The curious case of mini marts and convenience stores in Indonesia and Vietnam

|

| A typical mini-mart found in Jakarta, Indonesia |

Domestic winners

When strolling along the busy streets in Jakarta, visitors cannot help but notice a strange situation: global convenience store brands are virtually absent. Familiar names like 7-Eleven are nowhere to be found in Indonesia’s bustling capital.

This is particularly interesting when we compare Jakarta to other cities in Southeast Asia like Bangkok, Kuala Lumpur or Singapore, where convenience stores are ubiquitous.

So what is happening in Jakarta? After a quick look, it becomes clear that the locals here shop at domestic minimarts like Indomaret or Alfamart instead of frequenting convenience stores run by global brands.

The minimarts here, littered across the city, tend to be bigger and offer more products than typical convenience stores. It is estimated that Indomaret has almost 14,000 outlets across Indonesia, while Alfamart runs another 11,000 shops. Together, these two chains take up 90 per cent of the market share in modern trade in Indonesia, Euromonitor noted.

|

| A mini-mart like this can be found within 1km on any street in Jakarta |

Contrary to the flourishing local players, 7-Eleven was a story of woes. The global convenience store giant closed down its last store in Jakarta in June last year, merely eight years after it debuted in the ASEAN’s largest market.

Other globally recognisable names are also trailing far behind—for example, Japan’s FamilyMart only has 80 outlets in Indonesia, six years after setting foot in the country.

|

| 7-Eleven closed it franchise system in Jakarta last year (Source: Jakarta Globe) |

Not for the general public

What has hampered the success of global convenience store brands in Indonesia, while the concept works so well in other ASEAN markets?

For starters, many Indonesians believe that these stores are overpriced and only suitable for young urbanites, who loiter there for free Wi-Fi and air-conditioning. Most of the time these customers do not spend a lot and seldom go to these stores on a daily basis, making repeat purchases a big problem for global chains.

“I believe 7-Eleven only attracts teenagers who spend the whole day there to buy Slurpees, hang out with each other, and enjoy free Internet,” said Ratna Nurmalita, a 24-year-old reporter living in Bogor, a city 60 kilometres south of Jakarta.

Nurmalita told VIR that for daily necessities, she goes to mini-marts like Alfamart or Indomaret instead.

|

| In Jakarta, mini-marts co-exist with traditional street vendors |

Most global convenience stores have limited presence in downtown Jakarta, undermining their relevance to the daily lives of most locals. Moreover, some Indomaret stores have set up sit-in areas for ready-to-eat meals, imitating the concept of global convenience stores.

In a research note, Olly Prayudi, director of Fitch Ratings Indonesia, said that 7-Eleven failed to differentiate itself against fast-food restaurants, which also have cheap food, free Wi-Fi, and air-conditioning. There is also competition from traditional food stalls, which remain popular among Indonesian consumers.

"7-Eleven’s risk profile is significantly different from that of other mini markets and convenience stores, such as Alfamart and Indomaret, which put greater emphasis on groceries and have a bigger network across the country," Prayudi wrote.

|

| Inside an Indomaret mini-mart |

How about Vietnam?

With this in mind, it can be interesting to see whether the same situation could happen in Vietnam. For now, convenience stores are all the rage in Ho Chi Minh City, where young locals frequent the air-conditioned stores in hordes to study, chat, and have a quick meal.

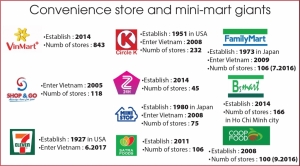

It seems that the market share battle between foreign and domestic stores in Vietnam can be more fragmented than Indonesia. Dominant overseas players in Vietnam include America's Circle K, Japan’s FamilyMart and 7-Eleven, and Thailand’s B-Mart. On the domestic side, the VinMart+ system is gaining popularity thanks to their mini-mart format. Other players are Ministop, GS25, and Shop-and-Go.

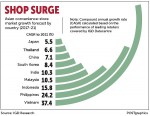

The Institute of Grocery Distribution (IGD) noted that Vietnam is the fastest-growing convenience store market in Asia. The compound annual growth rate of Vietnam’s convenience stores is at 37 per cent, while the figure for Indonesia is only 16 per cent.

|

| VinMart+, a local player facing foreign rivals in Vietnam |

In Vietnam, FamilyMart already runs 100 stores and plans to have 800 by 2020, while its competitor 7-Eleven plans to open 100 stores within the next three years.

200 new supermarkets and 4,000 convenience stores are the goals of VinMart and Vinmart+ for 2020.

With so many players, it can be hard for anyone to snatch the biggest share of the pie.

When asked about 7-Eleven Vietnam’s strategy and whether it can learn from Indonesia, CEO Tu Vu said he believed the key is responding to what customers need.

“I cannot comment on other markets, but for Vietnam, consumer needs change very fast and it is our responsibility to respond to those changes and offer what consumers look for,” said Vu.

| Vietnam in "Golden Period" for convenience stores Vietnam in "Golden Period" for convenience stores |

| Korean convenience store chain GS25 sets foot in Vietnam Korean convenience store chain GS25 plans to open its first store in Ho Chi Minh City this year, marking a foray in the Vietnamese retail ... |

| Vietnam leads Asia for growth in convenience store Việt Nam is forecast to be the fastest growing convenience store market in Asia by 2021, according to new data released by international grocery research ... |

| Convenience store business grows attractive to foreign retailers Foreign retailers are showing huge appetite for a slice of the convenience store business pie in Vietnam as their investment spree will not be over ... |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- MAE names big 10 policy wins in 2025 (February 06, 2026 | 08:00)

- US firms deepen energy engagement with Vietnam (February 05, 2026 | 17:23)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

Tag:

Tag:

Mobile Version

Mobile Version