Vietnam at crossroads over vehicle registration fee cuts

The prime minister has requested the Ministry of Finance (MoF) to submit a draft decree on reducing registration fees for domestically produced and assembled automobiles, as the latest MoF proposal is facing many comments.

Previously, the MoF submitted a draft decree stipulating reduced registration fees for cars, trailers, or semi-trailers pulled by cars and similar vehicles to manufactured and assembled cars, in which the costs were expected to be cut in half from August through to January 31, 2025.

|

While the MoF is now leaning towards not reducing registration fees in half for such vehicles, it is still open to doing so for the next six months, if approved.

However, the Ministry of Planning and Investment (MPI) stated that the solution to reduce fees is only a temporary solution, even though it has been enforced several times already since 2020.

The MPI raised concerns that continuing to reduce fees leads to the risk of being fined for violating international agreements. The ministry asked the MoF to analyse further the reasons for reducing fees for another six months, and conduct additional research to evaluate whether to continue implementing this policy or not.

“It is recommended to assess the impact, review the subject further, ensure the viewpoint of decree building, and ensure the compatibility is legal and consistent with the law,” noted the MPI’s written document to the MoF.

The fee cut was first introduced in mid-2020 to assist carmakers through the COVID-19 pandemic; it was then reintroduced at the end of 2021 for another six months, and also for the second half of 2023.

Industry expert Dinh Trong Thuc said, “If we continue to reduce registration fees for domestically-assembled automobiles according to the World Trade Organization and free trade regulations, we must also reduce registration fees for imported cars. But if we do that for imported cars, it will cause difficulties for domestically-assembled products.”

The tax and fee deferral and reduction policy aims to support local carmakers to overcome difficulties and promote consumption. However, Thuc also acknowledged that such an on-again, off-again policy prevents businesses from investing confidently.

“When the market goes down, the tax reduction is often applied by many countries in order to stimulate consumption. Thereby, it has a positive impact on the entire manufacturing industry, contributing to saving the automobile market from the risk of crisis,” Thuc explained. “In Vietnam previously, a 50 per cent reduction in registration fees for domestically-produced automobiles was made in the context of the COVID-19 pandemic, but now the situation has returned to normal, requiring stable and fair policies.”

Instead of a short-term stimulus police, he suggested larger and more sustainable policy options to promote the automobile manufacturing industry in the longer term.

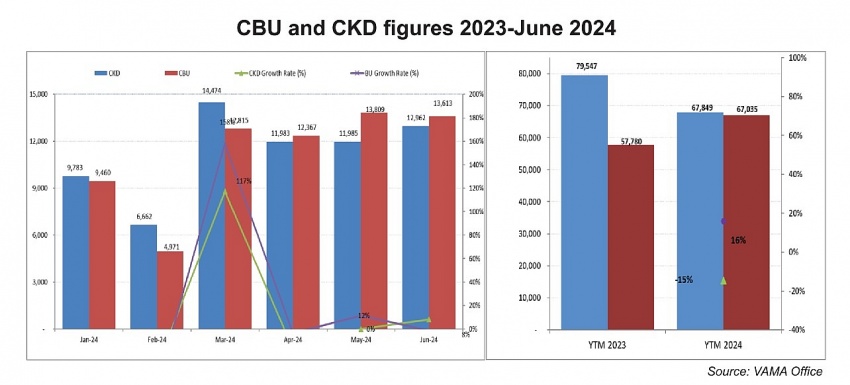

According to data from the Vietnam Automobile Manufacturers Association, the total sales of the entire automobile market by the end of June decreased by 2 per cent as compared to 2023, of which domestically produced and assembled products dipped 12 per cent.

| 50 per cent cut in automobile registration fees to be effective from July 1 The decree aims to help enterprises in the domestic automobile manufacturing industry who are faced with high surplus inventory alongside reduced access to capital, high interest rates, changes in exchange rates, and inflation. |

| Thailand starts digital wallet scheme registration Thai citizens can register to receive a digital wallet with a value of 10,000 THB (approximately 282 USD) starting August 1 under a scheme announced by Prime Minister Srettha Thavisin's government. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version