Advanced search

Search Results: 1,371 results for keyword "KPMG tax partner Le Thi Kieu Nga and senior tax manager Er Say Hun".

Lenders juggle with tax info obligations

30-08-2022 09:00

Cybercriminals and the exposure of account information remain significant barriers for all stakeholders, with commercial banks now required to identify and collect holding information of customers to relevant authorities in a bid to fulfil tax obligations.

Fixes aim to clear up e-commerce tax

05-10-2022 17:00

With the fast development of digital commerce in the past few years, an adjusted decree from the Ministry of Finance and a new e-commerce tax portal are expected to facilitate better tax management for e-commerce platforms.

Nation urged to prepare for tax overhaul

16-05-2022 08:58

Tax incentives have always been a key factor in attracting foreign direct investment into Vietnam. However, concerns are arising as a global minimum tax agreement threatens to shake up the entire system and, therefore, foreign funding prospects.

Tax cuts on agenda to assist recovery

16-06-2022 15:41

New fiscal solutions are set to be applied to reduce risks of high inflation this year which are looming due to massive pressure in growing prices of a series of indispensable items and services, affecting consumption recovery and economic growth.

No policy for draft law on property tax

15-03-2022 11:37

The Ministry of Finance (MoF) made an announcement on March 14 stating that there is currently no policy in place to prepare a draft law on real estate taxation.

Tax authorities ask for estate transactions through banks

05-03-2022 20:05

All real estate transactions must be implemented through banks, the General Department of Taxation has proposed to the Ministry of Finance.

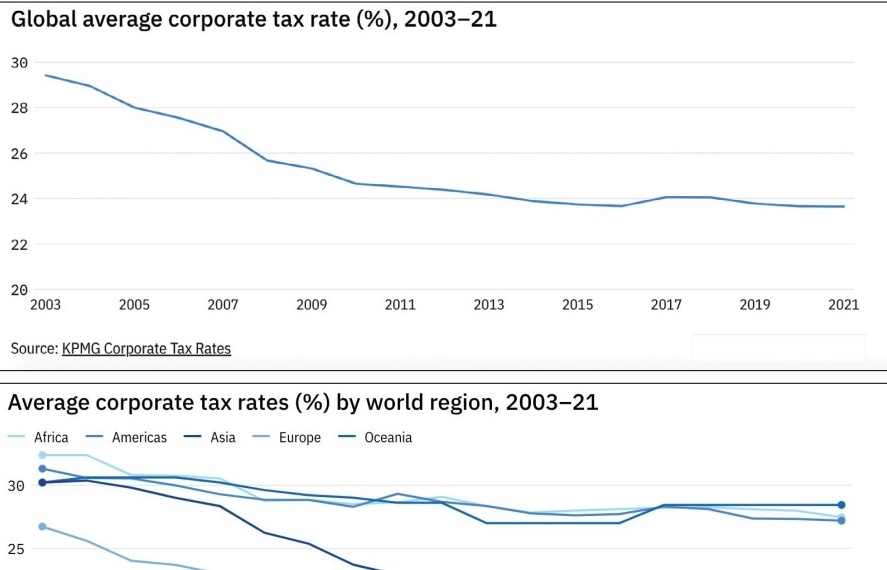

Nations strive to unite on tax collection

05-05-2022 18:00

Vietnam is being urged to stay current on the changing tax landscape and keep an eye on the broader global picture as the world continues to debate a far-reaching minimum corporate tax rate.

Tax authorities double down on cross-border compliance

19-04-2022 09:00

A fresh tax scheme by the General Department of Taxation is focusing on overseas providers engaging in cross-border activities without a physical presence in the country, helping to alleviate their tax compliance puzzles in Vietnam.

Businesses seeking access to tax cuts

05-11-2021 09:00

A new bailout package worth over $900 million is expected to help local companies to recover soon through tax reductions, but for some this solution may come too late to overcome the health crisis completely.

Hanoi clears up businesses’ tax concerns

17-11-2021 20:09

Enterprises, especially foreign-invested firms affected by the COVID-19 pandemic, had their tax-related concerns cleared up by the Hanoi Department of Taxation during an online conference on November 16.

Supporting multinationals to plan out tax strategies

18-08-2021 13:07

The Ministry of Finance’s Circular No.45/2021/TT-BTC guiding the application of advance pricing agreements is considered a mechanism for multinational corporations to plan tax strategies. Dinh Mai Hanh, tax partner at Deloitte Vietnam, talked to VIR’s Hoang Anh how the circular contributes to enhancing the regulatory framework on transfer pricing in Vietnam.

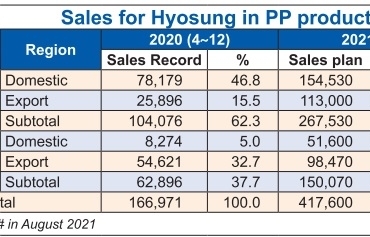

Plastic tax proposal meets opposition

31-08-2021 18:24

Hyosung Vina Chemicals’ proposal to increase the imported tax for models of polypropylene is facing opposition from the Vietnam Plastics Association because they believe it will push manufacturing costs up and limit their expansion.

Multitude of options on table for further tax interventions

18-06-2021 10:00

With the current outbreak still not entirely controlled, the government stands at a complicated crossroads as it needs to choose between further state budget security and continued support for the business community. Meanwhile, some black sheep are profiting from the current policies – an issue that would need to be remedied to free up resources for those in real need.

Landmark corporation tax deal changes the game

15-06-2021 10:00

Last week, the G7 countries agreed on a historic deal for a global minimum corporate tax rate for international companies.

E-commerce expansion complicates tax obligations

22-06-2021 16:37

As one of the fastest-growing internet economies, Vietnam boasts great potential for e-commerce thanks to the country’s increasing young and tech-affine population. E-commerce has driven significant growth in Vietnam at 46 per cent, alongside strong growth across most sectors except for travel, according to a report from Google, Temasek and Bain & Company.

Mobile Version

Mobile Version