The push for PPP projects in health

|

| Lawyers Le Net, Pham Manh Hung, and Hoang Nhu Quynh of LNT & Partners |

In recent years, alongside remarkable economic development, Vietnam’s population has rapidly increased with a widening demand for healthcare services. To solve this urgent problem, the Vietnamese government has accelerated synchronous public and private healthcare development, widely known as the public-private partnership (PPP) model in the healthcare sector.

National healthcare in Vietnam is facing challenges in providing facilities to take care of a growing population. While almost all central hospitals suffer from very high occupancy rates, lower-level hospitals are not chosen as their quality of medical equipment and staff do not earn credibility from Vietnamese patients. On the other hand, standards in privately-funded hospitals are excellent but prices for treatment are significantly higher in comparison to the average income of most Vietnamese people. The PPP health projects are thus expected to help ease the overload suffered by central hospitals, enhance the capability of lower-level hospitals in primary care settings for communities, and offer high-quality services with almost equivalent prices to locals.

The key PPP legislation is Decree No.63/2018/ND-CP on Public Private Partnership issued by the Vietnamese government in May 2018 and coming into effect the following month to replace Decree No.15/2015/ND-CP. Decree 63 indicates that whilst there is improved clarity on some important positions that international PPP investors typically like to see, there remain areas of improvement that will help bring even greater clarity and certainty for international PPP investors, and thus foster a more solid legal and regulatory foundation for the PPP market in Vietnam. However, it is too early to determine whether Decree 63 will enjoy more success than Decree 15 in attracting international PPP investors, especially in healthcare.

|

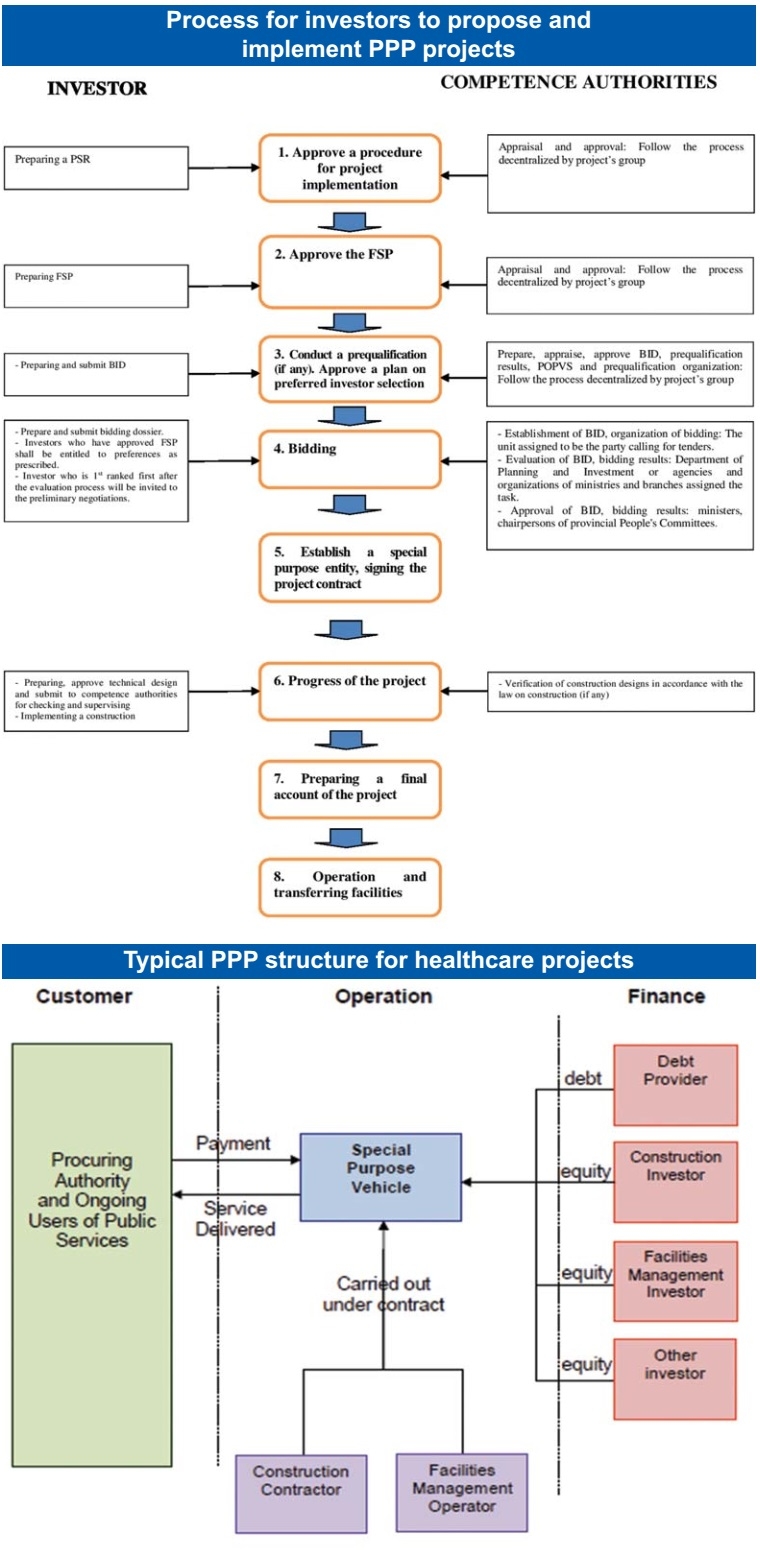

Under Decree 63, Article 4.1 clearly states that healthcare is one of the sectors in which the government encourages PPP projects. However, there is no specific higher incentive under Decree 63 for private investors when they invest in such ventures, as compared with other sectors. In terms of process for implementing general PPP projects, Decree 63 waives the requirement for backers to obtain an investment registration certificate for a PPP initiative, which greatly simplifies the procedures to implement them.

From a constitutional perspective, Decree 63 sits below the level of laws in Vietnam. It has been debated that elevating the regulation of PPP into a law would be one of the steps required to help deliver a more workable regulatory regime for international PPP investors in the sector.

The current process for approval of PPP projects under Decree 63 is still complicated. For example, Article 18 of the decree provides that the pre-feasibility study must include an environmental impact assessment. Such assessments must be prepared in accordance with the Law on Environmental Protection 2014 as well as other requirements. Meanwhile for granting the in-principle approval, Article 33, Article 34, and Article 35 of the Law on Investment 2014 do not require a full assessment but a preliminary environmental impact assessment submitted by the investor.

The purpose of the project identification stage is to obtain in-principle approval from the relevant authority to demonstrate that the project meets some basic pre-requisites to be procured using the PPP model. A detailed assessment at a pre-feasibility stage may delay the procurement process and lead to additional costs. Thus, the requirement for an approval process of pre-feasibility studies should be abolished in some specific PPP healthcare projects.

Pursuant to Article 174 and Article 175 of the Law on Land 2013, overseas lenders are not allowed to take mortgages over land use rights and land-attached assets (hereafter referred to as immovable assets). The owner of such immovable assets has the right to mortgage its immovable assets at licensed credit institutions in Vietnam. This requirement has been consistently interpreted by authorities, which prohibits foreign lenders from taking security interests over immovable assets.

This is a critical problem as it limits the project company’s ability to raise funds for their projects. Local banks in Vietnam are currently incapable of providing long-term capital required by investors, thus the bankability of such projects will likely depend on international banks. However, these banks would certainly not provide large funds for a company that is not allowed to mortgage land assets in favour of overseas lenders, as real estate is considered to be a highly reliable asset in applying for a secured facility agreement.

Taking security over immovable assets, particularly land, is typically part of the international lenders’ security package in PPP projects. A simplification of this process would help to reduce the number of contentious issues for lenders and assist the investors in effectively fund mobilisation.

There is no further difference in the incentives of healthcare projects under the PPP model compared with other sectors. Article 59.3 of Decree 63 states “Investors and special purpose entities shall be entitled to exemption of land levies for the land allocated by the state, or exemption from land rent during the execution of the project according to land laws”. Article 110.1 of the Law on Land 2013 regulates the exemption or reduction of land levies, and that land rental shall comply with investment law.

Article 15 of the Law on Investment 2014 provides that the incentives for any project shall be dependent on business lines, location, employee numbers, investment capital, and hi-tech companies. Thus, these regulations put the central and local authorities into difficulties in identifying cases of exemption or reduction of land levies and land rent for investors in implementing PPP healthcare projects. Therefore, exemption of land levy or land rental, among other wider incentives, for investors who would like to engage in PPP healthcare projects should be supplemented.

Currently, the Vietnamese government has strived to abolish aforementioned existing legal gaps of regulations in Vietnam by preparing a PPP law, and a draft is proposed for submission to the National Assembly this year. With the considerable effort to put forth a clear legal framework and ease risks for investors in the upcoming PPP law, it is possible to expect that Vietnam will achieve success in this area of healthcare in the near future.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: PPP in Healthcare

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Mobile Version

Mobile Version