Advanced search

Search Results: 31 results for keyword "VNDirect".

VNDirect to divest from Goldsun Food

6 ngày trước

Securities firm VNDirect has decided to make a complete divestment from Goldsun Food JSC, following its initial investment less than one year ago.

Vietnam seizes opportunities amid global trade shifts

16-12-2024 18:00

Vietnam is navigating the shifting currents of global trade and seeking to sustain its economic growth. Barry Weisblatt, head of research at VNDirect Securities, spoke with VIR’s Khanh Linh about the strategic avenues the country must explore to capitalise on its potential.

Connectivity a factor in positive results of logistics companies

03-11-2024 19:37

Port operators and shipping lines continue to record a robust performance in 2024, reflecting the vibrant potential of Vietnam’s logistics market. Dang Huy Hoang, research analyst at VNDirect Securities, shared with VIR’s Vy Bui the current performance data of Vietnamese logistics companies.

Vincom Retail poised for growth

25-09-2024 19:08

Shophouse sales will continue to be a key driver of revenue growth for Vincom Retail JSC (VRE) for the remainder of 2024, according to a VNDirect Securities report from September 23.

Rosier prospects for bank tickers in H2

17-08-2024 12:21

The prospects of a credit rebound, easing bad debt threats, and better net interest margins should help banks to maintain profit growth this year.

VNDirect invests in food operator

17-05-2024 07:44

Securities firm VNDirect has announced its plan to acquire Goldsun Food JSC, the owner of the King BBQ and ThaiExpress restaurant brands in Vietnam.

Securities firms enjoy rosy performance in Q1

06-05-2024 12:34

Securities firms have unveiled their first quarter business results, with many posting a spike in profits during the period.

SSC issues security warning following VNDirect system breach

27-03-2024 12:29

The State Securities Commission (SSC) on late March 25 issued a security warning regarding the online securities trading system of VNDirect Securities Company (VNDirect).

VNDirect cyberattack causes big splash on stock market

27-03-2024 12:24

The online securities trading system at VNDirect Securities Company (VNDirect) is likely to have suffered from a data encryption hack for extortion.

VNDirect explains large exposure to Trung Nam bond

19-06-2023 14:53

VNDirect, under scrutiny for its substantial exposure to Trung Nam, has clarified the reasons behind its significant investment while addressing the mounting risks and apprehensions of investors.

Steel industry to gradually recover in 2023

27-01-2023 14:00

Domestic steel demand is expected to keep falling due to the property market slump and tightened monetary policy, economic downturn in many export markets and a rise in supply making the outlook for the industry in 2023 poor, analysts said.

Tough year expected for banks in 2023

04-01-2023 16:20

With a dim outlook for the banking industry, most securities firms forecast that banks will post conservative profit growth in 2023.

The short-term implications of SBV credit room lift

23-12-2022 11:06

Lifting the credit room may be a temporary solution. Tran Thi Khanh Hien, director of VNDirect’s Analysis Division, talked to VIR’s Hong Dung about the central bank’s move on credit.

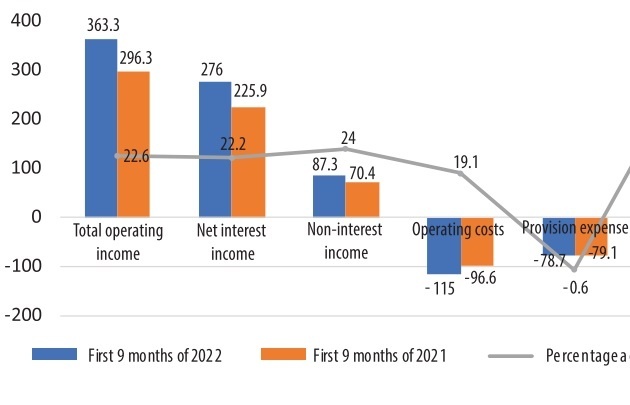

Commercial bank NIM status following projections

02-12-2022 13:04

The recent decline in net interest margin of commercial banks has been deemed not as significant as anticipated, with some smaller-scale banks showing improvements on the issue.

Debt obligations and fund access head banking issues

17-11-2022 16:53

Vietnam’s banking sector is likely to experience a bumpy road ahead. Tran Thi Khanh Hien, research director of VNDIRECT Securities Corporation, spoke with VIR’s Hong Dung about the outlook for the sector.

Mobile Version

Mobile Version