Vietnamese M&A property deals among Asia Pacific Top Ten

|

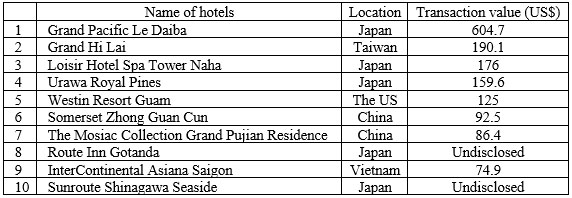

The total value of the ten biggest M&A deals reached $1.7 billion, with a total of 14,025 rooms switching hands.

Japan ranked first with five deals, followed by Australia with a total transaction value of $278 million. The runners up are China ($252.6 million), Vietnam ($237.6 million), Taiwan ($217.6 million), and Thailand ($138.3 million), in this order.

According to Michael Bachelor, managing director of JLL’s Hotel and Resort Division in the Asia Pacific, in the upcoming time a large capital inflow will hit the high-quality real estate sector. In addition, Japan is considered the most attractive destination in the second half of 2016, followed by Thailand, Vietnam, South Korea, and Myanmar, all foreseeing large M&A deals on the horizon.

The selling price of hotels located in first-grade urban areas are quite high, however, these hotels still attract investors due to their high profitability. Besides, investors are increasingly pouring finances into hotel real estate deals in second-grade urban areas to find profitable opportunities.

“The Brexit, by dropping the pounds, will limit the number of British visitors to the Asia Pacific. However, the volume of Chinese visitors will remain an important factor in the tourism sector of the Asia Pacific,” Bachelor added.

The Top 10 Biggest Hotel Real Estate Deals in Asia Pacific in the first half of 2016 (See table below)

|

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Unlocking urban potential of smart cities (December 18, 2025 | 16:50)

- Green finance offers 'passport' for Vietnamese construction, building materials firms (December 15, 2025 | 08:00)

- Gamuda Land commit long-term investment (December 12, 2025 | 11:49)

- HITC ties up with Evolution to develop AI and hyperscale data centres in Vietnam (December 11, 2025 | 12:09)

- Real estate deals boom via high-profile names (December 08, 2025 | 11:32)

- Industrial segment shaped by M&As (December 08, 2025 | 08:00)

- The Privé sets the benchmark for luxury real estate (December 05, 2025 | 08:28)

- TD CASA and the rise of bespoke interior design in luxury living spaces (December 03, 2025 | 14:14)

- Lee Soo-man's Blooming Sky to build Gia Lai culture, sport, and entertainment complex (December 02, 2025 | 16:41)

- Sustainability in DNA of Keppel Vietnam's future urban development strategy (November 28, 2025 | 10:53)

Mobile Version

Mobile Version