Study finds corporate governance is crucial for SOE equitisation

|

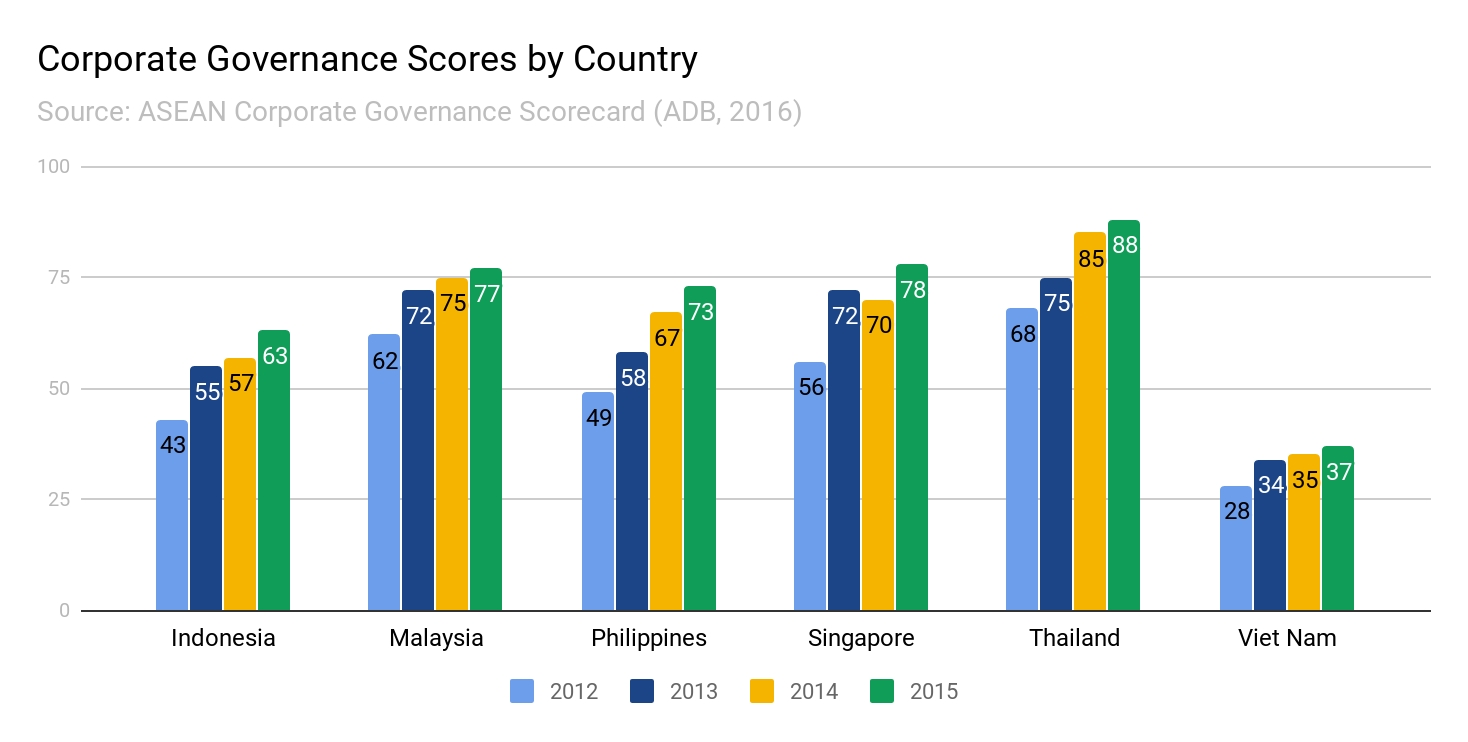

| Vietnam's corporate governance score lags behind other ASEAN countries, which reduces the appeal of SOEs equitisation (Source: ADB) |

In this study, researchers from RMIT University, with support from VinaCapital, suggested that transparency and accountability in Vietnamese state-owned enterprises (SOEs) would be a key building block of Vietnam’s economic growth and rising appeal as a foreign investment magnet.

Specifically, an increase of 10 points on the corporate governance scale of the Asian Development Bank (ABD) would result in an increase of around 17 per cent in the market-to-book value of a firm.

According to Dr Burkhard Schrage, lecturer at RMIT School of Business & Management, such an increase in better governance will benefit all Vietnamese citizens who are ultimately the “owners” of equitised SOEs.

|

| Dr Burkhard Schrage from RMIT Vietnam |

“It is time for Vietnam to implement best governance practices in SOEs. This will have two important consequences: first, Vietnam signals […] that good governance is a serious concern, and second, it also increases the valuation of the forthcoming equitisations,” Dr Schrage explained.

The finding comes from one-on-one interviews with 20 market participants, ranging from investors, advisors, and SOE management to political decision makers. An analysis of past equitisation data was also conducted, together with several in-depth case studies of recent equitisations.

The RMIT study also found that some SOE leaders and employees are hesitant to equitise out of fear of losing benefits, positions, and privilege. Other issues are based on a possible lack of co-ordination and oversight of relevant authorities.

Another area of improvement is the actual process, which was considered by study participants as “often cumbersome, lengthy, and not-so-transparent.”

As an example for opaque governance practices, Dr Schrage said that at a number of Vietnamese SOEs, the CEO is also the board chairman, which has been shown as detrimental for shareholder value. At other SOEs, there are virtually no independent directors: the supervisory board is entirely composed of management and other employees of the company.

“This is another practice that goes against accepted good governance mechanisms,” said the researcher.

| Licogi cannot cover debts with tiny profit Equitised construction giant Licogi earned little after-tax profit in recent years, which cannot cover the instalment payments of its half a trillion dong debts. |

| SOE divestment a priority in CPTPP era Vietnam will be required to comply with strict commitments to remove state ownership in enterprises, as laid out in the new Comprehensive and Progressive Agreement ... |

| Enhance accountability for SOEs: PM Prime Minister Nguyen Xuan Phuc asked accountability to be enhanced in the restructuring and divestment of State-owned enterprises (SOEs) to improve the efficiency of the ... |

| Equitisation changes too little in SOEs Experts claim that state-owned enterprises (SOEs) cannot adopt modern corporate governance standards and improve performance because state ownership remains high even after equitisation. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version