Debt obligations and fund access head banking issues

According to recent financial statements, most banks posted third-quarter earnings that were twice as much as last year. What are the main sources of these profits?

|

| Tran Thi Khanh Hien, research director of VNDIRECT Securities Corporation |

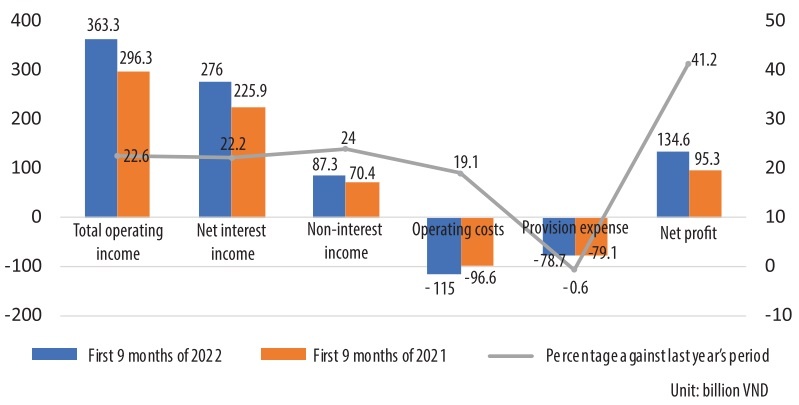

The growth rates of Vietnam’s top 14 banks illustrate that the profit growth is mainly attributable to the lower expenses compared to the previous period. Among them, provision expenses decreased slightly by 0.6 per cent over the same period, while the increase in operating expenses has been slower than earnings growth.

Looking back at the data (see graph), net interest income still grew well for various reasons. Firstly, the growth of the whole system was excellent at 16.7 per cent on-year, although the growth rate slowed down compared to the beginning of the year. Secondly, banks kept their net profit margin (NIM) quite high despite the sharp increase in deposit interest rates since Q2.

Many banks only use their existing deposits to finance loans and receive little new cash flow from customer deposits. That is why the bank maintained this relatively low cost of capital even though deposit interest rates have increased since the second quarter of 2022. The downside is that banks’ liquidity has been much more strained than at the start of the year.

The ratio of outstanding loans to mobilised capital has increased, and some banks have almost reached the determined ceiling. In addition, a few banks have improved their return on assets. We think these banks have penetrated deeper into retail lending with a higher risk appetite.

Some banks announced unsatisfactory business results due to decreased income and increased provision expenses. What is your view on this?

Although some banks recorded negative results, most large banks maintained a good growth rate. As a result, the overall picture of the whole industry in the third quarter is brighter than in the previous quarter.

The banks with negative results have withdrawn accrued interest and made provisions for overdue and outstanding debts. However, we believe they are doing the right thing, as their preparations will be a solid buffer.

Why have highly profitable banks recorded a rise in subprime loans?

Group 3 and 4 debts are downward, though not as much as in 2021. Banks have actively classified and handled bad debt when group debt increased dramatically in 2020-2021. It is worth noting that Group 2 debt is increasing significantly. This is partly because Circular 14 has expired since the end of the second quarter of 2022. This is a group of debts that tend to become bad debts in cases of non-payment of loans on time.

At present, the deposit interest rate is increasing day by day. As a result, the lending interest rate will also tend to increase. This will greatly affect the payment progress for customer loans. We may see an increase in non-performing loans (NPL) in the third quarter of 2022, but the loan-loss reserve is still well secured and higher than at the end of 2020 and 2021. I think this is a positive signal when banks prepare for the increased risks of bad debt in the future.

|

What is the outlook for profits in the banking industry going forward?

There are two major problems for the banking sector. First is the lower credit growth and NIM compression. Vietnam’s banking sector has been challenged by external and internal headwinds. The exchange rate pressure has forced the State bank of Vietnam (SBV) to loosen the VND trading band from 3 to 5 per cent, and made a second consecutive 100 basis point hike on its policy rates.

The additional increase in policy rates has directly impacted the deposit rates of all terms, and all of the banks have to raise their deposit rates at the same pace.

On the other hand, lending interest rates are unlikely to align with the rising funding cost as the SBV strictly monitors interest rates to support the enterprises. Therefore, this aggressive rate hike from the SBV will negatively impact banks’ NIMs due to higher costs of funds. Currently, more rate hikes from the US Federal Reserve are expected in these two last months of this year; hence, this tension could last until the second half of 2023.

Tight monetary policy will slow down credit growth next year. Some banks with high capital adequacy ratios and low loan-to-deposit ratios are dealing with weak credit institutions. These banks will have an advantage over other banks to have more credit room granted in 2023.

The second risk is weakening asset quality. We see another issue relating to liquidity constraints among Vietnamese corporates, particularly small- and medium-sized enterprises, which could hit banks’ asset quality. Vietnamese corporates have to deal with a higher interest expense (from the USD strengthening and VND’s higher interest rate), which dents profitability and heightens the pressure on their debt obligations.

On the other hand, Vietnam’s capital market is being obstructed by a tightening bank’s credit and a squeezed C-bond issuance, thus many corporates will find it hard to generate enough funding for their operations.

The difficulties in accessing funding and the lower ability to fulfil debt obligations of Vietnam corporates may threaten banks’ asset quality from 2023 onwards. In conclusion, due to the tightening monetary policy and macro uncertainties, Vietnam’s banks’ future outlook will see elevated risks relating to lower credit growth, pressure to sacrifice profits, and concerns over asset quality.

| Banking industry steps up digital transformation The pandemic has been prompting banks to adapt. As digital transformation has become inevitable, banks have stepped up their efforts to adopt more new technologies in the digitalisation race. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version