Varied solutions available to contain pandemic impacts

What are your expectations for the Vietnamese economic outlook for the rest of the year?

|

| Andrew Jeffries, country director for Vietnam at the Asian Development Bank (ADB) |

Despite the recent resurgence of the pandemic, Vietnam’s recovery prospects are expected to be strong in 2021. The rapid economic recovery of the US and China – two principal trading partners of Vietnam – would boost exports, which will spur the growth of export-oriented manufacturing.

Exports grew by 30 per cent from January to May, and imports by 36 per cent from 2020 figures over the same time period. Manufacturing rose by 12.6 per cent in the first five months over the same period in 2020. E-commerce, health, and banking and financial services are expected to lead the growth of the services sector, which is another driver for growth this year.

Successful containment of the pandemic has made Vietnam an ideal destination for foreign direct investment (FDI). Newly registered FDI in January-May remained robust at $14 billion, an 8 per cent increase compared with the same period in 2020, and disbursed FDI was $7.15 billion, up 6.7 per cent on-year. Accommodative fiscal and monetary measures are also expected to support growth.

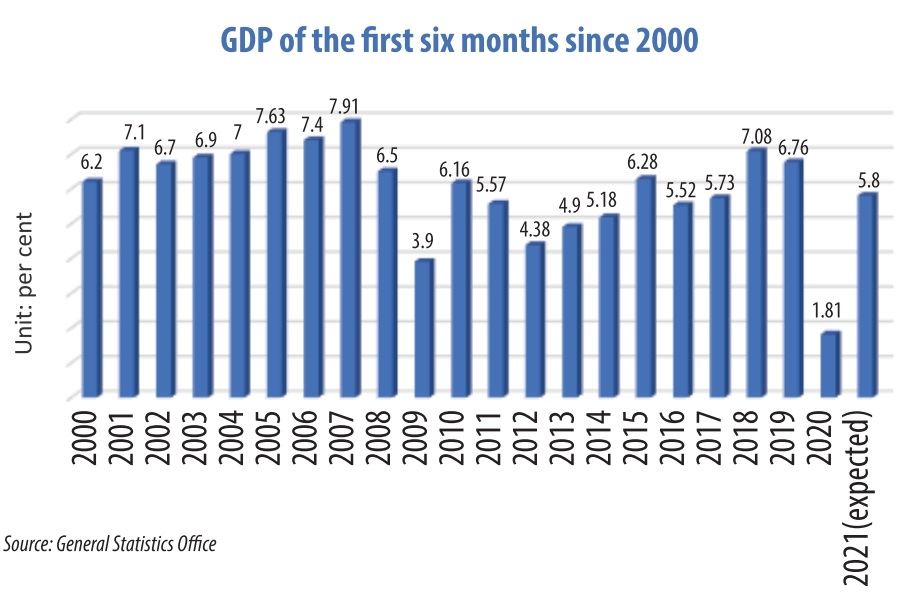

The ADB recently forecast that Vietnam’s economic growth will rebound to 6.7 per cent in 2021 and 7 per cent in 2022. What are the key drivers for this growth?

These figures of strong and steady growth are made possible by Vietnam’s success in containing the pandemic. Inflation will be under control, despite an expected rise to 3.8 per cent this year and 4 per cent in 2022 due to rising international oil prices on the global economic recovery and increased domestic consumption.

The drivers of this growth will be industry, driven by export-oriented manufacturing; increased private and public investment given accommodative fiscal and monetary measures; and expanding trade, thanks to the faster-than-expected economic recovery in China and the US, as well as Vietnam’s participation in 15 major free trade agreements involving all advanced economies.

What challenges can be seen ahead for the economy here?

I think the largest downside risks are the re-emergence of the pandemic by new strains and delayed implementation of the vaccination plan. Since our last forecast a month ago, the situation has been changing rapidly. The worrying sign is the spread of the outbreak to some industrial areas which may disrupt the export strength of Vietnam, affecting growth.

The fast economic recovery in the US and China may also push up commodity prices, leading to higher inflation. Slow vaccination progress may drag growth in the medium and long term. Vietnam lags behind some other countries in the region in vaccinations.

For example, the Philippines has vaccinated 3 per cent of the population with one dose, and 1 per cent with two doses, while only 1 per cent of Vietnam’s population is vaccinated, mostly for one dose. Vaccination delays could have immediate impacts on Vietnam’s economic recovery.

The Vietnamese government is trying to implement and achieve the dual goal of COVID-19 containment and economic development. What solutions do you think will be the most feasible to this end?

Private sector development is critical for Vietnam to achieve this goal. Growth drivers such as natural resource endowments and cheap labour are diminishing and no longer form Vietnam’s comparative advantages. The next stage of Vietnam’s economic development will depend on the application of technology, especially digital transformation.

Without the private sector’s stronger participation in the economy, Vietnam would not be able to transform digitally and technologically. Access to finance, a level playing field between state and private firms, and streamlining business procedures are all needed to support private sector development and thus job creation.

In addition, climate change and disaster-resilient infrastructure are important for Vietnam to sustain economic growth in the medium and long term. The majority of Vietnam’s transport infrastructure is in low-lying areas, vulnerable to storm damage, flooding, and sea level rises.

A 1-metre sea level rise could affect more than 4 per cent of the railway system, 9 per cent of the national highway system, and 12 per cent of the provincial roadway system. Storms and sea level rises may negatively affect power plants, transmission systems, mines, and other energy facilities in low-lying areas. Vietnam would need at least $20-25 billion annually for infrastructure development, and the country would not be able to leverage this amount of funds without the participation of the private sector.

Furthermore, skills development is essential to jumpstart the economy after the pandemic. Vietnam’s labour productivity remains low as compared with countries in the region, and vocational training of Vietnam was ranked low at 115th out of 140 countries according to the Global Competitiveness Report of the World Economic Forum.

The lack of skilled workers is also a result of inadequately trained graduates. The skillset of graduates was ranked low at 128th out of 140 countries. Wage growth is outpacing productivity growth, and this makes it even harder for private firms to get skilled workers.

The Vietnamese government is mulling over another hallmark package to support employees and employers, as well as enterprises hit by the pandemic. One of the most seriously affected sectors in the economy is in services, especially aviation and tourism. In your view, should the package be particularly aimed to support this sector?

|

There is no doubt that opening up the economy and reopening international routes will energise the travel and tourism sectors and the wider economy. Therefore, governments offered financial relief measures to support the airline industry and tourism sector to keep the sector alive and ensure the sector’s future crucial role as a major contributor to GDP and job creator.

According to the International Air Transport Association’s statistics, since the onset of the pandemic, governments have helped airlines survive the crisis with about $200 billion in various forms of financial support.

In Vietnam, the government has timely supported the aviation industry by reducing take-off and landing prices and flight control services for domestic flights by 50 per cent; and reducing the environmental protection tax on jet fuel by 30 per cent and extending this tax reduction through 2021.

In addition, the government also introduced policies to support businesses to restructure their loans amongst exemptions or reductions of loan interest.

It is important for the government to provide support measures that ensure critical employees and skills are retained to successfully restart and rebuild the sector. As the travel and tourism sector involves more and more small- and medium-sized enterprises, the government and authorities should support them to survive in these difficult times. The government’s intervention can again include tax relief and targeted cash transfers, which can help these enterprises stay in business.

The government can consider temporary waivers or suspensions of government charges, taxes and fees to airlines and passengers to reduce flights costs and lower travel costs for passengers, because increased travel costs will mean a slower economic recovery. The government can also use this pause for improving infrastructure such as airports, road systems, and tourism facilities.

Finally, it would be better for the government to have a plan in place to restart and rebuild the sector so that no time is lost in restarting the sector whenever the pandemic situation allows for a reopening of borders.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: COVID-19

- 67 million children missed out on vaccines because of Covid: UNICEF

- Vietnam records 305 COVID-19 cases on October 30

- 671 new COVID-19 cases recorded on October 1

- Vietnam logs additional 2,287 COVID-19 cases on Sept. 21

- People’s support decisive to vaccination coverage expansion: official

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Mobile Version

Mobile Version