Secondary bond market sees second quarter trade flurry

Investors were attracted by a significant rise in bond yields and the huge gap between yields in the primary and secondary markets. Bond yields in the secondary market by the end of the second quarter had bounced back strongly from a decline in the first quarter, as a result of strong credit growth, rising inflation, and a depreciation of VND against USD. In the second half of this year, it is expected that credit growth and inflation will increase further, which will likely cause bond yields to continue their upward trend.

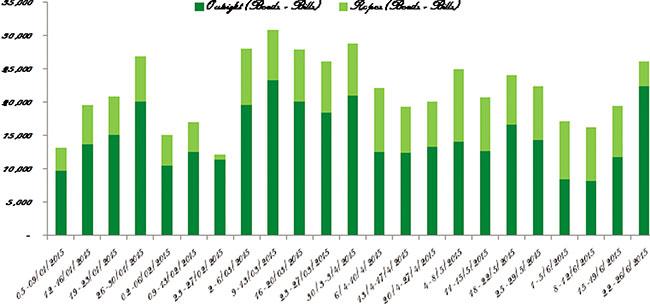

During the first six months of 2015, total traded value of bonds and bills in the secondary market via outright and repo transactions reached VND497.179 trillion ($21.9 billion), up 53 per cent compared to the same period last year. As a result, the average value per month was recorded at VND82.863 trillion ($3.79 billion). This was due to an increase in trading value in the second quarter, which reached VND260.552 trillion ($11.9 billion), up 10.1 per cent compared to the previous quarter and 45 per cent on-year.

Outright transactions dominated the secondary market in most of the reviewed weeks. For the first six months of 2015, total value of outright transactions was twice that of repo transactions. There were VND340.089 trillion ($15.5 billion) of outright transactions, contributing 68.4 per cent of the total. Repo transactions accounted for only 31.6 per cent, worth VND157.090 trillion ($7.19 billion).

By tenor, the breakdown of outright transactions shows short-term bonds overwhelmed the market. Bonds with short-term maturities usually have higher liquidity and much less risk than long-term bonds, which attracts greater investor attention. In addition, the supply of short-term bonds in the primary market has been reduced by Decision No78/2014/QH3 allowing the issuance of over-five-year bonds only. Investors therefore had to move to the secondary market to purchase short-term bonds. One-to-three-year tenors contributed 33.5 per cent of total outright transactions, while three-to-five-year made up 22.4 per cent. Less-than-one-year tenors also accounted for 17.9 per cent of the total. For long-term maturities, five-to-seven-year and over-seven-year tenors contributed 17.2 per cent and 9.0 per cent of the total, respectively.

As of June 2015, foreign investors net bought VND606 billion ($27.7 million) in the secondary market through outright and repo transactions. However, in the second quarter foreign buyers accounted for only 9 per cent of total trading value, much lower than the contribution of 17 per cent in the first quarter.

According to Bloomberg, bond yields over the second quarter of 2015 increased dramatically at all tenors after a decline in the first quarter. One of the main reasons was a rise in the CPI in the second quarter due to an increase in oil and electric prices, which caused investors to demand higher bond yields and lowered demand for bonds. The demand for bonds was reduced further as banks tried to enhance their credit activities, which was reflected in substantial credit growth in the second quarter.

Tenor structure in the primary market also prevented banks from buying bonds, as most of their need was for short-term bonds in line with the maturities of their funds. In addition, fluctuations in the VND/USD exchange rate in April–May motivated investors to move funds from the bond market to the exchange market to speculate on the dollar. Low demand for bonds led to a surge in bond yields.

Mid-term (three to five year tenor) bond yields increased at a higher pace than short- and long-term tenors. Compared to March 31, bond yields by the end of June were listed as: one-year (5.10 per cent, +34bps), two-year (5.53 per cent, +56bps), three-year (5.90 per cent, +79bps), five-year (6.41 per cent, +95 bps), seven-year (6.73 per cent, +58bps), ten-year (6.90 per cent, +39bps), and fifteen-year (7.70 per cent, +42bps).

By Nguyen Thi Ngoc Anh Research Department VPBank Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version