Stronger flows on the horizon

|

After the UK and Vietnam forged diplomatic ties 45 years ago, British companies have been active investors in the Southeast Asian country. The first wave of investment started in 1988, when UK investors in various sectors such as mining, oil and gas, manufacturing, real estate, and finance entered Vietnam in the hopes of gaining the first-comer advantage in this newly-opened market.

Over the years, British investors have established a strong presence in Vietnam. Well-known names include oil giant BP, carmaker Rolls-Royce, telecommunications group Vodafone, drugmaker GlaxoSmithKline, and financial institutions like Standard Chartered, and Prudential. It is notable that HSBC and Standard Chartered are the first banks to set up a 100 per cent foreign-owned entity in Vietnam, paving the way for lenders from other countries to enter the market.

UK-Vietnam trade relations were given a boost in 2010, when the two countries signed a strategic partnership, aiming to strengthen ties in business, trade and finance. Vietnam became an important partner for the UK in Southeast Asia, driven by regulatory support, Vietnam’s openness to foreign investment, and robust economic growth.

In 1992, the UK was the first donor of official development assistance (ODA) to Vietnam, and it currently remains a steady investor in Vietnam’s development programmes, from healthcare to renewable energy and smart cities, via the UK Vietnam Fund. The Prosperity Fund, set up in 2015, was a regional initiative to improve Vietnam’s business climate, boost financial sector reform, and ensure energy security.

Regarding investment, as of June 20, 2019, the UK is the second-largest European investor in Vietnam (after the Netherlands) with 378 projects worth $3.648 billion. In terms of trade, the UK stands only behind Germany and the Netherlands as the biggest European partners for Vietnam, with two-way trade turnover standing at $6.77 billion in 2018 (up 10 per cent from 2017).

The two countries have so far signed a range of frameworks on double taxation, business and investment promotion, and the UK was also a strong supporter of the EU-Vietnam Free Trade Agreement. In light of the UK’s upcoming departure from the European Union, both the UK and Vietnam have expressed wishes to start negotiations on a bilateral trade agreement.

In Vietnam’s capital market, British investors have also made their mark as a long-time supporter of Vietnamese companies. Established in 1994, the $3 billion Dragon Capital was the first foreign investment fund in Vietnam and remains a major player in the domestic stock market. The fund, together with Vietnam Holding Ltd., and Vietnam Opportunity Fund from VinaCapital, is currently listed on the London Stock Exchange.

Despite these milestones and achievements, experts and regulators pointed out that UK-Vietnam business relations have yet to live up to their potential.

In particular, the UK is the world’s fifth-largest investor with $300 billion of capital, and the country is also one of the world’s prominent financial hubs. Yet indirect investments from the UK to Vietnam stood at only $1 billion via share purchases, and direct capital remains below $4 billion. This is much smaller than that of countries such as South Korea, which pours approximately $8 billion into Vietnam on a yearly basis.

According to Vietnamese Minister of Finance Dinh Tien Dung, the amount of British investment capital in Vietnam at the moment does not reflect the immense potential of the bilateral partnership. This is particularly evident in Vietnam’s financial market, which is growing exponentially and presents ample opportunities for British investors.

A quick look at the numbers made it clear that Vietnam is among the fastest-growing financial markets around the world. Market capitalisation expanded 17 times in the past decade, accounting for 72 per cent of GDP in 2018. By the first quarter of 2019, Vietnam’s stock market was valued at $191 billion, up 10.9 per cent against December 31, 2018 and surpassing the national target.

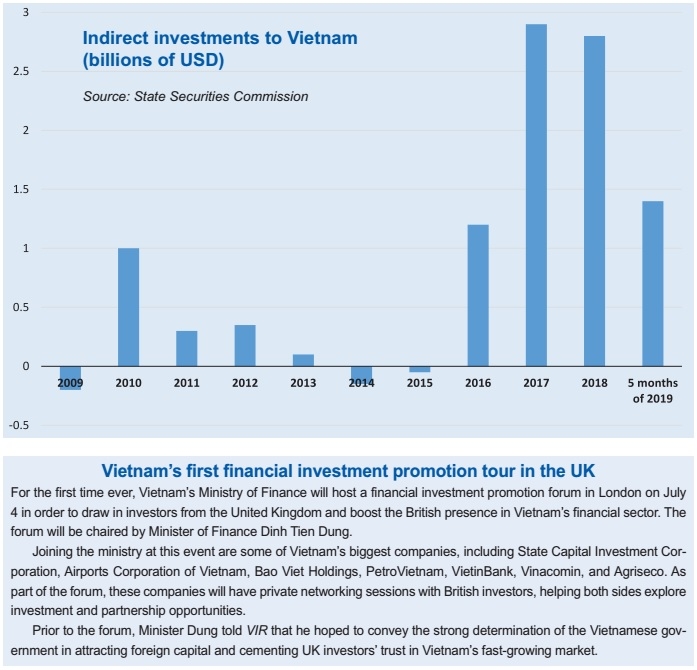

Since 2016, indirect investments from foreign investors average at $1.98 billion every year – and $1.28 billion has already flown into Vietnam in the first five months of 2019. This number is expected to surge even higher as Vietnam is planning to amend the laws on Investment, Enterprises, and Securities within 2019, making it easier for foreign investors, including those from the UK, to join the domestic stock market.

Minister Dung pointed out some potential changes in the regulations regarding foreign ownership limits, information disclosure in English, bond market development, and the establishment of Vietnam’s stock exchanges. More derivatives products are also slated to enter the market, providing a wider range of options for investors. One highly potential area of investment, for those from the UK, is Vietnam’s equitising state-owned companies (SOEs).

According to the 2017-2020 plan, Vietnam must equitise 140 SOEs and, so far, only 37 companies have finished their transition into private entities. This means there are still a lot of opportunities for foreign investors to join in initial public sales, or strike up strategic partnerships with Vietnam’s industry leaders.

“We strongly appreciate British investors looking to join hands with Vietnam’s SOE equitisation efforts. Besides capital, we hope that investors from the UK, and Europe in general, will help Vietnamese companies improve their standards in corporate governance and technology,” said Minister Dung.

| Richard Irwin - Partner, PwC Vietnam

I have seen continuously growing foreign investor interest in Vietnam in recent years. The longer, established reasons for this still stand – attractive demographics, emerging middle class, alternative location next to China for multi-national corporations’ manufacturing bases, and plentiful labour supply. But recently we have also seen foreign investors attracted by the equitisation of some large state-owned enterprises, the relaxation of limits on foreign ownership at listed companies and an increasing interest in green energy. We also generally see Vietnamese business owners as being more open to foreign investment and co-operation than in some other countries in the region. However, the presence of investors from the EU and the US remains limited as they are still concerned with the poor physical infrastructure in Vietnam. Vague regulations and inconsistent enforcement continue to cause problems to existing investors, and these ongoing problems can deter new investors. We also see a generally low lack of awareness in Vietnam in some of these territories. Overall, Vietnam has a very compelling story to tell to investors from these countries, but more needs to be done to promote this message. Vietnam’s still weak physical infrastructure needs improvements and this could be a key target for foreign investment. At the same time, the regulatory and licensing environment needs to be improved in order to really tap into foreign investor interest in this sector – as evidenced by the paucity of public-private partnership projects that have got off the ground to date. The banking sector and e-commerce are also areas where foreign investment could pay off for both sides. However, manufacturing still clearly has potential for more growth, particularly in the value added sectors, and in import substitution so that Vietnam can build up a domestic supply chain, instead of importing the components and materials for its exports. Mike Lynch - Managing director, co-head of Institutional Brokerage, SSI Securities Corporation

Joining the delegation of the finance and securities industry to promote investment in Vietnam, SSI Securities Corporation (SSI) would like to contact many investors to inform them about the event – and invite them to attend. These are institutional investors with global investment mandates based in England and Scotland. We have many investing clients in the UK – and many more that are not yet engaged to trade in Vietnam. The message that they would want to see and hear is that Vietnam is working with global best practice exchanges (like the London Stock Exchange) to bring the Vietnamese capital markets up to global standards. Many investors from the UK are interested in finding a well-balanced risk-return way to invest in Vietnam. They are interested in infrastructure (roads, bridges, water, and utilities) and financial system investments – among others. They need to be convinced that Vietnam has foreign-investor-friendly policies in place – including corporate governance – to make it a market that is worth investing in. Free market policies and transparency are of key importance. It is also important to have investor protection and compliance at all levels of the system to help eliminate fraud. It is known that in investment activities, the British are very interested in the issue of social responsibility in addition to the financial profit factor. This falls into the areas of transparency, free markets, and compliance. Most global investors care about social responsibility to a degree because they must answer to their investors. It is far easier to invest in known and responsible companies than the unknown. No one wants to be caught holding interest in a company that behaves badly. Free markets should give the advantage to companies that act well against those who cheat and behave badly. Vietnam should prioritise improved corporate governance and establish good laws for things like labour practices and environmental practices to alleviate concerns. In terms of calling for capital or setting up an intermediary, and creating a bridge to attract investment from the UK into Vietnam, I think that any move to make it easier for global investors in Vietnam will be seen positively. This could include off-shore exchange-traded funds (ETFs) or asset management products that treat foreigners and locals the same way and feel like products they are all used to. This could include sector ETFs (banks, utilities, and consumer) and ETFs that allow for the purchase of foreign limited (FOL) shares at local prices. Vietnam should enable global-standard trading practices that include short-selling, day-trading, and margin lending to foreigners. Perhaps most importantly, Vietnam needs to implement a way for foreigners to trade FOL shares with a price that can be marked-to-market on a daily basis. The solution for this FOL issue can be found in Thailand – and the Ho Chi Minh City Stock Exchange team is working on this. If we could communicate a clear decision to go in that direction to the foreign investor base – with a deadline in the near term – it could help attract many foreign investors. Nguyen Thanh Long - chairman, Hanoi Stock Exchange

As part of this year’s Investment Promotion Forum in London, the Hanoi and Ho Chi Minh stock exchanges will sign MoUs with the London Stock Exchange Group. What areas of co-operation do you hope to see between the stock bourses? I think it’s important, first of all, to understand why we want to partner with the London Stock Exchange Group (LSEG). The LSEG was set up in 1698 and is now the world’s seventh-largest stock market with more than $3.7 trillion worth of assets. LSEG is a global provider of equity markets services, including risk management tools. The group is also a pioneer in ground-breaking solutions for the financial industry, with tech innovations that can be used at 40 leading organisations and stock exchange around the world. FTSE Russell, a member of LSEG, is a well-known provider of market indexes and data solutions. LSEG has four main trading platforms, including the London Stock Exchange (LSE), Borsa Italiana (Italian Stock Exchange), Turquoise (the European trading platform), and a fixed-income trading platform. Through these platforms, the LSEG welcomes market participants from all over the world who want to access the European capital market. The LSEG has an important economic and social role because firms in the UK and Europe can find the funding they need for their business activities. LSEG has services for the vast majority of securities around the world, from equities, bonds to exchange-traded funds and derivatives. The AIM market is one offer from the LSEG for small- to medium-sized companies and startups. LSEG is also a successful developer in derivatives to provide risk management services for developing countries, especially Russia and Italia. This includes futures and options on the FTSE. The government bond trading system in the UK is quite similar to the HNX, because the HNX is modelled after the whole-sale market of the LSEG. The HNX’s derivatives market is also developed by GMEX, which counts LSEG as an investor. We can see that LSEG offers such a wide variety of market tools, information structures, and development strategies that the HNX can learn from. We hope that this collaboration will fasten the learning process, especially in terms of a stock market for startups, bonds, and derivatives. Before that, in 2008 the HNX and the LSE have signed an MoU to share market information, train staff members and share experiences, which includes cross-listing. The new MoU this time will be an expanded and upgraded version of that one. As part of this MoU, we’ll find the right solutions that fit the two countries’ regulations, making it easier for Vietnamese firms to seek foreign funding. The first step is exploring how to list high-quality Vietnamese firms overseas, and developing the debt market in Vietnam. The three sides will exchange information related to the legal framework of listing, trading, corporate governance, and platforms. Dang Quyet Tien - head of the Corporate Finance department at the Ministry of Finance

At the Investment Promotion Forum in London this time, we want to convey these following messages from Vietnam to investors in Europe and the UK: First, we want to tell them about our regulatory updates on the equitisation and divestments process at Vietnam’s state-owned enterprises (SOEs). The general direction is to improve the transparency and accessibility of these transactions, following market principles. Second, Vietnam has a ready supply of SOEs and other financial products for sale to foreign investors. Third, the Ministry of Finance and the State Securities Commission will always be ready to listen to suggestions and opinions of investors from Europe and the UK, filfulling our role as your trusted companion in Vietnam’s investment and business environment. This year, we’re announcing the list of equitising SOEs, or upcoming state divestments, which we believe has a lot of interesting names that can capture the attention of European and British investors. We want to emphasise that Vietnam’s government is determined to restructure the SOE segment, push the efficiency level at SOEs and follow market principles, together with developing non-public companies. Our goal is to minimise the number of SOEs in Vietnam, and increase the amount of listed firms on the stock market. This initiative will force companies to follow international rules on corporate governance, starting with OECD standards. Some attractive segments that investors might consider include: 1. Energy (Genco 1,2,3 – PV Power – TKV Power, etc...) 2. Mining and natural resources (TKV, Binh Son Refinery, PetroVietnam Camau Fertiliser, Phu My Fertiliser, etc..) 3. Services (VNPT, PV Oil, etc…) 4. Banking and insurance (Bao Minh Insurance, Agribank, etc…) To make it easier for European and British investors to join in the equitisation and state divestment process at SOEs, we’ve conducted research on the book building method. In our opinion, book building clearly showcases our determination in following market principles and ensuring transparency and accessibility of SOE sales. We hope that with book building coming up in the future, investors will no more be concerned about the lack of information or time when they decide to invest in Vietnamese SOEs. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version