Spillover FDI effects require levelling up

This year, spillover effects of foreign direct investment (FDI) on the domestic market have returned to the interest of policymakers and the business community as it is “an indicator of continuous recovery, maintenance, and expansion of production activities in Vietnam,” according to the latest assessment of the Foreign Investment Agency under the Ministry of Planning and Investment.

|

| Spillover FDI effects require levelling up - illustration photo |

Foreign investment disbursement in the first nine months of 2022 reached the highest 9-month growth rate over the past five years - up 16.2 per cent over the same period in 2021, reaching $15.4 billion.

Regarding the adjustment of FDI policy in Vietnam in recent years, Dr. Nguyen Tue Anh, deputy director of the Central Institute for Economic Management, emphasised the extent of possible spillover effects on domestic suppliers.

“The issue that many people have been concerned about is the spillover on the domestic sector,” said Anh. “The current FDI policy has not yet played a good role in creating links between foreign-invested enterprises (FIEs) and domestic ones.”

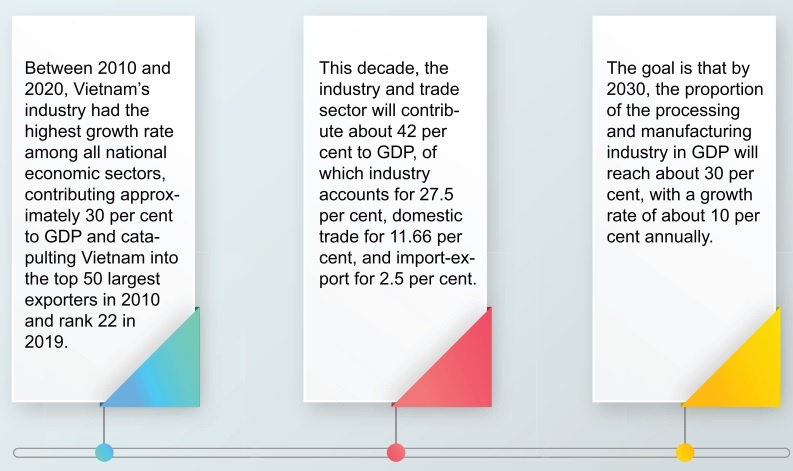

Macro data showed the role of FIEs in Vietnam’s economy. According to the General Statistics Office, the industrial sector not only recovered but also grew strongly. The industry and construction sector increased by 9.44 per cent on-year, contributing almost 42 per cent to GDP in the third quarter of this year, up over 13.6 per cent over the same period last year.

However, the degree of dependence on FIEs is now different from before. Dau Anh Tuan, head of the Legal Department under the Vietnam Chamber of Commerce and Industry, said that a few years ago, half of the Vietnamese export turnover came from FIEs, but the rate increased to three quarters at present. “The links between FIEs and domestic suppliers have been improving but are still insufficient,” said Tuan.

The results of the chamber’s annual survey also show that FIEs only buy about a quarter of their equipment and input materials from Vietnamese enterprises – the rest is imported from parent companies.

Last month, the Ministry of Industry and Trade (MoIT) released a new report, showing that the industry’s key bottlenecks over the past several years have not improved. The internal strength of the industry would remain weak, heavily depending on FDI.

Although these enterprises only make up a fifth of all companies in the country, they account for more than 70 per cent of Vietnam’s total export turnover, especially in key export industries such as electronics, textiles, and shoes.

FDI into Vietnam is mainly concentrated on downstream businesses that take advantage of tax incentives, cheap input costs, such as labour, and not too high environmental and labour requirements. However, this also renders any spillover effect to the domestic sector meagre compared to initial expectations.

Vietnam’s competitiveness and ability to participate in regional and global value chains also remain limited. Industrial production is mainly processing and assembling and of low added value, all of which rely heavily on cheap labour and have not yet brought into play scientific, technological, and innovation advances. The contribution of the manufacturing industry to GDP is also low. Lastly, Vietnam does not have many Vietnamese products and brands that are competitive throughout the region.

Meanwhile, the capacity of local industrial enterprises remains low. State-owned enterprises mainly focus on infrastructure using national resources. Most private enterprises do not have enough resources to invest in research and development to upgrade and innovate technology and increase added value in production activities.

However, the country has the ability to change the degree of spillover between FIEs and domestic enterprises, and the government has been working with organisations and the business community to implement activities to strengthen links between the two sides.

Data from the MoIT’s Department of Industry showed that Vietnam currently has about 2,000 enterprises producing spare parts and components, but only about 300 participate in the multinational supply chain.

The opening of trade through a series of signed free trade agreements has turned Vietnam into the focus of FDI attraction in recent years. However, the dependence on exports that often comes with these funds is assessed by experts as potentially risky.

Experts are concerned that when Vietnamese enterprises have not yet joined the global value chain, it would leave the nation vulnerable to external shocks. Meanwhile, Vietnam’s golden population cycle is coming to an end, so foreign investors may consider looking for new production locations. Experiences from previous countries remind Vietnam that no country can develop sustainably if it only depends on FDI.

|

| Prof. Dr. Nguyen Mai - Chairman, Vietnam’s Association of Foreign-Invested Enterprises

The lack of spillover effects between foreign-invested enterprises (FIEs) and domestic businesses is the main drawback today, which is evident in the limitation of Vietnamese enterprises participating in the global supply chain. Currently, in the textile and garment and footwear industries, Vietnamese enterprises only perform low value-added stages. Likewise, the localisation rate in automobile production is only at about 10 per cent. However, first of all, the responsibility belongs to Vietnamese enterprises. They must have a strategy for development, innovation, and improvement, and actively seek partners to participate in the global chain. Meanwhile, the government needs to come up with specific policies to encourage FIEs to connect with domestic suppliers. Pham Tuan Anh - Deputy director-general, Department of Industry, Ministry of Industry and Trade

Vietnam strives to become a modern industrial country in the next 10 years, but during the national development, the country’s industrial sector faces many obstacles. Therefore, it is necessary to develop the Law on Industrial Development to develop the national industry. The renewed national industrial development policy should focus on resources to promote the development of the processing and manufacturing industry in the country, rendering it qualified to participate in the global production chain and creating a premise for the industrialisation and modernisation of the country. The Law on Industrial Development will create synchronisation and links, which are a basis for bringing into full play the potential of the manufacturing and processing industry, mobilising maximum development resources and creating breakthroughs to contribute to the accomplishment of the country’s goals. |

| Vietnam has “golden chance” to welcome new FDI wave Vietnam has a “golden chance” to attract a new wave of foreign investment, especially to economic zones (EZs) and industrial parks (IPs), according to Deputy Minister of Planning and Investment Tran Quoc Phuong. |

| 2.97 billion USD in FDI poured into HCM City in 9 months Ho Chi Minh City attracted 2.97 billion USD in foreign direct investment (FDI) this year to September 20, a year-on-year increase of 26.1 percent, according to the municipal Department of Planning and Investment. |

| FDI poured into real estate sector doubles Real estate sector attracted 3.5 billion USD in foreign direct investment (FDI) the first nine months of this year, accounting for mearly 19 percent of total FDI that the country lured in the period, coming second among sectors in terms of FDI attraction. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version