SBV continues net withdrawals

The third quarter featured ample liquidity in the banking system despite strong credit growth at 10.78 per cent year to date and lower deposit growth of 8.88 per cent year to date through September. The high liquidity was due to a whopping VND35.3 trillion ($1.58 billion) in bonds and bills becoming due during the period, while banks have not been investing actively in government bonds (G-bonds). Banks are the main investors in the bond market. However, G-bond issuance fell 46.3 per cent in the third quarter compared to the same period last year, largely because the overall winning ratio of the quarter reached only 31.7 per cent. At the end of August, Tier 1 and 2 capital of the banking system rose by 10.2 per cent from the beginning of the year.

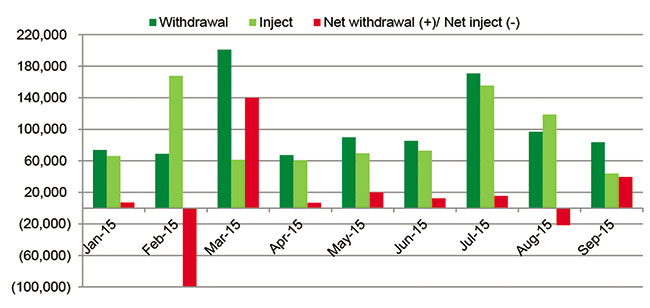

Abundant liquidity enabled banks to increase their position in dollars, speculating on further devaluation of the dong following rate hikes projected in September. High volume of treasury bills (T-bills) was issued in the third quarter to help the SBV withdraw money from the banking system to prevent such speculation. Total volume of sales outright in the third quarter reached VND307 trillion ($13.7 billion), up 53 per cent compared to the second quarter.

However, in August there was a huge foreign outflow from Vietnam’s equity and bond markets for fear of further dong devaluation, after the Chinese yuan’s devaluation and expectations of a dollar rate hike in September. Demand for short-term loans to purchase dollars also increased, which was illustrated by a strong rise in interbank market rates from August 10 to 20. Commercial banks borrowed money from both the interbank market and the OMO. Therefore, in August, the SBV net injected VND21,908 billion ($981 million).

In September, the SBV withdrew money to support the dong in the currency market, after adjusting the exchange rate by 1 per cent and widening the trading band to +/-3 per cent. Responding to the surprise devaluation of the Chinese yuan, the SBV also devalued the dong. As of September’s end, the dong had been devalued by more than 5 per cent from the beginning of the year, including its move to the top of the widened trading band. This caused investors to worry about a further devaluation of the dong if the US’ Federal Reserve System were to raise interest rates. However, the SBV affirmed not to depreciate the dong further till the end of this year. Therefore, the central bank withdrew the dong from the banking system to reduce pressure on the currency and prevent ample capital from being used to purchase the greenback.

In the third quarter, the total amount of T-bills due was VND273 trillion ($10.6 billion) while there were VND44.1 trillion ($1.97 billion) of reverse repos that became due. The volume of reverse repo activities stood at VND45.4 trillion ($2.03 billion), rising up only 15 per cent from the previous quarter. In sum, the central bank net withdrew nearly VND33.4 trillion ($1.49 billion) in the third quarter.

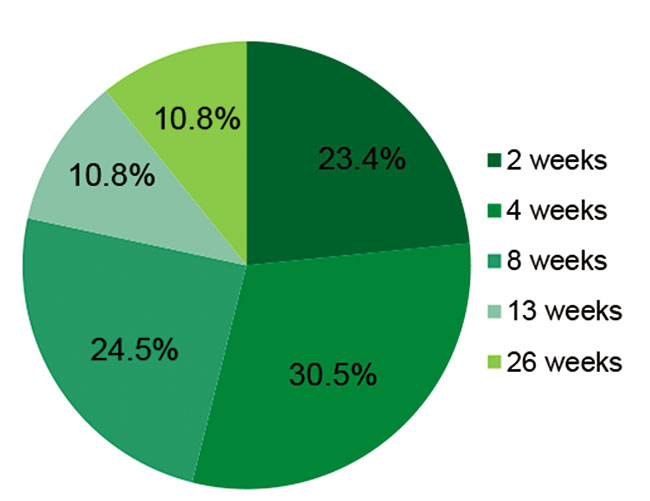

According to the central bank’s statistics, the total transaction value of reverse repos and bills issued in the first nine months of 2015 reached VND937 trillion ($41.9 billion), down 9.48 per cent compared to the same period last year. Lending volume through reverse repos stood at VND248 trillion ($11.1 billion), while the volume of T-bills issued during the first nine months of this year totalled VND689 trillion ($30.8 billion). T-bills issued were mainly bills with short-term tenors which were two weeks (contributing 23.4 per cent of total issuance), four weeks (30.5 per cent), and eight weeks (24.5 per cent).

By Nguyen Thi Ngoc Anh Research Department VPBank Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version