The subtle art of choosing a foreign exchange broker

|

| Tong Quoc Dat, senior market strategist from Exness |

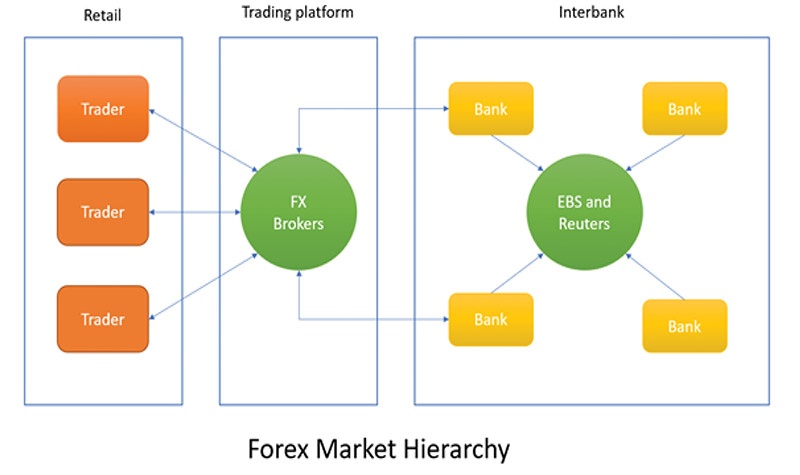

The major banks quote different prices for currency to their customer’s banks, which are essentially smaller commercial banks. Those smaller banks add some commissions to the price and continue to quote their clients (such as retail brokers, smaller investment funds, and smaller financial institutions).

Those clients who are retail brokers then provide financial products to retail customers (see Chart 1). At first, the forex was designed only for the bigger commercial banks to exchange currency rates with the smaller ones. This exchange platform is known as the interbank market.

Later, smaller parties also appeared on the market and they wanted to fulfil the niche as the bridge between retail traders and the forex market. They work with small- and medium-sized banks to receive from them the price for currency rates and then, in return, re-quote the price to retail traders.

Thus, the forex broker is a type of financial institution that acts as an intermediary between the interbank and retail traders. They make money by marking up the price of interbank before offering it to retail traders. They also provide liquidity on their own by keeping the orders from traders. If retail traders are interested in investing more money in the forex market, they can also borrow the shortfall amount and charge a so-called swap fee for this service.

In short, retail traders need forex brokers to trade currencies because they cannot independently access the interbank market. Naturally, retail traders will be charged some additional fees for this intermediary service.

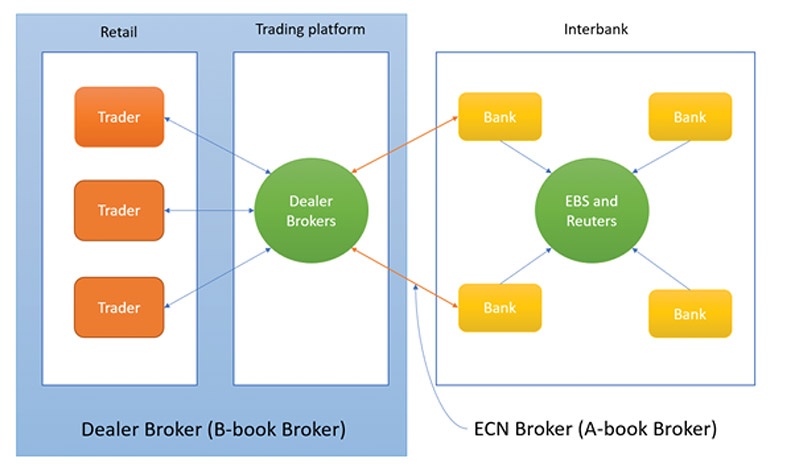

There are two different types of forex brokers. The first and the most common is a dealer broker (also called a B-book broker). They play the role of market makers by providing liquidity to their retail traders. The second is an ECN broker (also called an A-book broker). They match retail traders’ orders with each other or with banks (see Chart 2). These are quite complex issues and this it is important to give them more attention.

|

|

Broker types

A dealer broker creates their own price, which is usually in line with the prices offered on the interbank market or other sources. But sometimes (for their sole benefit) they might change their fee and make it a little bit different from interbank. The dealer broker owns a book of trading orders from all of his or her retail traders and, especially in a volatile movement, they might manipulate the price feed. In that phase, it is harder to detect such manipulations than in normal market conditions, and naturally, it will put the retail traders at a disadvantage.

The traders cannot access the interbank market to make sure all the broker’s feed is at a fair price or not. Simply put, retail traders bet against the broker. But most of the time the price feed is in line with the interests of the interbank market.

Apart from that, it is not especially recommendable for retail traders to track the charts and make decisions based only on what is presented in front of their eyes. Prices in forex move constantly second by second, and it is not possible to compare the smallest movements of prices in forex. Naturally, in forex, even one tick could change the whole story between win/loss – but to detect this tick, something different than human eyes is demanded. Special computer applications are doing it instead, but they are generally not available for retail traders.

Besides that, dealer brokers can apply different pricing strategies by using the spread, commission, and swap. This pricing does not have to be higher than the pricing established by ECN brokers, as most people think. This means that in some cases, the cost of trading will indeed be higher but, in other cases, it will be lower.

Last but not least, dealer brokers also apply several trading rules to protect their capital, which can include a requirement for a number of pips to place a stop loss, for example. They also may not fully support Expert Advisor, which is an automatic trading programme used on the Metatrader platform.

Meanwhile, ECN brokers work with different banks to provide liquidity for their clients. They use a smart routing system to match the orders of traders with each other. Then they match those orders with a liquidity pool from the interbank quotation.

There is less conflict of interest between this type of broker and retail traders. The reason is that the brokers do not provide liquidity on their own. The interbank market feeds all the prices to the brokers. The traders will receive most of the trading data that goes through the interbank market. Thus, retail traders can see the price levels of all limit orders from the general trading order book. This gives a quick glance at demand and supply in the live market.

Besides this, ECN brokers usually provide a very tight spread. The reason is that they can access a deep liquidity pool from the interbank market. But, they will charge the commission for providing this service to their clients.

In addition, an ECN broker usually does not apply a set of trading rules as most dealer brokers do, because the interbank market rarely does so. Thus, it is easier for traders to put in place different trading strategies.

Critical thinking

Usually, most brokers choose the dealer broker model because they will get a much better profit than ECN brokers. Dealer brokers are more practical as they provide products and services for small-sized retail traders and those traders usually trade with limited capital. Then, they may burn their account after some time.

B-book brokers believe that most traders will lose after several months of trading. Thus, it would be financially much more rewarding to profit from those losing traders. This is much better than earning commissions during those initial months. This is common sense in the brokerage business.

But there is one problem - the other 10 per cent of traders that do not lose during that period. Most of them have better trading experience and a larger capital to invest at their disposal. In this case, those dealer brokers may lose their capital. The obvious solution is not to go against the winning traders. Brokers just need to route their orders to the interbank market.

That way, brokers can still charge commission and keep all the profits from losing traders. Nowadays, there are a lot of changes happening in both types of brokers, and it is hard to distinguish between them. There are a lot of dealer brokers who can provide a very tight spread and no commissions. Sometimes their pricing is even better than that established by some high-cost ECN brokers.

Some forex brokers can position themselves to be both dealer and ECN brokers at the same time. They now provide different types of trading accounts. Each account requires a different amount of depositing funds. Thus, they can provide traders with both a dealer and ECN model. This leads to other core criteria to examine, as we cannot choose one on the basis that they are one or the other.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIR hosting talk show on the stock market stability and sustainability (April 04, 2024 | 10:22)

- Stock market supported by diverse factors (March 14, 2024 | 16:46)

- SSC proposes new Information Disclosure System (March 04, 2024 | 09:09)

- Stock market offers promising opportunities as it enters bullish cycle (December 18, 2023 | 16:00)

- JB Securities Vietnam launches innovative securities trading platform Finavi (October 02, 2023 | 08:00)

- DNSE Securities takes lead in new account openings in Q2 (July 27, 2023 | 08:00)

- Major bourses to hail raft of fresh supplies (July 14, 2023 | 09:56)

- Securities firms falling short of business plans (November 24, 2022 | 21:35)

- Trading volumes increase in spite of money market jitters (September 28, 2022 | 10:00)

- Weighing stock market opportunities in H2 (September 21, 2022 | 19:21)

Tag:

Tag:

Mobile Version

Mobile Version