

| FMO proposes $15 million investment in Vietnamese shrimp producer Dutch Entrepreneurial Development Bank (FMO) is mulling a credit package of $15 million for Vietnamese shrimp producer Camimex Group JSC. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version