Vietnam in crosshairs for South Korean startups

|

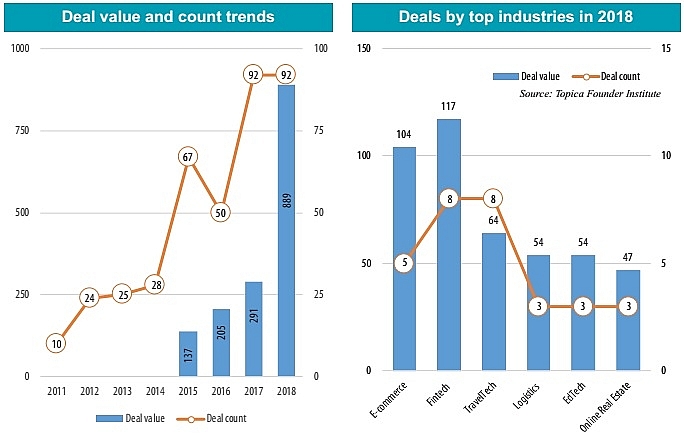

According to Topica Founder Institute (TFI), a startup accelerator programme in Vietnam and Thailand, the year 2018 saw an explosion in startup investment. Total deal value surpassed $889 million, tripling from the $291 million of 2017. Of these, the 10 biggest deals were upwards of $40 million in value.

These agreements included Yeah1, which received $100 million from a group of investors, Topica, which received $50 million from Northstar Group, and Sendo, which gained $51 million, and seven undisclosed deals valued at about $533 million.

The sectors of fintech, e-commerce, traveltech, logistics, and edtech have attracted investors’ eyes. Of these, fintech sat in the first place in both deal value and deal count, with eight deals for $117 million. E-commerce came in second, with significantly fewer deals (only five, against 21 in 2017) worth approximately $104 million. They are followed by traveltech ($64 million), and logistics and edtech (three or four deals valued at over $50 million) for each sector.

Among around 388 startups receiving funding over recent years, VNG Corporation becomes Vietnam’s first-ever tech unicorn, whose existing value has mounted to $1.2-1.5 billion now, while Yeah1 has just debuted on the Ho Chi Minh City Stock Exchange with a valuation slightly above $500 million.

The remaining startups are far off the billion-dollar mark. According to an expert, startups rarely remain afloat after the third year.

In the opinion of Yinglan Tan, founder of Insignia Ventures Partners, a $120 million investment venture fund, Vietnam needs time to build an ecosystem. For example, Silicon Valley spent decades to reach where it is now, and Chinese companies went through a similar period of construction.

“Vietnam is only at the starting line, but it had a very promising start because of the convergence of favourable factors like ambitious investors and IT talent.

Investments have been pouring into the market. Good ideas and investments are the most important factors to develop a billion-dollar unicorn,” said Tan.

However, startups maintain operations through investments that they heavily outnumber.

Additionally, funders usually pay more attention to well-known startups rather than poorly-performing ones. Thereby, competition for investment is fierce.

The quality of human resources also remains a problem. An expert said that senior employees always demand high salaries, and only accept normal wages if there are good conditions like promising products or a share in the business.

Vietnamese startups have also been facing external threats, such as competition from foreign equivalents from countries like South Korea.

Telling VIR about the reason why they chose Vietnam as their destination, Patrick Jeon, Generation Convergence Startup Campus’ global team manager, said, “The South Korean market is very small, developed, and the population is old now, thus, the government wants enterprises to go abroad. You can see that almost all of the largest groups in South Korea, including Samsung, LG, and Lotte, arrived in Vietnam, showing the country’s potential is tremendous. Along with those, small- and medium-sized enterprises (SMEs) also see opportunities.”

In addition to the sectors where they have been successful like electronics, construction, real estate,

processing, and banking-finance, South Korean investors and startups are also showing interest in IT and services.

“This is the third time I have visited Hanoi to organise a programme for startups. The reason we

selected Hanoi is because the market in Ho Chi Minh City is more developed. Hanoi is the capital city and has the presence of almost all of the largest groups,” added Jeon.

However, he also emphasised that along with the efforts of startups and investment funds, government support also plays an important role in helping startups develop.

In the case of South Korea, for example, the government runs a number of initiatives, including matching funds with international investors, establishing entrepreneurship programmes at universities, and opening up research institutes, providing safety nets for scientists who strike out on their own. The government has built 15 organisations and agencies to support startups.

In Vietnam, the government has provided many policies to develop SMEs and startups. However, these companies need even more support to be able to seize the opportunities.

“The road ahead for startups is not flat. There will be very many internal and external factors impacting the development and success of Vietnamese startups,” said Tan from Insignia Ventures Partners.

“However, I think this is a golden time for them because there is a rare convergence of the most

important factors like abundant talent, capital, and government assistance.”

| Seo Woori Director, Hall Chuu

In South Korea, the first birthday of a baby is one of the most important milestones, so the parents always try to organise the most meaningful celebration for their child. In Vietnam, with the population of nearly 100 million and high birth rate, in collaboration with the growing middle and affluent classes, this country is very promising market for our startup. I knew that there are numerous event organising companies in Vietnam, but there are very few large companies that specialise in first birthday parties. Regarding the investment location, I came to Ho Chi Minh City to study the market and meet partners to discuss co-operation opportunities, and I found that a number of players have already set foot in this segment. Thus, I hope to find partners after this event to become one of the pioneers in this sector in Hanoi. I expected to start operations in Hanoi in June or July this year. Bang Junho Director, Coworksys

Coworksys provides computers and solutions of automatic computer management for schools, agencies, and companies where servers, personal computers (PCs), and smart devices are connected. This software has been applied to manage 60,000 PCs and smart devices across 10 big companies in South Korea, including schools, universities, banks,and companies which use a great number of PCs. This software also provides solutions for managers to supervise what their employees are doing, how long they keep the PCs turned on, which jobs they are doing, and monitor their performance. While similar software can do a single command at a time only, our system can implement many commands in different PCs and optimise repeated activities. Vietnam has been developing significantly, but is still very far from developed countries. Thereby, this is a promising destination for South Korean investors, especially in the IT sector. Sung Hyun Jin CEO, Kew & Leaves

Kew & Leaves specialises in producing different types of tea in the high-end segment, packed in a luxury format. These tea products are marinated with aromatic spices and dried flowers. We would like to co-operate with Vietnamese partners to develop and process their products for the high-end segment. We know that tea is easy to grow in Vietnam, but there are very few types of tea in the business and high-end segments. The high-end tea segment in the country is quite a promising sector. In the time coming, if the co-operation with Vietnamese partners goes well, we will consider carrying out direct investment in the country by building a factory processing and producing tea. We expect that our products will be exported to many countries in the Americas, Europe, and Asia. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version