Advanced search

Search Results: 2,237 results for keyword "banks".

Fintech groups and banks linking up for new payment partnerships

07-08-2023 15:17

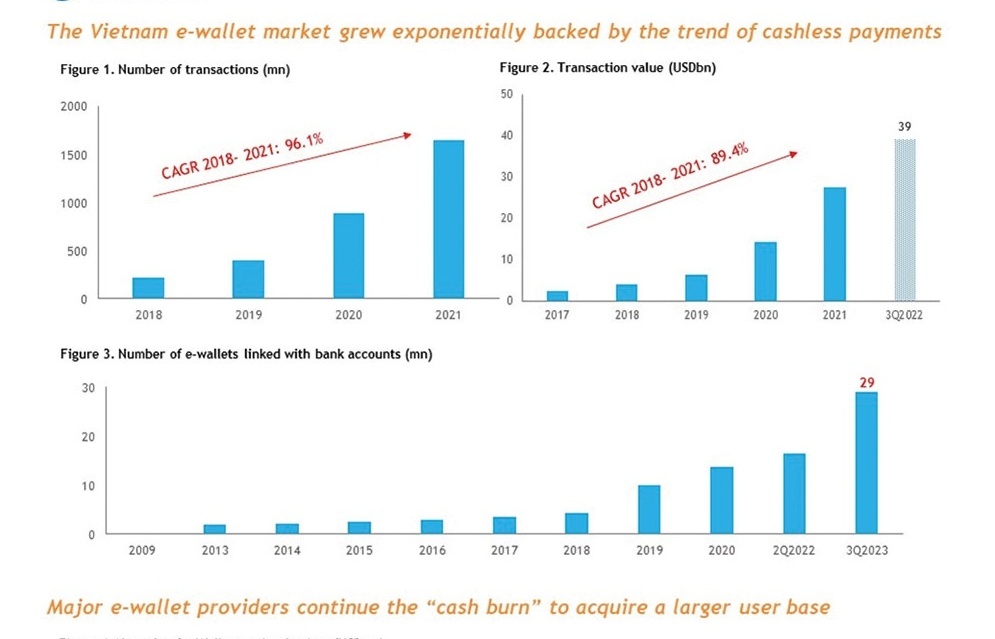

Vietnam’s payment fintech landscape is witnessing a surge in partnerships between foreign giants like Apple Pay and local banks, while local payment apps are teaming up with international firms, signalling promising growth prospects for the digital payment sector.

MB ranked in Top 5 most reputable banks

07-08-2023 14:46

On the morning of August 4, Military Commercial Joint Stock Bank (MB) secured its position in the Top 5 Vietnamese banks at an awards ceremony, a testament to its vital contributions towards its sustainable growth in the banking sector.

Five banks earned profits of more than 10 trillion VND in H1

04-08-2023 12:44

Five banks in Vietnam recorded a pre-tax profit of more than 10 trillion VND (422 million USD) in the first six months of this year, financial statements of the banks showed.

Banking organisations seek VAT reduction addition

02-08-2023 10:53

The Vietnam Banks Association has proposed a 2 per cent VAT reduction for the entire banking sector, which is currently excluded from the list of sectors entitled to the tax cut.

MB posts stellar performance in H1

31-07-2023 14:21

Military Commercial Joint Stock Bank (MB Bank) has affirmed its position by recording robust business results in the first half of 2023, maintaining momentum in the execution of its strategic plan.

Expansions ripe with South Korean banks

26-07-2023 14:00

As South Korean banks grapple with intensifying domestic rivalry, they are strategically shifting their focus to Southeast Asia, particularly Vietnam, as an emergent arena for growth and expansion.

Vietnamese banks prove attractive to foreign investors

21-07-2023 16:22

A number of Vietnamese banks are grabbing interest of foreign investors who are major banks or financial groups.

Agribank chairman proposes additional capital injection

19-07-2023 12:36

During a recent conference reviewing Agribank's activities in the first half of 2023, chairman of the Board of Directors Pham Duc An put forward a proposal to increase the bank's charter capital. The move aims to ensure sufficient funds to support the bank's credit expansion goals.

Banks buckle up to tackle security issues head on

18-07-2023 12:00

Many local banks are wading through troubled waters as they strive to comply with personal data protection regulations, navigating the delicate balance between privacy rights, regulatory compliance, and cybersecurity.

“Substandard” banks failing with cross-ownership norms

18-07-2023 10:04

Amidst rising concerns over cross-ownership practices in Vietnam’s rapidly evolving banking sector, experts are calling for effective mechanisms to ensure the independence and competency of board members, stringent sanctions, and better regulations on ownership ratios to bolster corporate governance.

Credit bubble risk reality as banks hit lending capacities

18-07-2023 08:00

The availability of cheap capital has the potential to fuel subprime projects and activities, leading to a credit bubble risk for the economy.

KB Financial's 'glocalisation' strategy to focus on Southeast Asia

17-07-2023 19:08

Yoon Jong-kyoo, chairman and CEO of KB Financial Group, has reinforced the group’s commitment to its 'glocalisation' strategy, highlighting Southeast Asia, particularly Vietnam, as key regions for customised product offerings and market penetration.

Vietnamese businesses await relief as SBV slashes interest rates

14-07-2023 10:39

Vietnamese businesses anticipate some relief as the central bank slashes interest rates amidst the economic challenges, with credit growth expected to accelerate in the second half of 2023.

Vietnam's banking sector faces uphill battle in 2023: FiinGroup

05-07-2023 16:39

Vietnam's banking sector is grappling with stagnant credit growth, rising non-performing loan (NPL) ratios, and the need for sustainable credit activities amidst the economic challenges in 2023.

Central bank asks credit institutions to reduce interest rates

03-07-2023 17:05

The State Bank of Vietnam (SBV) has sent a document to credit institutions and branches of foreign banks and SBV in provinces and centrally-run cities regarding the reduction of interest rates.

Mobile Version

Mobile Version