Vietnam sets sights on regional lead

|

It has been just over a year since the first COVID-19 vaccines were administered in Vietnam, to medical staff at Hai Duong Tropical Disease Hospital in the northern province of Hai Duong and two other hospitals in Ho Chi Minh City. By late last week, over 200 million doses have been administered, including virtually everyone over the age of 18 years for at least two shots, and 40 per cent for a third shot, according to the Ministry of Health.

Vietnam last year was hit hard by the largest wave of COVID-19 infections, resulting in a sharp contraction in consumption, investments, and industrial production and an even greater impact on firms and people’s lives. As a result, the country’s GDP expanded by only 2.62 per cent in 2021.

“Nonetheless, the economy is expected to converge to its pre-pandemic growth rate of 6.5-7 per cent in 2022 and beyond, thanks to fast vaccination progress, sustained global economic recovery, and certain key drivers of economic growth which include the economy’s digital transformation,” said the Asian Development Bank (ADB) in its hallmark report titled ‘Southeast Asia: Rising from the Pandemic’ released last week.

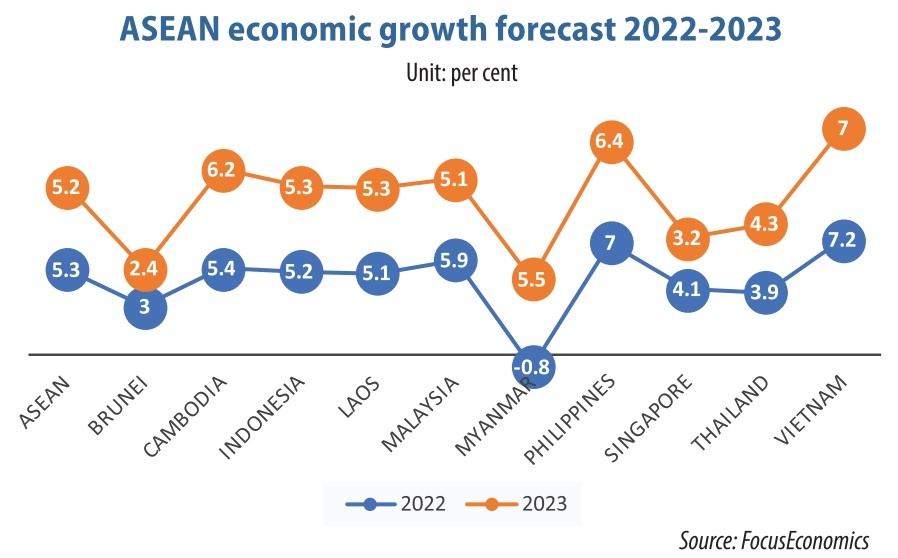

The forecast for Vietnam is the highest growth level among other regional nations and Southeast Asia as a whole (5.1 per cent) in 2022.

The ADB in Vietnam is now also compiling a new report on Vietnam’s economic outlook. It is expected that the bank will have a more positive assessment for the economy this year on the back of domestic production and businesses’ confidence gradually bouncing back thanks to a successful large-scale vaccination campaign, in addition to the government’s official reopening of the country’s doors to international tourists last week.

At the end of 2021, the ADB forecast that the Vietnamese economy would grow 6.5 per cent both in 2022 and 2023, topping Southeast Asia’s 5 and 5.1 per cent for those two years, respectively, “as expanding vaccination coverage may accelerate GDP growth.”

“We are optimistic and confident that, based on experience and lessons from the past waves, the government, together with the Vietnamese people, can contain the pandemic and regain the growth momentum,” Andrew Jeffries, country director for Vietnam of the ADB told VIR. “The government has responded swiftly to the economic impacts, which was supported by strong fundamentals, and has been instrumental in ensuring economy’s resilience.”

Prosperous economies

One of the biggest opportunities for Vietnam to achieve its target of 6-6.5 in economic growth this year set by the National Assembly is that the government last week granted a 15-day visa exemption to citizens from 13 countries upon arrival in Vietnam, irrespective of passport types and immigration purposes. The nations include the UK, some EU members, South Korea, Japan, and others.

The policy of visa exemption will be applied until March 2025 and will be reviewed for renewal in accordance with Vietnamese laws.

According to the Vietnam National Administration of Tourism, in 2019, the tourism industry created 9.2 per cent or $24.1 billion of the country’s GDP of $262 billion and generated 2.9 million jobs.

“We welcome this resolution and would like to express our gratitude to the Vietnamese government. This will, of course, go a long way in terms of promoting travel from Europe to Vietnam and is a step in the right direction towards Vietnam reaching its full potential as a premier international travel destination,” said the European Chamber of Commerce in Vietnam.

According to the administration and the Ministry of Planning and Investment (MPI), the tourism industry’s revival will help Vietnam woo more investment, which is bouncing back. The MPI reported that during January-February 20, Vietnam recorded $2.1 billion in newly registered investment and $1.6 billion disbursed, up 6.8 and 4.2 per cent on-year, respectively, in defiance of massive woes caused by the health crisis.

According to the Southeast Asia Development Solutions Knowledge and Innovation Platform (SEADS), created to sow seeds of growth to help member countries of the ADB become prosperous economies, while countries like Vietnam continue to grapple with the severe economic, health, and social impacts of the pandemic, vaccine rollouts, the promise of new treatments, substantial economic relief, and targeted social support are helping to make inroads.

“Green shoots of recovery are starting to appear, and Southeast Asian nations are now laying the groundwork for reopening, and a more enduring recovery,” said SEADS.

Underpinned by output

According to global analysts FocusEconomics, the outlook for 2022 for ASEAN remains upbeat, following 2021’s relatively muted rebound. GDP growth in the majority of countries in the region should accelerate this year, at an expected rate of 5.3 per cent for 2022 and 5.2 per cent for 2023, respectively, as higher household spending boosts domestic activity and continued foreign demand bolsters exports. Moreover, advancing vaccination campaigns bode well for activity.

“Vietnam’s economy is estimated to grow at the fastest rate in the region this year (see chart), following 2021’s relatively weak expansion. Higher growth in consumer and capital spending, combined with a robust external sector, should boost activity in 2022,” FocusEconomics told VIR. “Our panellists expect GDP to expand 7.2 per cent in 2022, and 7 per cent in 2023.”

FocusEconomics said that after the economy rebounded sharply in Q4 of 2021, with growth once again underpinned by strong output from the manufacturing sector, momentum is likely to carry over into 2022. Industrial production growth remained robust in January amid improving manufacturing output.

According to the General Statistics Office, in the first two months of this year, Vietnam’s index for industrial production (IIP) is estimated to go up by 5.4 per cent over the corresponding period last year when the IIP increased 6.8 per cent on-year. In which, the index for the manufacturing and processing sector ascended 6.1 per cent on-year, lower than the on-year rise of 9.4 per cent in the same period last year.

Though data for March and the first quarter have yet to be made available, it is expected that Vietnam’s IIP will be higher thanks to businesses’ confidence keeping an uptrend.

“Looking ahead, industrial production is projected to accelerate in 2022 as the pandemic abates and associated restrictions are eased. Moreover, the underlying strength of Vietnam’s industrial sector remains intact: Vietnam is an attractive low-cost base for manufacturing firms, including those looking to relocate from China due to the US-China trade tensions,” FocusEconomics said. “Our panellists estimate that industrial output will grow 10.5 per cent in 2022, which is up 2.1 percentage points from last month’s forecast, and expand 8.3 per cent in 2023.”

The country is doing its best to spur the economy. In early January, the government adopted more than $15 billion in stimulus measures aimed at supporting the economic recovery, including tax breaks, cheaper loans and increased infrastructure spending.

Dhiraj Nim and Khoon Goh, economists at ANZ, also felt optimistic about Vietnam’s economic outlook, writing, “Our forecast for 2022 GDP growth is at 8 per cent, higher than market consensus. There is a degree of uncertainty surrounding our growth forecast. Achieving it is dependent on the strong growth momentum at the end of 2021 carrying over into early 2022, and the absence of further tightening in restrictions as Vietnam moves to an endemic strategy for dealing with COVID-19.”n

| Available data suggests continued recovery of domestic economic activities, with industrial production growing by 8.5 per cent on-year and retail sales by 3.1 per cent on-year, although the effects of the recent surge in COVID-19 infections on labour supply, production, and consumption may not have been fully captured. While the economy continues to show resilience and is recovering, downside risks have heightened as infections are sweeping the country and the Russia-Ukraine conflict has increased uncertainty about global economic recovery, created new strains on global supply chains, and raised inflationary pressures. Commodity prices have also risen sharply and may rise further in the short term. Continued administration of the vaccine boosters and renewed health guidance are critical to managing the wave. As growth in the US, EU, and China – Vietnam’s largest export destinations – may be affected, authorities should encourage exporters to seek new markets and innovate into new products through global value chains and existing free trade agreements to strengthen export resilience. Commodity prices have increased sharply and may increase further in the short term. Keeping track of domestic price developments is therefore warranted. Nevertheless, reducing the environmental protection tax would not be the right policy to provide oil price relief.Source: World Bank |

-------------*---*---*-------------

| Giorgio Aliberti - Ambassador and Head of the European Union Delegation to Vietnam

Vietnam is expecting a brighter outlook on economic growth. The country and the EU are witnessing their trade and investment ties flourish. The EU-Vietnam Free Trade Agreement (EVFTA) and the Investment Protection Agreement (IPA) are the most ambitious agreements in terms of market access, rules and values ever concluded by the EU with a developing country. The trade and investment agreements will help complement and deepen the partnership between the EU and Vietnam and constitute an important benchmark for EU engagement in the region. Since August 2020, the EU has for the first time preferential access to a vibrant economy of almost 100 million inhabitants with the fastest-growing middle class in ASEAN and a young and dynamic workforce. As much as 48.5 per cent of the tariff lines or nearly 65 per cent of the EU exports to Vietnam have enjoyed zero tariffs since the trade deal entered into force. In fact, the EVFTA has put the EU exporters and investors at least on a par with those from other countries and regions which have already concluded FTAs with Vietnam such as ASEAN, Australia, China, India, Japan, South Korea and many more. For Vietnamese traders, the benefits after one year of implementing the FTA were even higher. Marketwise, EVFTA allows Vietnamese exporters to access more than 450 million European consumers whose disposable incomes top the world. Since the enforcement of the EVFTA, around 85.6 per cent of all tariff lines have been eliminated fully for Vietnamese commodities. This represents 70.3 per cent of Vietnam’s total exports to the EU. Such progressive elimination of import duties explains the 20 per cent year-on-year surge of Vietnam’s exports to the EU. Marko Walde - Chief representative Delegation of German Industry and Commerce in Vietnam

Vietnam remains an attractive investment destination, including for further relocations out of China, and German businesses are confident about their own business development. They expect a further revival of their own activities despite the cooling economy and are confident about business development in 2022. Some 55 per cent of German companies in Vietnam expect their own businesses to improve, while 83 per cent of survey participants intend to invest further in their activities in Vietnam and 33 per cent assume an increase in employment in the next 12 months. For the mid-term expectation, we look forward to an increase in investment from Germany into Vietnam based on the constantly improved conditions here. Many high-valued projects are expected to flow into Vietnam in the long term, including from Germany. German investors would bring their well-known technology in management and training, allowing more value-added production and less waste of material and resources. Last year, the Asia-Pacific Committee of German Business called for a stronger EU commitment in Asia and insisted on the growing importance of Vietnam as a production location. Vietnam is playing an increasingly remarkable role for German businesses in the region. Some of the potential benefits of the EVFTA for German companies are not fully realised yet due to the pandemic and various restrictions. However, the legal framework of Vietnam has been changing effectively and positively to meet new requirements of the agreement. Furthermore, many opportunities are gradually opening up when the global economic picture shows many bright spots in 2022 after a period of decline. Alain Cany - Chairman European Chamber of Commerce

The Vietnamese government’s ambitious and accelerated vaccine rollout, combined with the tireless and heroic work of our frontline healthcare professionals, has enabled a gradual re-opening of the country. Business leaders have signalled a vote of confidence in Vietnam’s trade and investment environment, with EuroCham’s Business Climate Index, our regular barometer of European business leaders, increasing by 42 points to 61 in January. Meanwhile, the EVFTA will eventually phase out almost 99 per cent of tariff lines. Even during an unpredictable global pandemic, the agreement has delivered on its promises. Last year saw a 14.8 per cent increase in trade between the EU and Vietnam, reaching about $63.6 billion. Now that the pandemic has been brought back under control, with the EVFTA in force, and with the EVIPA soon to follow, Vietnam has the chance to attract a new wave of foreign direct investment from European investors looking for a prosperous, safe, and competitive investment destination. Therefore, we applaud the government’s efforts in issuing, revising, and simplifying several regulations to align with EVFTA provisions. We were also delighted with the decision to reduce the mandatory quarantine period to three days as well as with the removal of approval procedures for foreigners with residence cards, visas, and valid visa exemption certificates. This is appreciated by Vietnam’s foreign business community. A return to pre-pandemic visa regulations is essential to bringing investment to Vietnam and for guaranteeing that the thousands of international enterprises already in the country can continue to contribute to Vietnam’s economic growth. Raymond Mallon - Senior economist

Some of the biggest risks to the Vietnamese economy are global. These include the ongoing pandemic, a slower than expected global economic recovery, rising inflationary and interest rate pressures, likely tightening of fiscal policy in major markets, and uncertainty about the Chinese economy. Other critical factors that are negatively impacting the global outlook include the impacts of – and tepid global response to – climate change, growing protectionism, and possible instability in some major markets. But there are also domestic risks that could especially impact the most vulnerable groups. Firstly, there is the real risk of another major wave of COVID-19 slowing the revival of domestic travel and services and potentially slowing economic recovery. Environmental risks are growing and are an increasing concern for Vietnamese society and businesses. Environmental deterioration will undermine efforts to promote sustainable development, improve health and the quality of life, and attract and retain the best national and international expertise in Vietnam. It will be important to continue to monitor and provide appropriate support to those most adversely impacted by the pandemic, climate change impacts, and ongoing economic restructuring. Increasing the low wages paid to public sector health and education workers could further stimulate expenditure throughout the country and help encourage employment in these key services. There is also a need for a renewed focus on building market institutions and an effective and predictable policy and regulatory environment that encourages fair, equitable, and sustainable development. Finally, it will be important to contain inflationary pressures. Maintaining macroeconomic stability will be challenging given the need for deficit spending to ameliorate the negative pandemic impacts, expected increase in international inflationary pressures, and ongoing supply chain constraints. Jacques Morisset - Lead economist and programme leader for Vietnam World Bank

I believe that Vietnam can grow again as an Asian tiger, and it started to grow again at the end of 2021. I think the government can do more and the National Assembly session to discuss this programme is a good signal. The government is aware of the situation and ready to do more. At the same time, I believe that Vietnam had great potential before the pandemic occurred, and I would argue that maybe the crisis can help to accelerate some of the reforms that Vietnam needs to become a higher-income nation by 2045. The country should further boost the development of a digital economy during the economic crisis, which would be a good signal for the future. In addition, we also see some reforms and changes in the thinking about public investment management, the economy, and the response to climate change. The commitments by Prime Minister Pham Minh Chinh at the COP26 climate summit is an indication that Vietnam is likely to move faster on this important issue. Vietnam’s goal of 6-6.5 per cent in economic growth will be feasible. You can project that Vietnam is going back to the growth trajectory of the time before the health crisis appeared, but this assumes that the world and Vietnam will not suffer any more from a big crisis. I hope that the government will stimulate the economy via spending and tax policies. If conditions materialised, I believe that there will be no reason why Vietnam will not be able to grow strongly again as it did previously, and even grow higher, because it can catch time to resume the high economic growth in the time before the pandemic occurred. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version