Advanced search

Search Results: 1,372 results for keyword "KPMG tax partner Le Thi Kieu Nga and senior tax manager Er Say Hun".

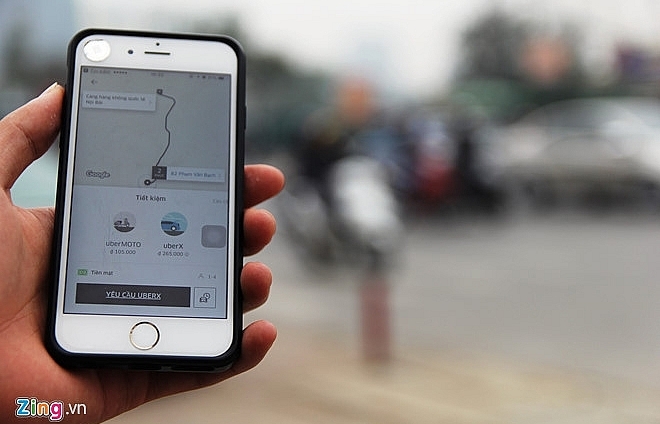

Grab refuses to pay Uber’s tax arrears

06-04-2018 11:47

Grab refused to pay the VND53.3 billion ($2.33 million) tax arrears that Uber owes to the Ho Chi Minh City Department of Taxation.

POSCO under the steely glare of tax evasion scrutiny

26-03-2018 16:05

POSCO-VNPC, a member of POSCO Vietnam Holdings, is faced with tax arrears of nearly VND30 billion ($1.37 million) due to a false classification of steel products, raising concerns about tax avoidance.

Sabeco charged $110 million in tax arrears

14-03-2018 18:27

Saigon Beer, Alcohol and Beverage Corporation (Sabeco) will have to pay nearly VND2.5 trillion ($109.8 million) in tax arrears, according to newswire Vnexpress.

Investors happy about new cut in corporate income tax

09-04-2018 23:12

The stock market has shown positive reactions to the disclosure of the government’s intention to slash the corporate income tax (CIT) from 20-22 percent to 15-17 percent.

Import tax on Japanese cars will be removed from 2029

17-03-2018 16:19

According to CPTPP commitments, import tax on motor vehicles from Japan will be removed from 2029.

Top bank fined for ATM tax fraud

24-04-2006 18:01

Vietcombank has been found guilty of tax evasion and fraud by the General Department of Customs (GDC), and must pay fines of VND19 million ($1,200).

HCMC Tax Department to collect Uber’s debt

15-04-2018 16:42

The HCM City Tax Department has said it will collect VND53.3 biilion (US$2.35 million) of tax liability from Uber.

Grab Vietnam refutes accusations of tax evasion

29-01-2018 16:46

Country head of Grab Vietnam Jerry Lim responded to accusations of tax evasion and confirmed to VIR that Grab has fulfilled its tax obligations in its three years of operations in Vietnam and paid over VND142 billion ($6.24 million) in the first 10 months of 2017.

New CIT law aims to halt tax evasion

24-01-2018 13:34

In the latest draft of Law on Corporate Income Tax (CIT), the Ministry of Finance has raised a regulation aimed at preventing multinational companies with related-party transactions from evading taxes.

ECB governor calls for tax, regulation on bitcoin

04-01-2018 08:55

BERLIN: A top European Central Bank official on Wednesday (Jan 3) called for governments to regulate and tax bitcoin, labelling the cryptocurrency an object of speculation and a tool for money laundering.

Microsoft reports loss due to tax charge

01-02-2018 14:00

SAN FRANCISCO: Microsoft on Wednesday (Jan 31) reported a hefty loss in the past quarter, as it set aside billions of dollars for taxes on profits it expects to bring back to the United States, following passage of a major tax overhaul.

Trump vows 'reciprocal tax' on trading partners

13-02-2018 21:45

President Donald Trump threatened retaliatory measures against US trade partners on Monday (Feb 12), accusing them of "getting away with murder."

R&D cuts after-tax profit growth

29-03-2011 15:14

One of Vietnam’s leading bedding goods producer Everpia Vietnam (EVE) deducted 10 per cent of its 2010 net profit to finance its research and development (R&D) fund, significantly reducing its after-tax profit growth.

Ministry rejects Uber’s complaints about tax arrears

09-12-2017 11:21

The Ministry of Finance rejected the Netherlands-based Uber International Holding BV’s complaints about the decision to collect 67 billion VND, or nearly 3 million USD, in tax arrears in a statement sent to the US-ASEAN Business Council.

The tax reforms needed to boost APEC’s connectivity

06-11-2017 12:03

Freer trade in the Asia-Pacific region has given rise to increased opportunities for tax avoidance and evasion. Warrick Cleine covers the tax reforms needed for Viet Nam to take best advantage of APEC market integration.

Mobile Version

Mobile Version