Advanced search

Search Results: 2,240 results for keyword "banks".

Government okays Vietcombank stake sale to foreign investors

20-03-2018 11:47

After the government green-lighted Vietcombank to sell the state-owned stake to foreign investors, the bank is expected to sell a total of 10 per cent, commensurate with over 350 million shares, in a separate issuance and/or through public auction to a limited number of foreign investors.

Vietcombank adjusts service charges yet again

19-03-2018 23:02

Recently, Vietcombank adjusted its banking service charges for the second time, effectively from April 15, after the first alteration of the service charge on March 1, raising controversy among the bank’s long-term clients.

Vietcombank continues quest to divest OCB

19-03-2018 09:49

In an effort to reduce its cross-ownership at local banks, Vietcombank is on route to auction over 6.6 million shares of Orient Commercial Bank (OCB) on April 17, at the starting price of VND13,000 ($0.59) per share.

Bad debts and risk provisions remain on top of banks’ agenda

17-03-2018 20:30

Throughout the annual general shareholders’ meeting (AGM) season, bad debt resolution and hefty risk provisions were the most worrisome issues emerging in the banking sector in since the beginning of 2017.

Vietnamese firms urged to work to win WB, ADB bids

17-03-2018 11:44

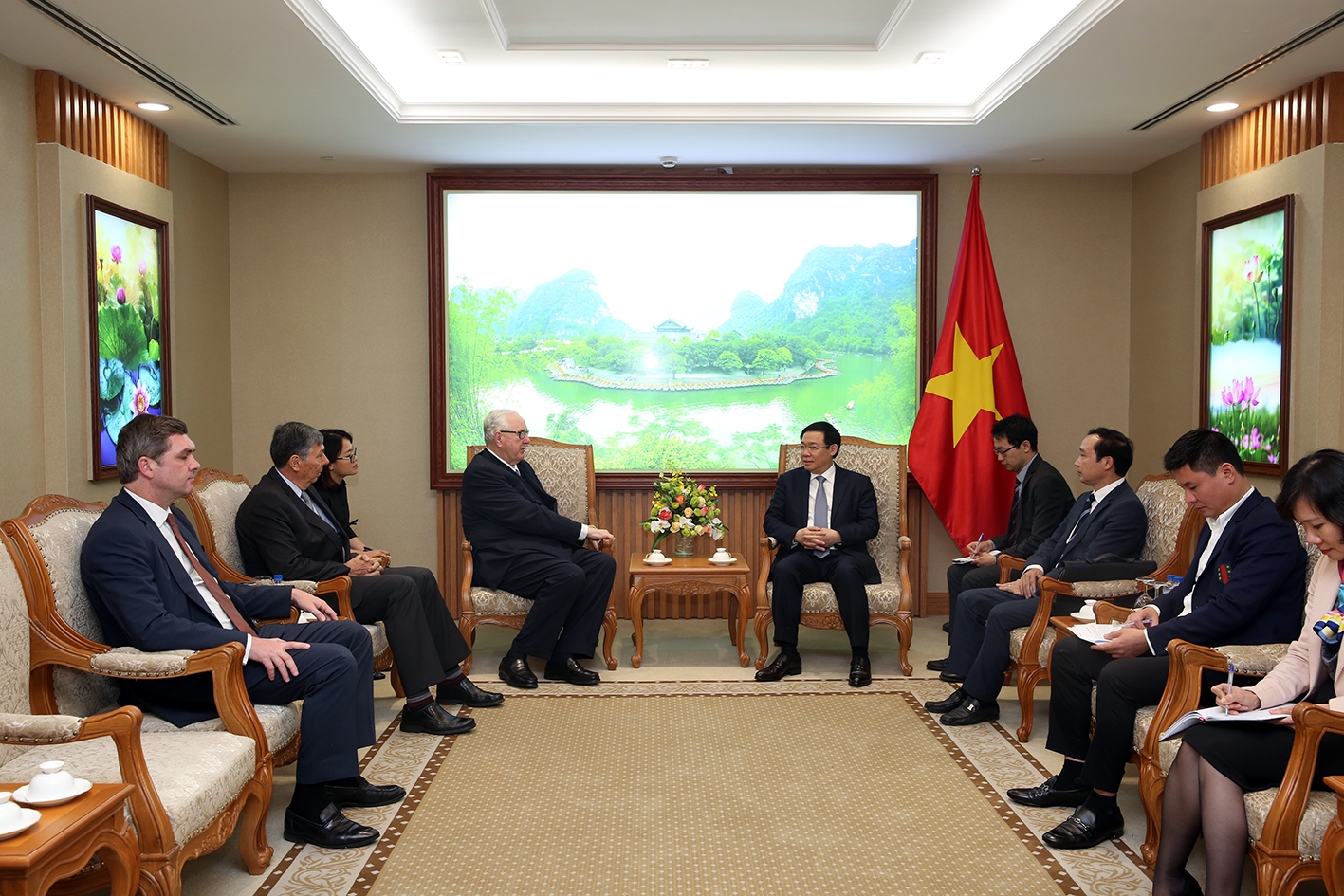

Vietnamese businesses should actively seek information and grasp the development and investment strategies of banks to win bids for projects financed by the World Bank (WB) and Asian Development Bank (ADB), said representatives of the two banks on Thursday.

Bank execs’ income in spotlight

15-03-2018 22:53

As the banks’ AGM season is approaching, bank leaders’ incomes are coming into focus, with figures touching millions of dollars, even at banks that will not pay dividends to shareholders this year.

Shares up on bank, property stocks

14-03-2018 15:20

Shares continued to rise on Wednesday morning largely on the strength of a handful of banking and real estate blue chips.

Foreign banks’ withdrawal no cause for concern

14-03-2018 11:51

The trend of foreign financial institutions withdrawing capital from their Vietnamese joint ventures has raised questions about the country’s state of financial stability, but experts claim the situation is no cause for alarm.

Govt seeks more non-cash payments for public services

14-03-2018 11:39

The Government has set itself a target of collecting 80 percent of tax payments in cities through banks and enabling treasuries in all provinces and cities to have cashless payment systems by 2020.

Jardines Matheson to play part in restructuring weak banks?

13-03-2018 15:28

Jardines Matheson, the strategic investor of Vinamilk, Truong Hai Auto Corporation (Thaco), Refrigeration Electrical Engineering Corporation (REE), and various other companies, will pay attention to the restructuring of weak banks and credit institutions in Vietnam.

Exchange rates rise, credit stationary

11-03-2018 13:12

Exchange rates for both the central bank and other commercial banks rose slightly in February, while the credit sector showed little significant change, said the National Financial Supervisory Commission (NFSC).

Suffering downstream of polluting coal plants

11-03-2018 09:00

The heavy toll taken by coal-fired power plants has prompted many pro-environmental international organisations to oppose banks in several nations that plan to provide loans for these plants in Vietnam, which mandatorily still considers coal a big power generator for the energy-thirsty country.

Banks expect a bumper crop

11-03-2018 09:00

The season for the banking world’s annual general meetings is fast approaching as shareholders pay particular attention to issues of bank profit, bourse listings, the safety of bank deposits, and the reshuffling of senior personnel.

Real estate firms ready to face tightened lending requirements

10-03-2018 14:12

Real estate firms need to scale up efforts to cope with more stringent lending requirements from banks from this year as well as the upcoming influx of new supply.

Commercial banks boost deposit security after Eximbank scandal

08-03-2018 17:33

Following the recent case of $13.2 million vanishing from a savings account at Eximbank, numerous commercial banks introduced new solutions to strengthen deposit security to restore faith in the finance-banking sector.

Mobile Version

Mobile Version