Shrimp segment above water

|

| Industry leaders are encouraging enterprises to diversify their products to match the demand of consumers. Photo: Le Toan |

|

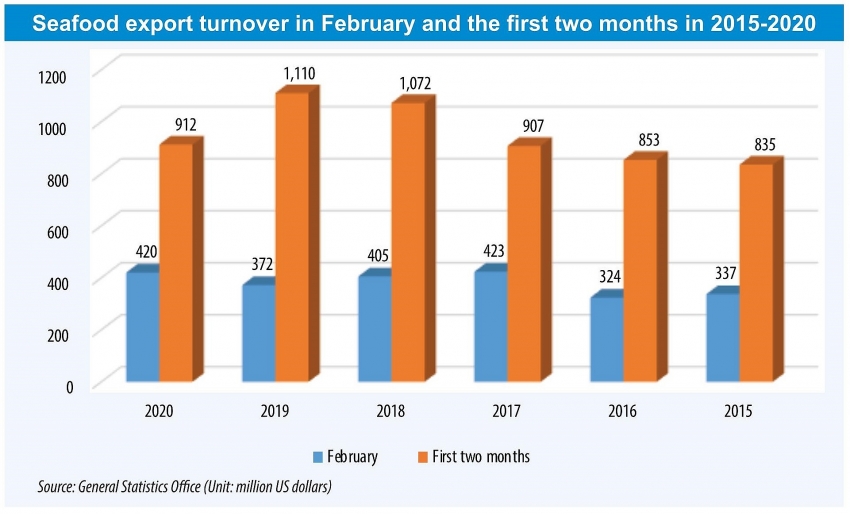

Vietnam’s total seafood export value fell by 17.7 per cent on-year to $912 million in the first two months of 2020 due to the impact of the novel coronavirus, according to the Vietnam Association of Seafood Exporters and Producers.

The pandemic has greatly affected China, one of Vietnam’s main markets, and caused a strong reduction in seafood exports. However, despite general difficulties in the sector, there is optimism about the future of exported shrimp.

According to statistics released by Sao Ta Foods JSC (FMC), in February, 937 tonnes of processed shrimp were exported, with a revenue of $10.7 million. These figures are 187 tonnes and $8.3 million lower than during the same period of last year.

Ho Quoc Luc, chairman of FMC’s Board of Directors, said, “The company has yet to face any difficulties in exporting products to traditional markets, namely the US, Japan, and Europe. No customers from these markets have raised concerns about the impact of the COVID-19 on their business. Even in South Korea, which makes up 5-6 per cent of the company’s exports, activity has been stable.”

“FMC has made an effort to expand export channels to Australia,” Luc continued. “In order to meet the demand of both traditional and new markets, the company raised new shrimp colonies in 220 existing ponds and accelerated the construction of new ponds so we can start to raise new batches in April this year.”

Luc went on to say that although the company has yet to be affected by the virus, in early March they established a COVID-19 taskforce. “The mission is to raise awareness about the outbreak among staff and develop preventive measures,” he said.

Boosted exports

FMC’s move is an example of how seafood processing companies can see opportunities in these difficult times. Furthermore, according to the Vietnam Association of Seafood Exporters and Producers (VASEP), the US’ decision to increase tax on goods imported from China is also a chance for seafood producers to boost exports to this market.

According to Truong Dinh Hoe, general secretary of the VASEP, at present, 70-80 per cent of Vietnamese exported shrimp is sent to Japan, the US, and Europe, with the remaining 20-30 per cent exported to China and South Korea. The COVID-19 outbreak will encourage large markets to reduce imports from China and increase imports from other countries, including Vietnam.

The expected rise in shrimp exports may be backed up by the statistics. According to the General Department of Vietnam Customs, in January, Papua New Guinea ranked as one of Vietnam’s top 10 largest export markets with a turnover of $2.8 million, up 1,358 per cent on-year and 108 per cent compared to last December.

In the first month of 2020, the US accounted for 20 per cent of Vietnam’s total shrimp export turnover with a total value of $37.9 million, a significant on-year increase. In 2019, the US reported a decrease on the total imported shrimp volume, including a drop in imports from Indonesia, Thailand, and China. Meanwhile, the turnover of shrimp imported from Vietnam – along with India, Ecuador, and Mexico – still rose on-year.

Improving quality

Hoe from the VASEP stated that the peak shrimp farming season is usually at the end of June, by when the COVID-19 pandemic may have been brought under control and the market could be vibrant again. “The sooner the outbreak stops, the better the sector’s prospects are,” he said.

Hoe also recommended diversifying products to match consumption demands, saying that, “Fresh and ‘clean’ shrimps are favoured by markets such as the US and Europe.”

While the virus is spreading and impacting numerous areas of the economy, the EU-Vietnam Free Trade Agreement (EVFTA) should prove to be an invaluable tool for the Southeast Asian nation, allowing it to cut taxes and approach new, potentially lucrative export markets and giving it a distinct advantage over competitors such as India and Thailand.

In order to seize this opportunity, Vietnamese businesses must satisfy many requirements relating to technical and quality standards and rules of origin.

“Moreover, they should develop an efficient supply chain in order to ensure food safety and hygiene, and enhance the competitiveness of products,” said the VASEP general secretary.

However, this is not an insurmountable obstacle for Vietnam to overcome. As one of the leading shrimp export companies, shipping thousands of tonnes of shrimp annually, Thai-backed C.P. Vietnam has applied numerous solutions to enhance productivity and improve the quality of shrimp farming to match the requirements of demanding markets, and explore new ones.

In 2019 alone, more than 4,000 new farms were developed and put into operation, following the company’s advanced CPF-Combine shrimp farming model. This remarkable growth expanded the shrimp farming industry by 9,000 households.

The CPF-Combine approach produces organic, safe, and traceable shrimp, utilising baby shrimp imported from the parent company – C.P. Group, new high-quality feed, and advanced technology, resulting in large shrimp and high productivity.

Boonlap Watcharawanitchakul, senior vice president of C.P. Vietnam, said that this provides a sustainable foundation for the company to strengthen output, as well as improve export volume and seize opportunities created by the EVFTA to reach new overseas markets.

After fish fillets, shrimp is the second-biggest seafood product exported by Vietnam to the EU. It makes up 4.3 per cent of the EU market, behind Thailand (4.5 per cent), India (9.1 per cent), and Ecuador (12.4 per cent).

Therefore, as a result of factors like the outbreak, the EVFTA, and significant investment into farming and processing lines, as well as prominent businesses’ experience in entering new overseas markets, the Vietnamese seafood industry is expectedly well placed to make even bigger inroads into the EU and US in the near future.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version