The “Win-Win-Win” formula of branded residences have proven successful

The first branded residential development appeared in the 1920s on New York’s Fifth Avenue, where the Sherry Netherland Hotel operated successfully alongside its own serviced apartments. The branded residence concept did not catch on until the mid-1980s, when Four Seasons sold out its hotel condominiums in Boston. Following Four Seasons, the Ritz-Carlton Hotel Company also entered the market. Currently, Marriott International is the world’s leading developer operating projects in 17 countries and territories. Marriott is expanding its overseas investment portfolio.

|

It is worth noting that the branded residence projects are located in prime locations. According to the report “Branded Residences: An Overview” by property experts Chris Graham and Muriel Muirden, the formula for branded residences is “Win-Win-Win”. The tie-up between the property developer owning the prime location, and a luxury hotel brand is the first “Win-Win” step. When a homebuyer decides to invest in branded residences, they will be the third party in the formula. It is clear that homebuyers will be the winners.

Location with guaranteed value

The expression “Location, location, location!” is commonly used in the real estate industry, which highlights an important factor of property investment. What is a prime location? The question is not difficult to answer: right in the middle of downtown, in the heart of financial centres and surrounded by shopping malls. In this location, property prices likely never fall.

According to a Knight Frank report in 2019, prices in prime locations in the world’s top cities for property such as London, Hong Kong, New York, Los Angeles, Singapore, and Sydney were increasing before the COVID-19 pandemic. The report predicted that these locations would not be affected in 2020 and will continue to appreciate by 5 per cent in 2021.

How do luxury properties in prime locations retain its value even amidst a crisis? The main reason is that these areas have set the standard for a top-notch living environment and guarantee the most luxurious amenities, making people feel safe and secure. A crisis like the COVID-19 pandemic will only push propery prices in these areas higher.

The first “win-win-win” formula in Vietnam

In Ho Chi Minh City, Vietnam’s most developed city, prime locations are at the heart of District 1 with a view of Saigon River. People can enjoy the fresh air and vibrancy of one of Southeast Asia's most dynamic cities. Many people assume that the area should be allocated for offices and mixed-used shopping mall developments. If there are luxury residential projects such as branded residences in that area, it will become a hotspot for wealthy Vietnamese.

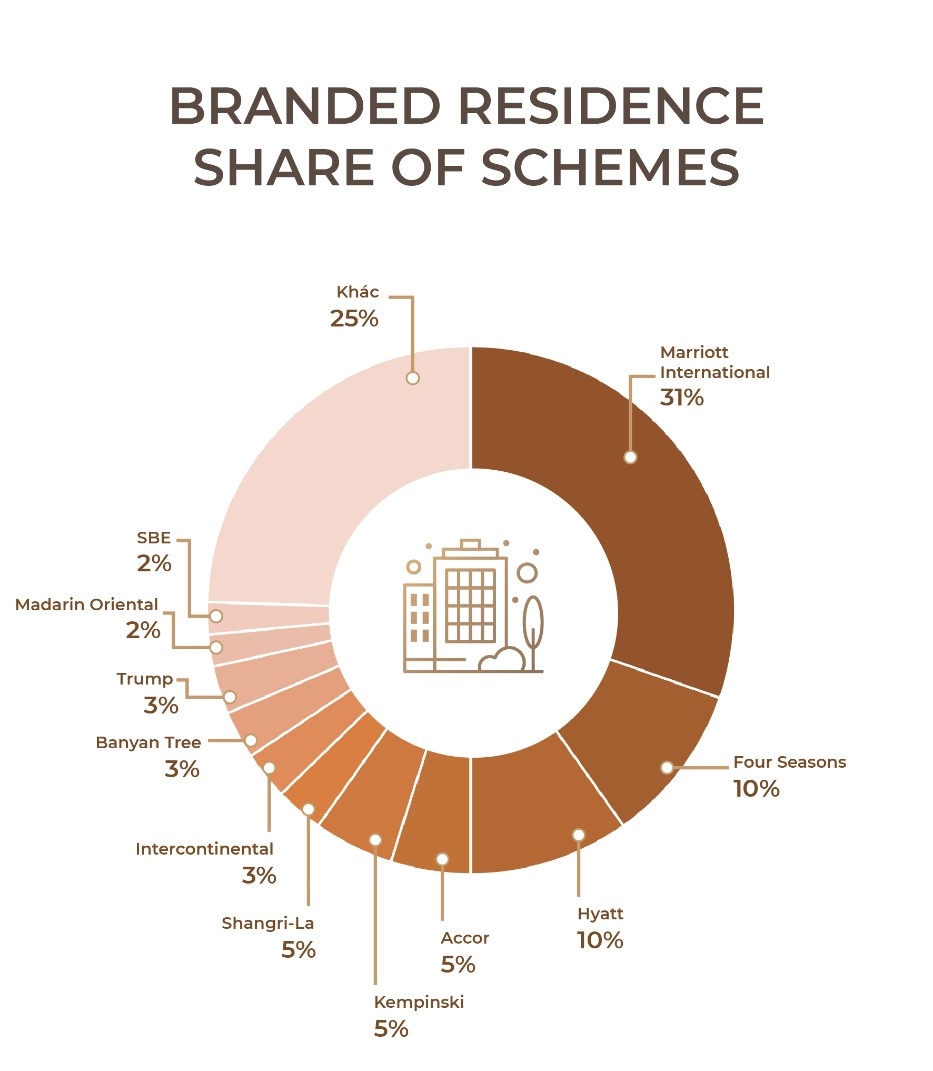

The “win-win-win” formula has been proven according to Savills’ statistics in 2019. Prices in the sector have nearly tripled in the last decade and are forecast to grow by a further 27 per cent in the next three years. Savills research reveals that there are 435 branded residence schemes. The projects are located in developed economies like Dubai, New York, Singapore, among others.

Masterise Homes has teamed up with Marriott International to develop branded residences, the first of its kind in Vietnam. This development offers Vietnamese consumers the ownership and benefits of an asset class akin to mature markets around the world. More importantly, it also sets a new milestone for the Vietnamese economy, creating a unique position for the country to be on par with other developed markets globally.

|

| Grand Marina Saigon – The largest Marriott branded residence in the world, developed by Masterise Homes |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Mobile Version

Mobile Version