Serviced apartments expect tougher competition

The serviced apartments in mix-used projects have showed off their advantages compared to the buy-to-let ones.

But buy-to-let apartments are gaining favour with many customers, due to flexible, lower rental costs. Nguyen My Anh, an employer who is renting an apartment from an individual in Nguyen Phong Sac street on the west of Hanoi, said that with the fee of only VND8 million ($380) she can have an 80 square metre apartment. The more important thing, Anh said, she could negotiate with the landlord whenever the price in the market comes up or down.

“My landlord is quite flexible and the negotiation mostly makes me satisfied,” she said.

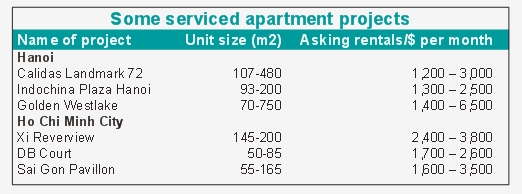

For serviced apartments in mixed-use projects tenants often pay more than $1,000 for the smallest one. According to the latest report from Cushman & Wakefield, there are approximately 2,900 serviced apartments in 49 projects in the Hanoi.

This number in Ho Chi Minh City is approximately 3,300 serviced apartments from 63 projects.

In Hanoi, 37 per cent of apartments are managed by international operators such as Frasers Hospitality, Sedona, The Ascott, IHG, The Accor and the rest is self-managed.

Grade A units constitute the highest share of the whole market – generally much larger in scale.

The supply of this grade A units increased by average 28 per cent over with the previous year because of an additional supply from Calidas Landmark 72 – a subproject of the highest building in Vietnam, Keangnam Landmark 72.

By mid 2014, grade A segment in Hanoi will be added with new supply of 240 units of Lotte Centre Hanoi. With the recent stable stock of the city’s serviced apartments, this supply would be remarkable figure. Meanwhile, grade B serviced apartments supply remains unchanged compared to 2011 and stands at nearly 900 units.

Tay Ho district around West Lake area is still the preferred location for Western expatriates while Ba Dinh area is the second leading supply of accommodation, especially for Japanese expatriates.

West Hanoi is the new central business districts (CBD) with the emerging trend of relocation for office and accommodation. Meanwhile, projects in Hai Ba Trung district in the south of the city are smaller in scale generally, as four out of eight projects have less than 10 units. In Ho Chi Minh City, grade A and B dominate the market when contributing the highest share of the whole market inventory. Seventy per cent of grade A & B projects are managed by international operators such as Sedona, The Ascott, IHG, Phu My Hung, Norfolk Group and The Peninsula Properties while the rest is self-managed.

Unlike Hanoi, Ho Chi Minh City’s grade A supply remains unchanged year on year with 94 per cent located in the CBD and CBD fringe.

Meanwhile, grade B supply increased by approximately 7 per cent year on year. Approximately 50 per cent of grade B total supply is concentrated in the CBD and CBD fringe.

In Ho Chi Minh City, District 1 still accounts for the highest share of the total supply because tenants, especially singles, prefer to lease in the CBD due to the location.

Districts 2 and 7 ranked second in terms of supply. These districts attract families due to the larger unit types and concentration of international schools.

In 2013, Cushman & Wakefield predicted that rental rates will remain stable in grade A and B in CBD but go lower in surrounding districts. However average occupancy rates of these grades are predicted to drive downwards given the tenants’ budget tightening and relocation.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Tag:

Tag:

Mobile Version

Mobile Version