SBV cash injection spurs credit growth

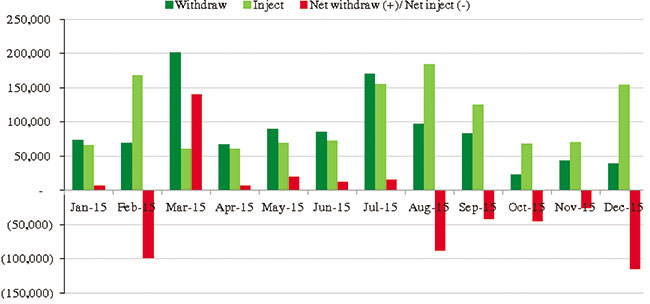

Normally, before the Tet holiday, the central bank injects a large volume of money to support credit growth, which typically soars during this period, and gradually withdraws money thereafter until the end of the year. In 2015, the SBV injected a huge volume of money, not only during the pre-Tet period, but also over the last five months of the year. The substantial growth of credit was the main reason for the huge injection, to support short-term capital needs. By the end of the year, credit growth had reached 17.17 per cent, significantly higher than in 2014.

|

|

During the second half of the year, demand for short-term capital again surged as commercial banks speculated on the dollar after the SBV widened the trading band and raised the exchange rates in August, due to concerns that the Chinese yuan devaluation and the Fed’s interest rate hike would devalue the dong further in the near future. Demand for capital to buy the dollar therefore rose, interbank market rates increased strongly, and commercial banks consequently borrowed money from the central bank via open market operations (OMO). Due to a high demand for capital, interbank market rates in December reached their highest levels of five per cent per annum. Commercial banks therefore chose to borrow money via the OMO instead, with long maturities of up to two months.

More significantly, in December the SBV injected a net amount of VND114,087 billion ($5.1 billion), which was even higher – by 16 per cent – than the net injection volume in February’s pre-Tet period. This was because, in addition to credit growth and USD speculation, there was also a large volume of borrowing via the OMO to meet commercial banks’ need to make bond-purchase payments.

Despite disappointing bond issuance in the first three quarters, government bonds attracted the attention of commercial banks in December as they replaced bonds that had come due, and short-term bonds with less-than-five-year maturities were offered again in the primary market. In December, the total monthly bond issuance reached a four-year high of VND63,149 billion ($2.82 billion).

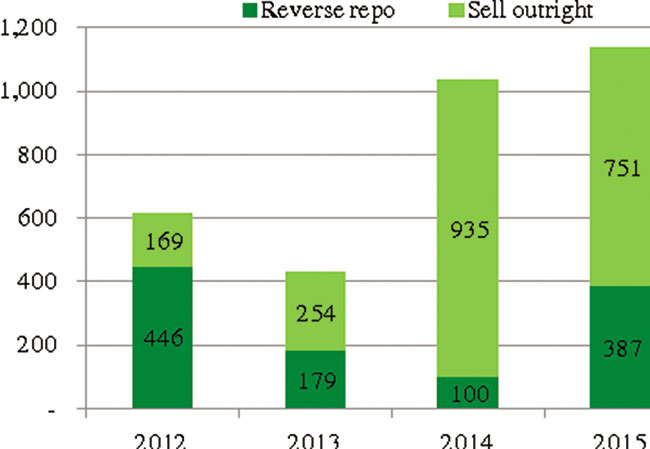

Trading in the OMO in 2015 was very active. The total amount of T-bills issued and reverse repo transactions conducted via the OMO reached VND1,137 trillion ($50.8 billion), up 10 per cent compared with the previous year, and comprising VND387 trillion ($17.3 billion) of T-bills and VND751 trillion ($33.5 billion) of lending via reverse repos. The strong growth in reverse repo transactions showed increased lending by the SBV to banks to support liquidity.

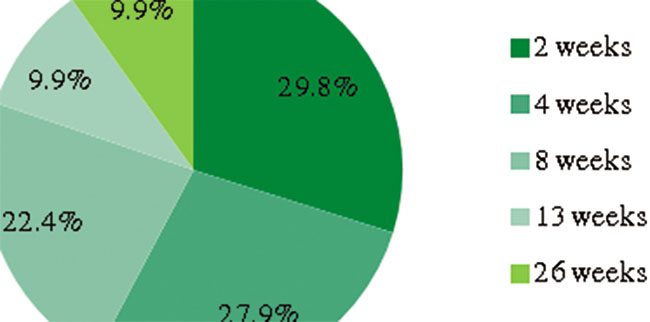

Instead of offering only one tenor for reverse repo transactions, in the fourth quarter of 2015 commercial banks were able to borrow money from the central bank with due dates of two weeks, three weeks, one month, or two months. T-bills issued were mainly those with short-term tenors of two weeks (contributing 29.8 per cent of total issuance), four weeks (27.9 per cent), and eight weeks (22.4 per cent), according to SBV statistics.

In 2015, the total amount of T-bills that came due was VND871.68 trillion ($38.9 billion), while VND294.46 trillion ($13.2 billion) of reverse repos came due. In total, the central bank net injected VND212.38 trillion ($9.49 billion) via OMO in 2015.

By Nguyen Thi Ngoc Anh-Research Department VP Bank Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version