The effects to land and market price through bracket removal

How does the land price bracket affect the land market?

|

| Assoc Prof. Dr. Nguyen Dinh Tho - General director of the Institute of Strategy and Policy on Natural Resources and Environment |

Vietnam’s land market currently has a two-price land mechanism. A land price according to the framework issued by the state is the basis for calculating tax payments or calculating a land price for compensation for project clearance. The second is the market price, often many times higher than the price bracket.

The difference between these two types of prices leads to many consequences such as disputes, lawsuits, corruption, and land price disturbances, causing housing prices to rise.

According to Savills, the housing price index in Hanoi is 20 times higher than Ho Chi Minh City and 33.5 times higher than the average income of most people, making it difficult for them to own a house despite.

The draft revised Law on Land, expected to be submitted to the National Assembly this month, proposes to remove the land price bracket. Why is there a need for this proposal when the land price bracket is still adjusted every five years?

Land prices have a strong impact on the lives of people, businesses, and the state’s land management. The content of the land price bracket removed during the drafting of the 2023 draft land law has received a lot of attention.

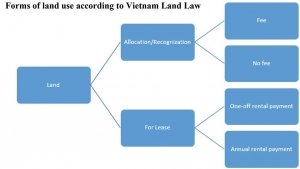

The 2013 law stipulates that the framework and price list of land must be suitable for the market, considering the interests of both people and businesses. The goal of the government when promulgating a land price bracket lower than the market price is to ensure social security and land access for businesses, especially smaller enterprises.

However, the 2014 annual land price bracket and the 2019 land price bracket have not met the appropriate requirements of the market. Recently, many localities have proposed to the government to remove the land price bracket so that the locality can push the price list up to match the market price.

Therefore, when developing the land draft, the Ministry of Natural Resources and Environment (MoNRE) decided to remove the price bracket and build a land price list in accordance with market principles.

What will the removal of the land price bracket in the revised Law on Land mean for people and businesses?

The 2013 law stipulates that the land price bracket and list are only applied to determine people’s financial obligations. The removal of the land price bracket will help localities bring prices up in line with market prices to determine the obligation to pay annual non-agricultural land use tax. These are the revenues that people and businesses will see a direct impact on when removing the land price bracket.

In contrast, land prices applied for compensation for site clearance or valuation in the process of equitisation or sale of public assets are subject to market principles, project bidding is required and an auction on land allocation. Therefore, this type of land will not have a big change when the land price bracket is removed.

Whether land prices increase or decrease in the market depends on many factors, especially credit-related factors. This land law has introduced tax provisions for abandoned land and land that is slow to be put into use. The introduction of this regulation obliges people to put the land to use, to avoid speculation.

The government will find ways to push down prices in line with people’s ability to access land and create conditions for all people to have residential land through social policies such as social housing, dorms for students, and housing for workers, these are the orientations of the land law we have recently revised.

On what principles will land be valued if the general price bracket is removed?

During the survey, the MoNRE has built a land price bracket in each locality for different purposes in line with market prices. In order to pass this decree, the ministry must go through the appraisal process of the Ministry of Justice and the Ministry of Finance as well as collect opinions of people and businesses. This is after considering many factors such as GDP growth and inflation rate as well as the adjusted salary of people in 2014-2019 as the basis for promulgating the land price bracket.

Land valuation is very difficult and, worldwide, the number of licensed land appraisers accounts for a very small percentage. Therefore, the human factor will be decisive in determining whether the land price is accurate or not.

Countries like South Korea and Japan are willing to apply a valuation equal to 60-70 per cent of the market price to determine the financial obligations of the people. Vietnam does not expect to need to raise land prices too high, in line with actual transactions taking place in the market, but just achieving the rate mentioned would be considered successful.

What benefits can changes in land regulations be gained for individuals and businesses?

Land resource management is extremely important for Vietnam. When opening the economy, oil and gas is the financial source that brings stability to the budget. In recent years, revenue from annual land use has replaced oil and gas as the main source of income. Around 15-16 per cent of the state budget comes from the collection of land use tax amounting to $12.9 billion.

But this number is still not significant compared to the ability that land resources can bring to the country and people.

The conversion of land use purposes from agriculture to non-agriculture, or other types of land to residential land has brought great value. The land use tax difference will be reallocated to the state, people, and businesses, ensuring the harmony of interests between them. It can also create a balance between today’s and future generations, ensuring that future generations still have land to use.

| PM urges thorough consideration, prudence during Land Law revision Prime Minister Pham Minh Chinh on August 24 requested thorough consideration and prudence during the revision of the Land Law, which deals with a wide scope and relates to many other laws. |

| Advantages of amending Law on Land Land is the most valuable asset of each person, business, and country, and thus a major goal is to unleash the potential of land use. Le Net and Tran Thai Binh, lawyers at LNT & Partners, propose amendments to the current legislation regarding the land. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Talent boost vital for semiconductor chip industry (February 20, 2026 | 09:27)

- A suitable growth model for Vietnam (February 19, 2026 | 19:56)

- Growth success hinges on reforms (February 19, 2026 | 19:36)

- Strong 2025 economic performance carries further positive momentum (February 19, 2026 | 18:00)

- From policy intent to decisive action (February 19, 2026 | 17:33)

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version