Advanced search

Search Results: 672 results for keyword "bond".

Nearly 29.5 trillion VND worth of G-bonds raised in June

04-07-2024 11:40

The Hanoi Stock Exchange (HNX) held 18 auctions of government bonds in June, raising nearly 29.5 trillion VND (over 1.15 billion USD) in June.

Impacts of delayed interest rate ease

03-07-2024 21:00

There is a potential delay in interest rate cuts until November due to strong economic indicators, while Asia’s bond markets, particularly in credit and environmental sectors, are poised for robust performance and growth this year.

AIIB invests $75 million in SeABank bonds

01-07-2024 19:04

The Asian Infrastructure Investment Bank (AIIB) on July 1 announced its latest investment of $75 million in the green and blue bonds issued by Southeast Asia Commercial Joint Stock Bank (SeABank, HSX: SSB).

Vietnam's sustainable bonds reach $800 million in value

27-06-2024 19:01

The total stock of sustainable bonds reached a size of $800 million at the end of the first quarter 2024,

according to a new report by the Asian Development Bank (ADB) on June 26.

IFC offers $150 million financing package to SeABank

25-06-2024 11:40

The International Finance Corporation (IFC) is providing a financing package of $150 million to Southeast Asia Commercial Joint Stock Bank (SeABank) to catalyse a viable blue finance market, foster green bonds and support smaller businesses in Vietnam.

Vietnam will deepen bonds with China and WEF, says PM

25-06-2024 08:00

Prime Minister Pham Minh Chinh delivered a speech at the Opening Plenary of the Annual Meeting of the New Champions at the World Economic Forum in Dalian, China's Liaoning province, on June 25, in which he spoke of Vietnam's success over the past nearly four decades.

Thailand to issue 20 billion THB in sustainable bond sales

24-06-2024 17:12

Thailand’s Public Debt Management Office (PDMO) is set to issue 20 billion THB (540 million USD) in sustainable bonds to institutional investors this year.

Bond issuances surge despite lack of credit ratings

17-05-2024 20:43

A report by the Vietnam Bond Market Association shows that in the first four months of this year, the total value of corporate bond issuances amounted to $1.5 billion and included six initial public offerings and 30 private placements.

Credit rating culture deemed vital for transparency

30-04-2024 08:00

Rated corporate bond issuances in Vietnam still trail behind regional peers, though efforts to enhance credit rating culture aim to expand the market significantly.

Citi wins three Environmental Finance awards

16-04-2024 14:05

Citi was recognised by Environmental Finance magazine, a leading publication in the sustainable debt finance market, as lead manager of the year for corporate green bonds, lead manager of the year for corporate sustainability bonds and lead manager of the year for supranational, sub-sovereign and agency green bonds.

More vibrant corporate bond market anticipated

16-04-2024 09:40

With bright signs on the horizon right, experts and businesses expect the corporate bond market to heat up from this year's second quarter.

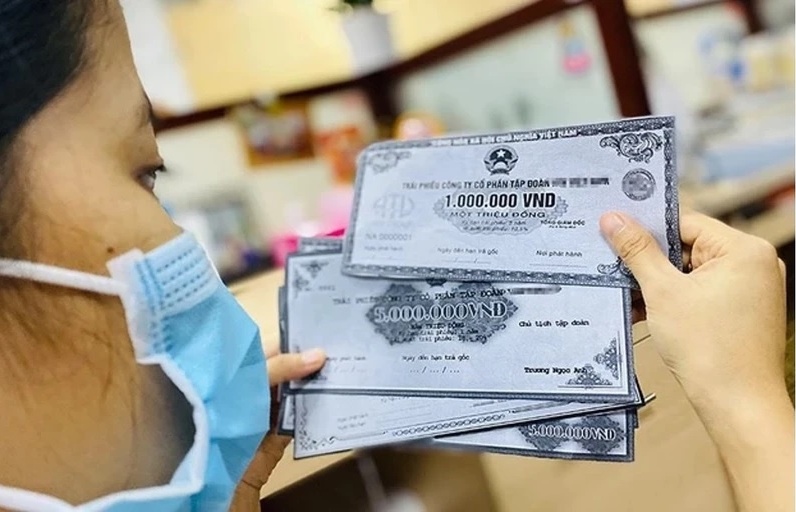

Thousands hope for compensation in $349 million bond scam

21-03-2024 17:35

Thousands who invested in a $349 million bond scam by Tan Hoang Minh Group are hoping to get their money back soon.

SSI and foreign funds direct $21 million in bonds into Hai An Transport & Stevedoring

01-03-2024 11:29

Hai An Transport & Stevedoring JSC announced a landmark investment collaboration with prominent foreign investment funds led by SSI Asset Management Co., Ltd. (SSIAM) on February 28.

Lethargic opening to 2024 bond market poses questions for challenging outlook

07-02-2024 22:16

Vietnam’s corporate bond market in early 2024 has experienced a subdued start, marked by a notable absence of new issuances and a predominant focus on bond buybacks.

Cautious approach suggested for corporate bonds

09-01-2024 12:29

With a new legal process to ease capital challenges, Vietnam’s corporate bond market anticipates a modest recovery in 2024, balancing new regulatory frameworks with cautious investment approaches.

Mobile Version

Mobile Version