Strong solutions required to upgrade efficiency of domestic enterprises

|

| Figure 1 |

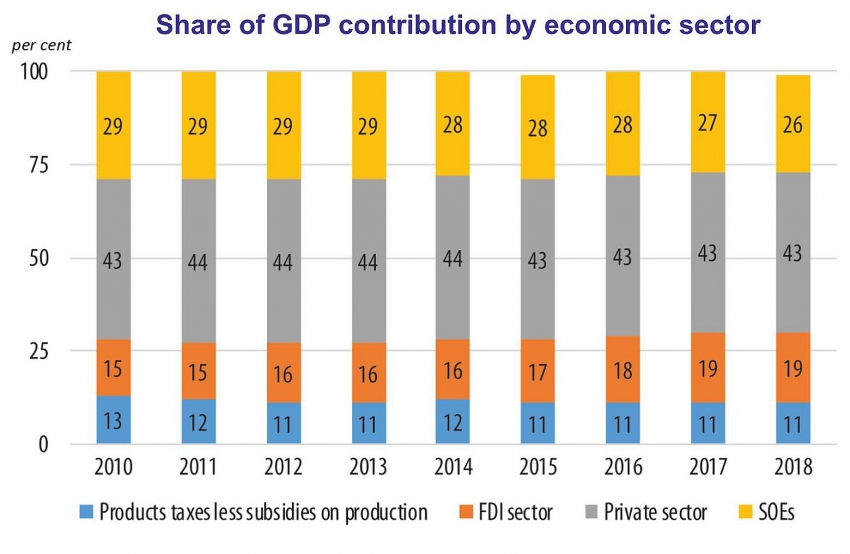

Since the renovation period, state-owned enterprises (SOEs) and the private sector have always been the two main pillars of economic growth in the country, besides foreign-invested enterprises (FIEs). Although the proportion of the two economic sectors in GDP has decreased from 72 per cent in 2010 to 69 per cent in 2018, they still make up a relatively high proportion.

|

| Dam Nhan Duc, head of Research and Corporate Development at MBBank |

It is noteworthy that the contribution of the private sector has been maintained at a high rate of 43 per cent while SOEs decreased slightly from 29 per cent in 2010 to 26 per cent in 2018 (see Figure 1). This can partly be explained by the results of the government’s equitisation process, as the contributions of many enterprises were carried on from the SOE to the private sector bracket after equitisation. According to the General Statistics Office, the number of SOEs decreased from 12,000 in 1990 to 500 wholly-state-owned enterprises in 11 industries and sectors by the end of 2018.

Notwithstanding their remarkable successes and contributions, domestic enterprises (including SOEs and privately-owned firms) are underperforming compared to the average, especially to FIEs, despite the many barriers in language, culture, and business practices.

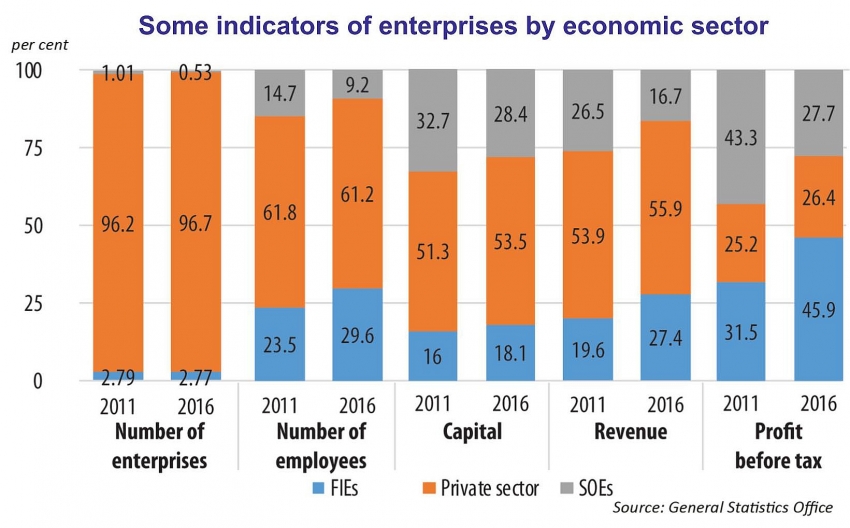

Specifically, in 2011, with 32.7 per cent of the capital, SOEs contributed 43.3 per cent of the profits of all types of businesses, but in 2016, their capital volume decreased to 28.4 per cent and profit contribution to only 27.7 per cent. Furthermore, in 2011, the private sector accounted for 51.3 per cent of the capital but created only 25.2 per cent of the profit, while in 2016, these figures were 53.5 and only 26.4 per cent (see Figure 2).

Meanwhile, with only 16 per cent of the total capital in 2011, FIEs generated 31.5 per cent of the total profit in the economy. However, by 2016, they increased capital slightly to 18.1 per cent, however, they accounted for nearly a whopping 46 per cent of the total profit.

The media often talks about SOEs losing billions of US dollars like Vinashin, Vinalines, or the series of recent projects of the Ministry of Industry and Trade, as well as oil and gas projects, but it seems they are forgetting an important fact – that the private sector, with its large GDP contribution, is also operating inefficiently, as shown by the GSO statistics.

Is this really true and are the holdups different from those reported at SOEs because normally the private sector should be more effective? Are domestic enterprises loosing competitive advantages in their home market?

With resources such as headquarters, factories, government incentives, customer base, operational experience, market knowledge of SOEs and the youth and dynamism of the private sector, they should have made better use of their competitive advantages.

If the government takes measures together with businesses to overcome the above-mentioned weaknesses and improve the efficiency of domestic enterprises, Vietnam still holds ample room for economic growth. Many researchers, ministries, and government agencies have proposed and implemented many different solutions, which can be categorised into the following seven groups of solutions with the hope of adding to the voice of policy-making agencies and the Vietnamese business community.

|

| Figure 2 |

Promoting equitisation

Although this has been discussed and implemented, the importance of the equtisation and divestment of state capital from enterprises which the government does not need to control needs to be emphasised with new arguments and supporting. While the many successful cases of wholly-state-owned enterprises such as Viettel may lead to the thought that equitisation is not necessarily the only solution to help enterprises to be effective.

This may be true because, in addition to the ownership structure, corporate governance and management also play a very important role. However, equitisation proffers added benefits such as enhancing transparency and the supervision of business operations by the media and society. Additionally, it helps enterprises access long-term capital in the capital market, and even more importantly, frees up important government resources for important state management activities.

Modern corporate governance must be applied to SOEs in accordance with market principles. SOEs must strive for efficiency, with financial efficiency a top priority. For SOE reforms to be truly effective, these enterprises need to follow market mechanisms, compete fairly with other enterprises in all economic sectors, and take responsibility for their own performance, in other words, operate on the same footing as other types of businesses.

Attracting talents, especially for leadership positions, is the fastest solution to address the weaknesses of not only inefficient SOEs but any enterprise, because a good leader will identify and minimise the causes of inefficiency.

However, in order to attract talents, especially good leaders, the government needs to apply strong mechanisms such as open recruitment instead of the appointment mechanism, allowing the recruitment of outsiders, even foreigners such as the case of recruiting the head coach of the Vietnamese U23 football team, Park Hang Seo.

It is necessary to link the remuneration packages of key executives to business performance, rewarding them with a worthy share of the profits they produce and applying appropriate penalties for weak or unprofitable business operations.

Additionally, competent leaders are not enough, it is necessary to empower them with the necessary executive rights such as selecting, appointing, and dismissing subordinates, the right to decide on spending and managing finances as well as the right to run the day-to-day operations of the business. In order to stimulate the development of the private sector, the government needs to continue creating a level playing field among businesses in all economic sectors. This includes perfecting mechanisms and policies, improving the business environment, and motivating and improving Vietnamese entrepreneurship.

Closer supervision of capital mobilisation

Financial indicators, especially when comparing capital and profitability ratios, may not reflect the true performance of economic sectors, especially the private sector. The reasons might lie in the capital raising process and taxation activities. In reality, there seem to be loopholes in the regulations on capital raising.

For example, the process is conducted via the local department of planning and investment before the enterprise is listed. The results are mainly based on reports compiled and submitted by the enterprise and the listing license is handed out by the State Securities Commission of Vietnam mainly based on the examination of submitted documents and papers. Functional agencies do not co-ordinate closely in supervising the capital raising activities of enterprises, which may lead to inadequate increases of capital.

After a research of the financial statements of many companies, it is apparent that enterprises prefer conducting large-scale capital hikes very swiftly before applying for listing. Therefore, the authorities need to issue co-ordinated measures, strengthen the inspection and supervision of capital mobilisation activities, especially the new issuances of private companies before and after listing.

Going from the premise that the private sector operates more effectively and that it is necessary to promote the equitisation of SOEs to diversify ownership structures, increase autonomy, and innovate corporate governance, another solution, especially for the private sector, is to increase tax inspections, along with monitoring capital mobilisation activities of questionable enterprises. More meticulous tax inspections can, at least, draw a more accurate picture of the performance of each business sector before implementing different solutions.

The article represents the author’s views and does not necessarily express the views of the organisation he is working for

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- IP alterations shape asset strategies for local investors (January 22, 2026 | 10:00)

- 14th National Party Congress: Vietnam - positive factor for peace, sustainable development (January 22, 2026 | 09:46)

- Japanese legislator confident in CPV's role in advancing Vietnam’s growth (January 22, 2026 | 09:30)

- 14th National Party Congress: France-based scholar singles out institutional reform as key breakthrough (January 21, 2026 | 09:59)

- 14th National Party Congress: Promoting OV's role in driving sustainable development (January 20, 2026 | 09:31)

- 14th National Party Congress affirms Party’s leadership role, Vietnam’s right to self-determined development (January 20, 2026 | 09:27)

- Direction ahead for low-carbon development finance in Vietnam (January 14, 2026 | 09:58)

- Vietnam opens arms wide to talent with high-tech nous (December 23, 2025 | 09:00)

- Why global standards matter in digital world (December 18, 2025 | 15:42)

- Opportunities reshaped by disciplined capital aspects (December 08, 2025 | 10:05)

Tag:

Tag:

Mobile Version

Mobile Version