Advanced search

Search Results: 837 results for keyword "State Bank of Vietnam".

Proposed lending changes threaten market recovery

02-03-2016 10:28

Property experts are warning that the draft amended Circular 36 of the State Bank of Vietnam on credit tightening could have a detrimental effect on the real estate sector, which is still undergoing a process of recovery.

Unravelling cross ownership in the Vietnamese banking system

24-02-2016 15:58

The issue of cross ownership has hindered Vietnam’s banking industry over the last ten years, causing damage to and threatening the stability of the local banking system. In spite of vigorous efforts by the State Bank of Vietnam (SBV) to deal with the issue and efforts by certain banks to reduce cross ownership to a level congruent with law, cross ownership continues to pose a serious threat to the Vietnamese banking system. Banking expert Nguyen Tri Hieu comments.

Singaporean bank branch to increase charter capital

10-02-2016 21:36

The State Bank of Vietnam (SBV) has allowed the HCM City branch of the Development Bank of Singapore Limited (DBS Bank Ltd.) to increase its charter capital.

SBV cash injection spurs credit growth

25-01-2016 09:26

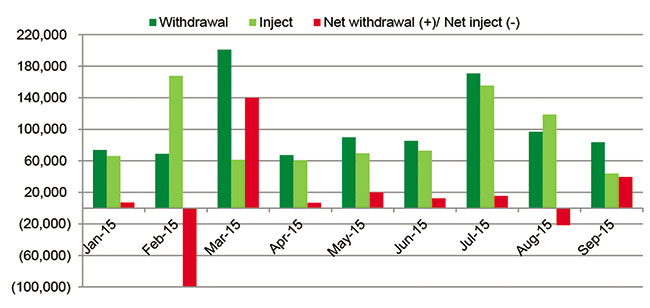

Through open market operations, the State Bank of Vietnam (SBV) exercises control over the liquidity of the banking system. During 2015, the bank injected a large volume of money to spur credit growth, and facilitate the purchase of government bonds and USD (from the SBV). It also extended the tenor of lending in the fourth quarter for the first time in 2015.

Vinasiam breakdown brings prospects for Thai banks

06-01-2016 15:21

Upon request of Vinasiam Bank (VSB), the State Bank of Vietnam (SBV)’s Governor issued Decision No. 2653/QD-NHNN on December, 30, 2015, to revoke the bank’s licence.

Lending in foreign currency regulations

06-01-2016 10:45

The State Bank of Vietnam (SBV) has issued Circular No. 24/2015/TT-NHNN on providing foreign currency loans by credit institutions and foreign bank branches to residents. The Circular applies to credit institutions and foreign bank branches allowed to conduct foreign-exchange activities and lending in foreign currency ("Lender"), and residents borrowing from Lenders ("Borrower").

StoxPlus signs FiinPro® Subscription Agreement with the State Bank of Vietnam

04-01-2016 19:05

On Dec 25th, 2015, StoxPlus signed an agreement to provide FiinPro® platform for the State Bank of Vietnam (“SBV”) in Hanoi.

Vietnam begins setting central rate for VND-USD transactions in de-dollarization bid

04-01-2016 11:41

The State Bank of Vietnam (SBV) on Monday set the daily central rate for the dong/dollar at VND21,896, the very first day it adopted a new management mechanism in the hope of giving more flexibility to the foreign exchange rate.

SBV continues net withdrawals

19-10-2015 09:26

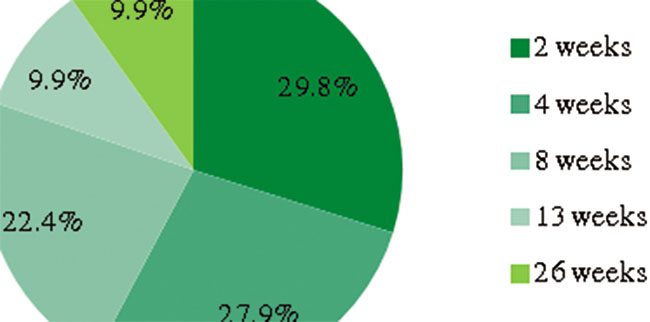

The State Bank of Vietnam (SBV) continued to withdraw quite strongly via the Open Market Operation (OMO) in the third quarter of 2015. Except for February and August, the SBV has made net withdrawals every month this year.

Shares become volatile on dollar deposit rate cut

28-09-2015 15:16

Shares opened higher on the two exchanges this morning, after the State Bank of Vietnam cut the US dollar deposit interest rates late on Sunday.

Important documents regulating bank guarantee

19-09-2015 11:11

On 25 June 2015, the State Bank of Vietnam issued Circular No. 07/2015/TT-NHNN on bank guarantee which is considered as one of the most important documents regulating bank guarantee applied to domestic credit organizations, branches of foreign banks for foreign customers. The Circular is to replace the previous one, namely Circular No. 28/2012/TT-NHNN on 03 October 2012 issued by the State Bank of Vietnam on bank guarantee.

SBV approves merger of Sacombank and Southern Bank

16-09-2015 09:05

The State Bank of Vietnam (SBV) has approved the merger of Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) with the Southern Commercial Joint Stock Bank.

SBV makes third exchange rate adjustment this year

24-08-2015 09:39

On August 19, the State Bank of Vietnam (SBV) increased the average interbank dollar exchange rate by 1 per cent from VND21,673 to VND21,890. The SBV also increased the trading band from +/-2 per cent out to +/-3 per cent. As a result, the ceiling price is now VND22,547, while the floor price is VND21,233 per $1. These moves followed changes made on August 12, when the SBV expanded the trading band from +/-1 per cent to +/-2 per cent.

Vietnam devalues dong by 1%, widens trading band to 3%

20-08-2015 17:00

The State Bank of Vietnam (SBV), the country’s central bank, on Wednesday depreciated the dong by one percent against the U.S. dollar in its latest move to cope with the devaluation of the Chinese yuan last week.

Vietnam cbank counters yuan devaluation to buck external risks to national economy

14-08-2015 17:01

The swift move of Vietnam’s central bank on Wednesday in response to the devaluation of the Chinese yuan will fortify the local banking and financial system so that it will stand firmly against any external destabilizing factors, according to a senior official of the State Bank of Vietnam (SBV).

Mobile Version

Mobile Version