Advanced search

Search Results: 673 results for keyword "bond".

MoF announces 13 market makers for debt market

15-01-2020 08:58

Thirteen commercial banks and securities firms will be allowed to join the debt market or Government bonds (G-bonds) market in Viet Nam this year.

Gov’t bond yields hit record low

13-01-2020 16:23

Government bond yields hit a record low in December 2019, with the interest rates of Treasury bonds of all terms seeing decreases by between 0.03 and 0.37 percentage points compared to November.

VPBank scoops up Best Bond House in Asia award

13-01-2020 14:09

The Asset, Asia's most reliable finance magazine, has recently awarded VPBank the Best Bond House in Asia title, adding to the fame of being the first Vietnamese institution with successful bond issuance on the international market since 2014.

Masan Group to mobilise $434.78 million through bonds

26-12-2019 17:20

Masan Group has just approved the decision to issue 100 million bonds worth VND10 trillion ($434.78 million) altogether. with a maximum term of 36 months to expand its business, lending to its unit, and repay a loan.

VPBank completes buying back bad debts from VAMC

26-12-2019 17:11

Privately-held Vietnam Prosperity Commercial Joint Stock Bank (VPBank) has just completed buying back all the outstanding bonds (bad debts) at state-owned Vietnam Asset Management Company – dubbed as the "bad debts bank" – providing the foundations for profit growth in the forthcoming years.

Invested in the future of corporate bond market

12-12-2019 10:36

Eastspring Investments is a global asset manager with Asia at its core, offering innovative investment solutions to meet the financial needs of clients. It manages a total of over $215 billion across equity, fixed income, multi asset, quantitative, and alternative strategies on behalf of institutional and individual investors globally.

G-bond market aims to become a safe and effective investment tool

11-12-2019 15:54

Viet Nam’s Government bond (G-bond) market would become a safe, effective and highly lucrative investment mechanism for commercial banks, insurance networks, investment funds and foreign investors.

Mekong reasserts bonds with Japan

26-11-2019 09:00

The business community and local people are lining up to take part in a cultural and trade exchange programme with Japan at one of the Mekong Delta region’s biggest international events, which will take place in Can Tho city from November 29.

Firms issue 7.71 billion USD worth of bonds in 10 months

15-11-2019 11:07

The total value of corporate bonds was 178.7 trillion VND (7.71 billion USD) in January-October this year, according to SSI Retail Research.

Interest rates of G-bonds plunge in 10 years

26-09-2019 10:00

Over the past 10 years, the interest rates of successfully-issued Government bonds (G-bonds) have decreased significantly, saving thousands of billions of dong for the State budget, contributing to regulate and stabilise the macroeconomy.

Anonymous foreign investor buys entire batch of Phu My Hung bonds

23-09-2019 11:29

Phu My Hung Development Corporation has mobilised VND800 billion ($34.78 million) for real estate projects from a "secret" foreign investor through bond sales.

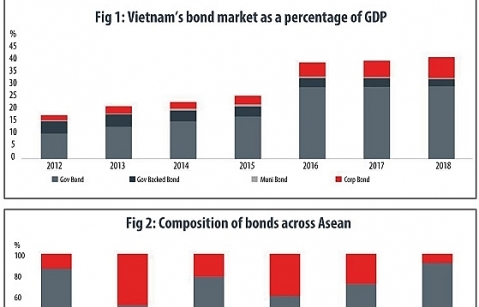

Vietnam bond market continues growth

20-09-2019 14:00

Vietnam’s local currency bond market grew 2.6 per cent to US$52.9 billion in the second quarter of this year, after a 0.7 per cent expansion in the first quarter.

Corporate bond issuance rises in eight months, transparency still biggest concern

09-09-2019 09:32

A total of VND117 trillion (US$5.03 billion) worth of corporate bond notes were raised in the first eight months of 2019, according to SSI Securities Corporation’s research unit.

Banks warned about risks of real estate corporate bonds

27-08-2019 09:36

The State Bank of Viet Nam (SBV) has instructed local banks to better control risks in corporate bond investment, especially bonds of real estate firms.

Hunting for income amid falling yields

26-08-2019 13:13

About $13 trillion worth of bonds in the global marketplace now offer a negative yield. Perhaps most starkly, a rising number of riskier, so-called high yield or ‘junk’ bonds in Europe are offering a negative yield. Understandably, many investors question why they would lend to an entity and assume credit risk knowing they will get back less money tomorrow than they have today.

Mobile Version

Mobile Version