Advanced search

Search Results: 1,371 results for keyword "KPMG tax partner Le Thi Kieu Nga and senior tax manager Er Say Hun".

Tax challenge to continue in New Year

06-01-2019 08:00

The Law on Cybersecurity entering into force requires cross-border platforms to establish representative offices or branches in Vietnam, but challenges for local tax authorities are far from over.

How to maximise value added tax refunds

21-01-2019 08:53

Despite the fact that enterprises understand the importance of VAT (value added tax) refund, they are not aware of all the issues of workload, time-consuming assessment process, as well as potential tax risks to successfully obtain tax refunds and maximise the refund amount.

PNJ fined for tax arrears

20-09-2018 10:56

Phu Nhuan Jewelry JSC (code: PNJ) has been fined to dozens of millions of dong in tax.

Chinese tourists evading tax

07-09-2018 10:28

Chinese tourists are reportedly avoiding paying tax in Viet Nam, with the help of tourism companies.

Tax clampdown on online incomes

24-08-2018 08:00

The Ho Chi Minh City Tax Department is sending out tax notices to individuals making millions of US dollars from Facebook, Google, and other foreign technology platforms running in Vietnam.

Three airlines get exemption from import tax

27-04-2018 21:58

Deputy Prime Minister Vuong Dinh Hue has agreed with the proposal of the Ministry of Finance to exempt three airlines from import tax.

Pundits unruffled by slashed US tax

12-03-2018 22:33

The massive reduction in corporate income tax in the US, despite being an initial concern for the Vietnamese government, may not have as strong an impact on the country’s ability to attract foreign direct investment as previously thought, thanks in part to Vietnam’s improving business climate improvements, which are increasing investor confidence.

Ministries to study US tax reform

01-02-2018 20:48

Prime Minister Nguyen Xuan Phuc asked ministries and relevant sectors to study the effects on Viet Nam of the tax reforms US President Donald Trump signed into law last month.

Ministry proposes tax law changes

15-11-2017 09:44

The Ministry of Finance has proposed amendments to the Law on Tax Management, aiming to enhance efficiency of tax collection from multinational companies, cross-border transactions and online businesses.

Firms hope for better tax reforms

28-11-2017 11:12

The business community wants the general departments of Taxation and Customs to carefully consider reforms on tax and customs procedures, so as to create the most favourable business conditions for enterprises.

HCMC talks tax with businesses

16-12-2017 10:45

HCM City authorities on Friday discussed the current shortcomings of tax and customs regulations in Viet Nam at a dialogue between the city authority and enterprises.

FDI tax exemption delayed

04-12-2006 18:00

The tax exemption status of equipment and machinery forming fixed assets for foreign direct invested enterprises will be delayed until next year when a circular guiding firms on how to settle import procedures and set up import tariff exemption lists is launched.

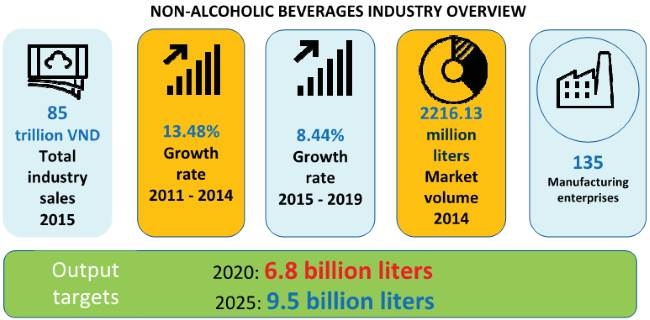

Sugary drinks may get unsavoury tax

24-08-2017 08:00

The Ministry of Finance is proposing the levy of a special consumption tax of 10-20 per cent on sugary drinks to combat obesity rates, though a similar proposal was rejected by the government three years ago. VIR’s Van Thu offers insight into the hot debate surrounding the new proposal.

In defence of the call for raised tax

21-08-2017 10:23

There is a widespread concern that the financial obligations of businesses are too high, preventing firms from accumulating capital for business and production expansion.

New tax policy has no blind spots

22-06-2017 11:15

The new price range for the calculation of the natural resource tax that will come into effect from July 1, 2017is found to be remarkably wide. Moreover, in specific cases, the highest price used to calculate the tax is 1.42 times as much as the minimum level. Still, Nguyen Huu Tan, deputy director of the Tax Policy Department under the General Department of Taxation, told VIR’s Manh Bon that illegal profiteering is simply not possible with this tax policy.

Mobile Version

Mobile Version