Vietnam - Japan enter new phase of investment ties

What are the key focuses of the initiative and how will it benefit the businesses of the two countries?

|

| Takeo Nakajima, chief representative of the Japan External Trade Organization (JETRO) in Hanoi |

In March, the Vietnam-Japan Joint Initiative in a New Era kicked off, integrating the previous 11 working teams into five.

The initiative will focus on improving the legal and institutional system and addressing fundamental business needs. These needs include energy transition, innovation promotion, strengthening supply chains, and developing highly skilled human resources.

Although the basic structure remains the same, involving various Vietnamese ministries and agencies, the public and private sectors, and progress presented approximately two years later, the content has become more symbolic of Japan-Vietnam relations as business partners. For example, transitioning to green energy is vital for Vietnam and the wider region, including Japan. Vietnam can employ technology and business models from Japan and other countries.

Also, as we see more business promotion elements, there is an increasing overlap with JETRO’s activities. We have focused on promoting innovation and enhancing supply chains over the past three years. We want to contribute to this area with tools such as matching companies and providing information.

How has Japanese investment changed since the launch of the Vietnam-Japan Joint Initiative in 2003?

It started as an agreement between the leaders of both countries. The governments, Japanese companies, and industries will work together to improve Vietnam’s investment climate. It is a remarkable initiative that will enhance Vietnam’s attractiveness and create a win-win relationship between the two countries. Government agencies and the Japanese Chamber of Commerce and Industry in Vietnam are collaborating alongside counterparts in this country.

The joint initiative has undeniably succeeded, significantly expanding investment from Japan to Vietnam. The initiative, with its substantial improvements in investment conditions and the reassuring message of dialogue remaining open, has instilled confidence and peace of mind in investors.

Japanese investment in Vietnam has expanded dramatically. In 2003, investment was $4 billion, accounting for just 9 per cent of Vietnam’s total.

Year by year, the value and share have grown, reaching $75 billion and a 16 per cent share in 2023. Japan is a crucial investor for Vietnam, ranking third in amount and second in number. In addition, the two countries are binding partners in official development assistance, trade volume, and people’s and tourism exchanges.

In order to further enhance Vietnam’s industrial competitiveness, a public-private partnership initiative was launched about two decades ago, based on consensus between the leaders of Vietnam and Japan. How has it been performing so far?

The initiative has a cycle of approximately two years. The two sides define specific issues in each field as an action plan to visualise the progress towards the final meeting.

The evaluation consists of four levels from implemented to not implemented, and the ratio of “implemented’’ and “progressed as planned’’ has reached approximately 80 per cent. In each phase, Japan and Vietnam identify up-to-date issues and work towards improvement, so the impact of their progress in solving problems is also significant.

For example, in the eighth phase, from October 2021 to March 2023, both sides discussed Vietnam’s judicial precedent system, investment law, labour environment, the securities market, renewable energy, innovation, and many other areas.

International investors are eyeing opportunities in AI and semiconductors. How about Japanese firms?

AI and semiconductors are paramount sectors for Japan, and there is a two-way movement to attract investment to Japan and Vietnam.

Regarding investment in Japan, foreign IT companies with strong AI capabilities are investing in Japan. The need is increasing dramatically due to changes in Japan’s industrial structure, consumer behaviour, and labour shortages.

From Vietnam, major IT players such as FPT and CMC and emerging tech startups like NTQ have expanded into Japan and are actively growing. The same goes for semiconductors. In the past few years, semiconductor giants such as Taiwan’s TSMC, Micron Technology, and SanDisk have announced notable investment plans in Japan. Also, the number of cases in which Japanese IT firms conduct AI development in Vietnam is rapidly increasing. The Japanese head offices outsource their tasks to their Vietnamese subsidiaries.

Additionally, Vietnamese IT companies in Japan get more contracts from Japanese firms and exercise AI development work collaboratively with their Vietnamese bases. FPT’s biggest customer is Japan. In Vietnam, there is an increasing number of collaborative projects in retail and transportation using AI between Vietnamese IT firms and Japan.

Japanese investments in the semiconductor industry in Vietnam are mainly in equipment manufacturing. Japan’s strengths lie in equipment, materials, sensors, memory, and electronic substrates, essential elements of the semiconductor industry. Each company may decide where to manufacture these products, but Vietnam is one of the substantial bases.

Vietnam also has strengths in semiconductor programming and software development. Renesas Electronics, for example, fully utilises Vietnam’s development capabilities.

| Vietnam - Japan extensive strategic partnership President Tran Dai Quang and his spouse will pay a State-level visit to Japan from May 29 and June 2. The visit aims to bolster the close relationship and political trust between senior leaders of Vietnam and Japan, contributing to strengthening the bilateral extensive strategic partnership. |

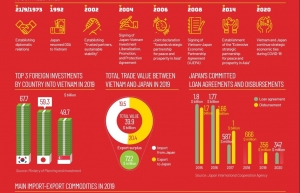

| VIETNAM - JAPAN trade and investment partnership (Infographics) VIETNAM - JAPAN trade and investment partnership |

| Vietnam-Japan Startup Forum to enhance bilateral investment The Vietnamese Embassy in Japan hosted the 'Vietnam-Japan Startup Forum' on October 14 as it hopes to foster genuine, effective collaboration between potential investors and the Vietnamese startup community. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- MAE names big 10 policy wins in 2025 (February 06, 2026 | 08:00)

- US firms deepen energy engagement with Vietnam (February 05, 2026 | 17:23)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

Tag:

Tag:

Mobile Version

Mobile Version