Vietnam sizes up for speedy growth

|

| Figures in industrial production, manufacturing, and processing all moved in the right direction last year, photo Le Toan |

Nguyen Thi Nhan feels happy with her work now. The 34-year-old worker used to work for a number of foreign companies in Hanoi before coming to work for Japanese-backed furniture producer Nitori Funiture Vietnam EPE in Quang Minh Industrial Park in Hanoi’s Me Linh district eight years ago.

For Lunar New Year, Nhan was granted some gifts and a bonus from the company which she told VIR will help her four-member family “save costs significantly” compared to similar events in previous years, when she had to spend a lot to prepare for the festive season.

“Our company is flourishing after some slowdown. However, we haven’t had to stop work as the company has had big orders from foreign partners. We can even work overtime as permitted by law,” Nhan said. “The life of nearly 2,000 workers at the company has been improved and we are all happy about that. With the bonus and the salary, I have been able to buy a new TV and refrigerator,” Nhan said. “The company is reported to continue expanding production here.”

Two weeks ago, the Japan External Trade Organization released the results of its survey on Japanese investment in Asia and Oceania for 2021. Of the over 700 businesses in Vietnam that responded, about 55 per cent of Japanese businesses look to expand their operations in the next 1-2 years in Vietnam, up 8.5 percentage points against the previous year, ranking first in ASEAN.

Also, the rate of Japanese firms operating in Vietnam that were projected to have been profitable last year was 54.3 per cent, up 4.7 percentage points compared to 2020.

Meanwhile, 56.2 per cent of surveyed businesses answered “improved” in terms of business profit prospects in 2022 compared to 2021. The number of Japanese businesses investing and operating in Vietnam saying their profit improved hit 31.4 per cent, an increase compared to the last survey in 2020.

|

On the rise

Global analysts FocusEconomics last week noted that the Vietnamese economy rebounded sharply in Q4 of 2021, with GDP expanding at a solid rate following Q3’s historic contraction. Growth was once again underpinned by strong output from the manufacturing sector, in the most part powered by a continued improvement in foreign demand dynamics, as indicated by rising goods exports in the quarter.

Last year, Vietnam’s added value for industrial production increased 4.82 per cent on-year, up from the on-year climb of 3.36 per cent in 2020. In which, that of the manufacturing and processing sector creating 80 per cent of industrial growth climbed 6.37 per cent on-year, higher than the on-year expansion of 5.82 per cent in the same period last year. The electricity production and distribution rose 5.24 per cent on-year, also higher than the on-year ascension of 3.92 per cent in 2020.

“Looking ahead, industrial production is projected to accelerate this year from 2021’s average level, as the pandemic abates and associated restrictions are eased. Moreover, the underlying strength of Vietnam’s industrial sector remains intact: Vietnam is an attractive low-cost base for manufacturing firms, including those looking to relocate from China. Our panellists estimate that industrial output will grow 8.4 per cent in 2022, and 8.7 per cent in 2023,” FocusEconomics said.

Turning to the new year, it is expected that there will be a continuation of strong activity growth in Q1 of 2022. In early January, the government approved over $15 billion in stimulus measures aimed at supporting the economic recovery, including tax breaks, cheaper loans, and increased infrastructure spending.

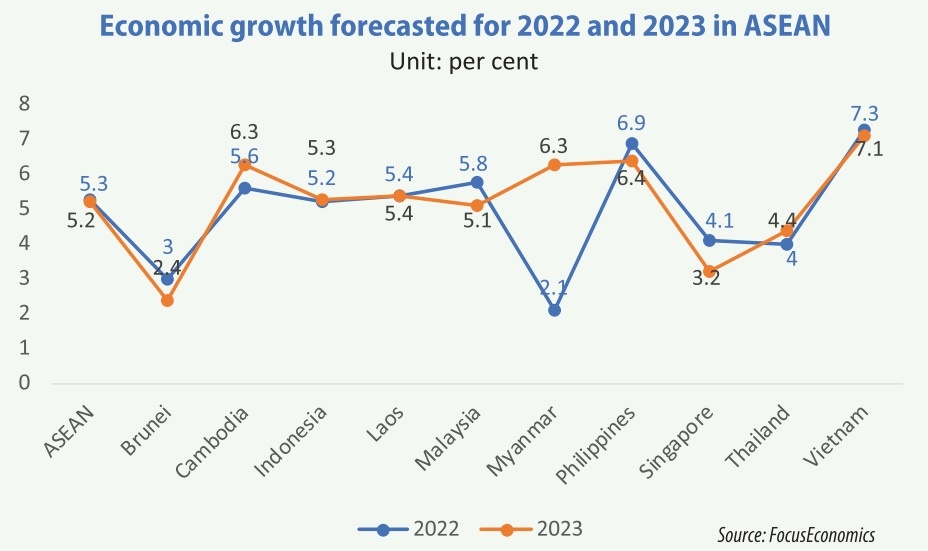

“The Vietnamese economy is estimated to grow at the fastest rate in the region this year (see chart), following 2021’s relatively weak expansion. Higher growth in consumer and capital spending, combined with a robust external sector, should boost activity in 2022,” FocusEconomics said.

For example, European companies ended 2021 more positive and optimistic about Vietnam’s trade and investment environment, according to the Business Climate Index (BCI) from the European Chamber of Commerce in Vietnam (EuroCham).

The BCI, conducted with more than 1,200 European firms in Vietnam, hit the highest point after last summer’s pandemic peak, with positive sentiment reaching 61 points. That represents a jump of 42 points since quarter three of 2021, with business leaders welcoming the end of lockdowns and the reopening of normal commercial operations.

“The BCI remains below its pre-pandemic peak. However, it is clear evidence that confidence is returning to the market,” EuroCham said in a report released over a week ago.

Fifty-eight per cent of European business leaders are now anticipating economic stabilisation and growth in quarter one of 2022, representing an 8-point rise in optimism. Meanwhile, only 17 per cent now projected a deterioration - a rate which has almost halved since the last BCI.

Business leaders are also more confident about the outlook of their own companies. Around 43 per cent plan to increase their investment in Q1, compared to just 17 per cent three months ago. Likewise, 38.5 per cent intend to raise their headcount - up about 15 per cent, while 51.5 per cent are forecasting an increase in orders and revenue, up 7.5 per cent compared to Q3 of last year.

“Our data shows that confidence and optimism are returning as companies get back to work. European business leaders are planning to increase their staffing levels, investment plans, and revenues as a result now that the pandemic is back under control,” said Thue Quist Thomasen, CEO of YouGov Vietnam which conducted the BCI.

“The challenge now is to capitalise on this positive sentiment and ensure that enterprises in all sectors and industries can operate to their full potential. In doing so, European businesses will be able to make their greatest possible contribution to Vietnam’s economic growth in 2022.”

Fresh forecasts

Looking ahead, the economy should grow at a markedly higher pace in 2022 than in the previous year as restrictions are further eased, prompting a release of pent-up consumer spending and a recovery in tourism, and as strong fiscal spending bolsters activity. However, COVID-19 infection rates still remain relatively high, with the possibility of further outbreaks a key risk given the global spread of the highly-transmissible Omicron variant.

Regarding the outlook, Suan Teck Kin and Peter Chia, economists at United Overseas Bank, commented, “We lower Vietnam’s growth forecast to 6.8 per cent (from 7.4 per cent) for 2022 against 2.6 per cent in 2021, versus the official projection of 6-6.5 per cent. It should be noted Vietnam is still in a favourable position to capture upside potential considering the low bases in 2020 and 2021, the strength of its external sectors, and the opportunities of the domestic sector adding to this growth momentum.”

Dhiraj Nim and Khoon Goh, economists at ANZ, are slightly more optimistic. “Overall, our forecast for 2022 GDP growth is at 8 per cent, higher than the market consensus. There is a large degree of uncertainty surrounding our growth forecast. Achieving it is dependent on the strong growth momentum at the end of 2021 carrying over into early 2022, and the absence of further tightening in restrictions as the country moves to an endemic strategy for dealing with the pandemic.”

FocusEconomics expects Vietnam’s GDP to expand 7.3 per cent in 2022, and 7.1 per cent in 2023.

For worker Nguyen Thi Nhan at Nitori Funiture in Hanoi, she told VIR that her husband is also working at a Japanese company near her workplace. He is now receiving some vocational training before working at a new production chain that will be imported from Japan in March.

“We are expecting a new year with sufficient work to do and this will come true as all workers at the company are working around the clock to meet deadlines,” Nhan said. “We have got our vaccinations so we feel secure at work. We do believe in the country’s economic outlook.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

Mobile Version

Mobile Version