Nations strive to unite on tax collection

G20 countries and the Organisation for Economic Co-operation and Development (OECD) last year reached a landmark agreement on a minimum global corporate tax rate of 15 per cent. However, the proposal is still in its infancy and getting the majority of nations to come to a position that means it can actually be implemented will be easier said than done.

Nearly 140 countries have backed the OECD position, a move that would force the world’s biggest companies to pay a fair share of tax. Under the landmark reforms, a new taxing right will be created that enables countries to levy a slice of the profits generated by a handful of the world’s biggest firms, based on the sales generated within each country’s borders.

Political parties in the likes of Australia have doubled down on their backing for the global rate in the past few weeks, using the situation as a potential election issue. In the EU, however, the Polish government is increasingly isolated in its opposition to an EU directive on the matter. Sweden and Estonia last month dropped their opposition after winning some concessions on implementation and flexibility, but the bloc is still struggling to stand on a united platform for a universal rate.

In the United Kingdom, the Chartered Institute of Taxation is urging the British government not to rush ahead with implementing any new globally-agreed corporation tax rules before other competitor countries.

|

The new tax reform aims to address two pillars in dealing with multinational corporations (MNCs), especially digitally-enabled companies. Firstly, it allows countries to tax a portion of profits made by large companies on the basis of in-country revenue generated, rather than where the company’s headquarters is located. Secondly, it sets a minimum corporate tax rate on global income.

Although Vietnam is not a member of the OECD, the country is embarking on its journey to collect more tax-related information on the business operations of MNCs, including those involved in cross-border e-commerce.

An industry insider told VIR that many MNCs expressed their views on the OECD tax rate proposal to the General Department of Taxation (GDT) under the Ministry of Finance (MoF) in April, although they only represented a small percentage of the global business community. Both the GDT and the MoF had encouraged more foreign-invested enterprises, multinational trade associations, and foreign business groups to submit constructive feedback in order to maximise their interest but also comply with international and local tax legislation. The deadline for receiving such feedback was April 29.

Between 2019 and 2021, the MoF gathered roughly VND5 trillion ($217 million) in revenues from online business transactions. Some major MNCs have paid taxes, including about $74 million from Meta, $70 million from Google, and $25 million from Microsoft, cited the ministry.

Vietnam is deemed to be ahead of some regional peers in an effort to design a holistic tax regulation for tech companies, despite their lack of physical presence in the country.

In late March, the GDT introduced an electronic information portal for foreign suppliers and an eTax mobile app to support overseas service providers without a permanent establishment to comply with Vietnamese tax laws.

However, one expert noted, “As the online portal has just been launched, its effect on cross-border businesses is minimal and is still unpredictable at this point in time.”

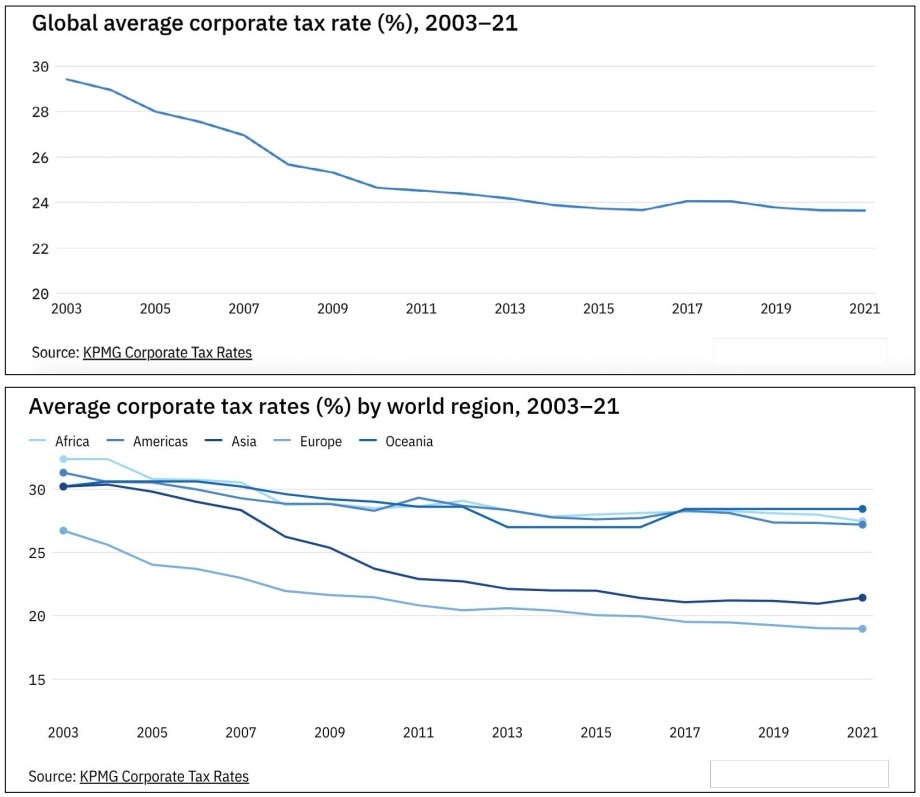

A new global minimum tax mechanism, the expert said, could discourage MNCs from using tax havens to divert earnings away. Consequently, emerging economies like Vietnam may be less likely to compete with one another in taxation, reversing a decades-long “race to the bottom” in corporate taxes.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version