Vietnam can become major semiconductor player

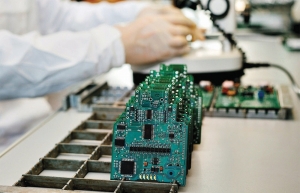

Vietnam in 2023 upgraded its partnership with the United States, in line with an emphasis on semiconductor cooperation, and a number of major semiconductor companies visited Vietnam in search of opportunities. What is your take on Vietnam’s potential for involvement in the global chip supply chain?

| Dr. Sadasivan Shankar, research technology manager at SLAC National Laboratory and Adjunct Professor in Stanford Materials Science and Engineering |

The semiconductor industry is a considerable supply chain in which countries can choose to participate in their favourable steps.

The two segments of the semiconductor technology industry are chip design and chip manufacturing. These two tasks are now carried out by separate companies instead of being handled by one, like Intel or Samsung, in the past. Plus, the former is becoming more pivotal because of the stagnation in the latter.

Vietnam should be aware that the average cost to establish a semiconductor manufacturing facility is approximately $10 billion. These factories need to update new technology every two years, requiring them to elevate facilities with the same frequency, and we cannot exclude the demand for myriads of skilled technical staff.

Besides designing, Vietnam can also participate in assembling and packaging. To start from the ground up, take advantage of Intel’s cutting-edge chip packaging technologies that have been implemented in Vietnam. Then try to be more value-added by exploiting your country’s plentiful supply of energy, abundant workforce and strong investment attraction capacity.

As a result, Vietnam will be on the path to becoming a promising prospect in the semiconductor industry.

Vietnam is still a latecomer to the design and packaging competition. What needs to be done by Vietnam in order to compete with earlier nations?

To establish your own advantage, drawing attention to the production of materials to support quantum computer models is a must. These kinds of large computers will be the foundation for all subsequent semiconductor developments.

Adding to that, Vietnam should also find its way through organic semiconductor. Why organic but not biological? The choice of organic is attributed to sustainability, due to the common ambition in developing technology products that will last and maintain their value over time.

Vietnam possesses a team of young, talented engineers, developing a lot of software and many applications. And giving those youngsters the best conditions to contribute to this process will be a smart move to help Vietnam narrow down the distance with other tech giants overseas. Of course, that is heavily based on action from governments.

Vietnam does not yet possess enough talent in line with the demand of this industry, so what are your suggestions to cope with this problem?

The current human resources of Vietnam have not really met the standards of the industry. Nevertheless, major powers such as the United Kingdom and the United States also deal with high-quality employment shortage.

But, the sincere issue lies in the lack of professors and scientists who can teach all the subfields in the semiconductor area. And so an event like the VinFuture Prize is a very positive example, gathering the best scientists in the world.

Through the event, top universities can invite them to come and give guest lectures or counsel them on the curricula for future endeavours. Many professors teach many sub-branches from materials to modules, which will be helpful for a comprehensive training system for the entire semiconductor field when combined.

The semiconductor field is very broad. No one can teach everything, and therefore, having the initial teaching initiative is pivotal for building from scratch.

What are the opportunities for Vietnam’s companies in this area and do they stand a chance against tech giants from around the world?

The semiconductor industry is 60 years old, so it is impossible for Vietnam’s firms to ask for the same position as businesses in developed countries.

They should begin with low-budget programmes, then start strategic collaboration with businesses, academic institutions, and governments in nations with robust semiconductor industries. The most crucial thing is to get started immediately.

I cannot name a specific domestic firm participating in this direction, however, a comprehensive national-level roadmap is inevitable. When there is a guideline, national companies will follow the same developing route.

Besides that, based on the roadmap, interested parties will know what Vietnam plans to do and decide on the degree and phase of collaboration.

| Chip training the hot new trend for 2024 The thirst for human resources in the semiconductor manufacturing industry has prompted many training institutions to open related majors before the 2024 enrolment season. |

| Policy advances applicable to semiconductor industry For years, Vietnam has been globally acknowledged as a nation of great potential for the advancement of the semiconductor chip industry, owing to its advantageous geographical position, political stability, and a reservoir of high-quality human resources. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version