The dynamics of Vietnam’s M&A market

|

| Minh Phu Seafood conducted a private placement of 35 per cent of the stake for a whopping $155 million, Photo: Le Toan |

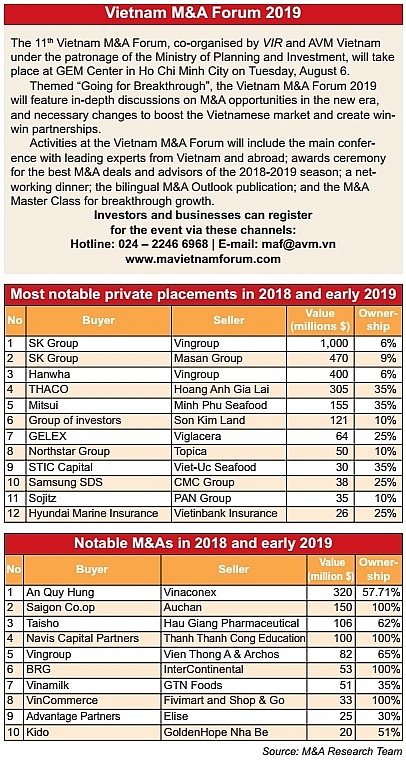

According to statistics by the M&A Research Team at AVM Vietnam, the value of mergers and acquisitions (M&A) deals in the first six months of 2019 reached $1.9 billion. For the entirety of 2018, Vietnam recorded $7.64 billion of M&A transactions, up 41.4 per cent from 2017.

Last year, due to global conflicts and trade slowdown, most of the ASEAN countries witnessed a decline in M&A transactions, in contrast to the situation in Vietnam. In fact, the combined value of all M&A deals in the country was the second-highest in the region last year, behind Thailand.

However, as typical of a frontier market, the value of each transaction in Vietnam remains smaller than the regional average, standing at $5 million. Small- and medium-sized deals took up 90 per cent of all M&A exchanges in the country, and bigger transactions at $10 million and above were carried out by foreign investors with deep pockets. In fact, four countries dominated Vietnam’s M&A market in the period observed, including Thailand, Singapore, South Korea, and Japan. It is no coincidence that these four Asian players also happen to be Vietnam’s top foreign direct investors, having set up multiple factories and projects in different sectors.

“Without a doubt, Vietnam is really one of the darlings of overseas investors,” said Ami Moris, CEO of Maybank Kim Eng. “Strong GDP growth puts Vietnam as one of the superior economic growth countries, with a young and vibrant population that is very tech-savvy. And given the very strong reforms and liberalisation, a lot of interest is coming from foreign investors.”

Different taste

The major M&A buyers, although similar in their eagerness for Vietnamese companies, have a number of strategic differences. Investors from Thailand, for example, are infatuated with Vietnam’s booming consumer sector as evident in their buying spree of leading consumer companies, from retailers like Big C and Metro Cash & Carry, and breweries such as Sabeco, to manufacturers including Binh Minh Plastics and Tien Phong Plastics.

The South Koreans, however, made their mark last year as an enthusiastic M&A investor in banking, insurance, and financial services. The targets for these investments were Maritime Securities (acquired by KB), BIDV (with KEB Hana), HFT Securities (Hanwha), Nam An Securities (Shinhan), Post & Telecommunications Insurance (Dongbu) and even the investment fund Dragon Capital (Samsung). The conglomerates Vingroup and Masan Group were also courted by South Korean heavyweights SK Group and Hanwha.

In total, South Korean investors poured in $2.2 billion of M&A capital last year, making them eager buyers in the Vietnamese market. Singapore was ranked second with $1.6 billion in a number of industries, mostly focused on real estate. It is notable that Vietnam’s tech startups also received great love from Singaporean-based venture capitalists last year – a trend that is rising thanks to the sizeable amount of tech talents in Vietnam, as well as the country’s high digital penetration.

Japanese investors have been interested in either banking or consumer finance – such as the case of Shinsei setting up a joint venture with Vietnam’s Military Bank – transportation, facilities, or real estate (notably Sumitomo–BRG and Nomura–Sunwah).

Investors expected these patterns to continue in the remaining months of 2019, with Vietnam’s M&A market likely to report around $6.8-7 billion worth of transactions. The key factor in determining this growth rate is whether the country puts any more major companies up for sale, similar to Vinamilk and Sabeco in previous years.

Challenges

Although the M&A market here has become more familiar with foreign investment, some challenges still linger. Investors often complain about the transparency of financial reports and the auction process at state-owned enterprises (SOEs), for example.

Kevin Snowball, chief investment officer at PXP Asset Management, pointed out that investors are worried about under-the-table transactions that might take place at SOEs, “where people might just sell the shares to their friends”. Other issues include the willingness, or lack of, group leaders to meet international investors and provide transparent details on their finance, operations, and strategies.

Regarding financial reports, Vietnamese accounting standards contain vast differences to the International Financial Reporting Standards (IFRS), making it harder for overseas investors to make sense of a Vietnamese company’s earnings and losses. There are also no official requirements to release corporate information in English, which can also discourage suitors from abroad. In response to this problem, the Ministry of Finance this year rolled out a pilot plan to launch IFRS at major Vietnamese companies, especially those with the intention to list on the stock market or raise funds from foreign investors.

M&A participants also reported that cultural differences can also make or break a deal. Surprisingly, despite their importance, cultural compatibility still takes lower priority than valuation and pricing in many M&A negotiations in the country. Last year the market witnessed a break-up between Vietnamese eggmaker Ba Huan and VinaCapital that ended in a complete fall-out. In another case, ongoing disputes between South Korea’s Lotte Group and Bibica have put a huge dent on the latter’s business.

“Most major M&A deals in Vietnam involve foreign investors, and the lack of English proficiency at many Vietnamese companies is doing more harm than good. It is much better for all sides if leaders can discuss strategies and negotiate directly with each other,” wrote the M&A Research Team.

|

The last major issue is seen as a technical one – with investors coming in flocks, the number of available targets in Vietnam for M&A will reduce. The possibility of partnering with industry leaders in the country is likely to fall, forcing financiers to be more competitive and aggressive in their dealing with target Vietnamese companies. This also requires the government to push the equitisation and divestment process at SOEs in the coming years, as these sales will bring more high-quality products to the market.

| Tan Soon Kim - Assistant CEO, Global Markets Enterprise Singapore

Overall, we see a lot of potential in Vietnam, which saw a GDP growth of 7.08 per cent last year, a record high in the past decade. Singaporean enterprises are keen to partner with Vietnamese companies in the country’s growth and transformation. There is potential for investments and collaboration in infrastructure, manufacturing, urban solutions, consumer, and the digital sector. There are many modes of collaboration, such as joint ventures, direct investments, and strategic alliances. In certain situations, M&A could also be considered when the conditions are conducive for both parties to forge partnerships and to pursue a bigger competitive advantage or higher growth. Business-friendly investment laws and the availability of financing and market information would be some of the key factors critical to the success of a thriving M&A scene. Andy Ho - Managing director and CIO VinaCapital

M&A activities in Vietnam have been vibrant, with minor investments to all-out and 100 per cent acquisitions. It’s another sign of how this economy has attracted enormous interest from domestic and international investors. VinaCapital typically invests and owns between 10-40 per cent of private businesses, intending to exit our investment in two to three years via a sale to a strategic buyer. We have enjoyed many such entries and exits over the year. However, with the stock market recently trading above 15x earnings, more of our private investments have decided to list on the stock market, making it easy for us to exit. The unique value proposal of our private investment strategy is that we can do full due diligence around legal, financial and environment, social and governance matters before we invest. This is vitally important because, in our experience, there can simply be too many skeletons in a company’s closet, and we have seen what can go wrong. It also gives us a chance to improve corporate governance and better position of the business sold to a strategic buyer in the years to come. M&A activities should increase in the coming year, both in the investment and control acquisition areas. We also expect to see business owners look towards private capital to raise money, especially banks, as their need for capital is generally quite high. We also expect to see stronger investment and exit terms like reps and warranties as investors and multinational corporations better understand Vietnam’s rules and regulations. Nguyen Thi Ngoc Chau - Senior manager Transaction Advisory Services Grant Thornton Vietnam

In 2018, foreign investors invested $9.89 billion through M&A activities in Vietnam, up 59.89 per cent on-year, accounting for 27.78 per cent of new registered foreign direct investment (FDI), and 51.78 per cent of implemented FDI, which are impressive figures. Also last year, M&A activities became the most important channel to attract FDI to Vietnam. While a new foreign project takes several years from market research and feasibility studies to detailed appraisal procedures before its execution, projects via the M&A route help investors save significant time and costs. Foreign investors just need to negotiate with local enterprises who prove to fit into their investment strategies. When becoming majority shareholders, foreign investors could further be involved in corporate governance of the local enterprises. The strong growth of M&A activities in Vietnam is supported by the following factors: the increasing potential and attractiveness of local enterprises, the acceleration in equitisation activities of state-owned enterprises, the ratification of recent free trade agreements, and the increasing confidence of foreign investors in Vietnam’s market. We expect this trend to continue. There are still challenges for foreign investors to tap into the Vietnamese market. Administrative procedures are one of the key challenges faced by foreign investors in Vietnam. Moreover, those procedures expose investors to the risk of delays and loss of opportunities. Another hurdle is the lack of a skilled labour force, especially within the digital economy. According to the 2018 Global Talent Competitiveness Index, Vietnam ranks 87th among 119 countries in terms of its ability to develop and attract talent. To address this concern, the government needs to keep working on providing high-quality education and training to its labour force to meet current industry demands, as well as preparing the next generation of workers to compete in those highly-skilled sectors. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

- DKSH to acquire Vietnamese healthcare distributor Biomedic (December 24, 2025 | 15:46)

- Central Retail refocuses Vietnam strategy with Nguyen Kim exit (December 24, 2025 | 15:01)

- RongViet Securities wins sixth consecutive M&A advisory award (December 22, 2025 | 17:30)

- Kido Group divests from ice cream and frozen foods (December 18, 2025 | 16:49)

- Insurtech startup Saladin wraps up Series A funding round (December 17, 2025 | 09:10)

Tag:

Tag:

Mobile Version

Mobile Version