Tax authorities double down on cross-border compliance

|

| Facebook, Netflix, and Google have stated their willingness to comply with Vietnamese tax regulations. Photo: Le Toan |

Vietnam’s General Department of Taxation (GDT) under the Ministry of Finance (MoF) last month officially announced the launch of the Electronic Information Portal for Foreign Suppliers and the eTax mobile app, with the main objective of creating the best conditions for overseas service providers that do not have a permanent establishment in this country to comply with Vietnamese tax laws.

Prior to the portal’s launch, at a meeting of the National Assembly Standing Committee on March 16, Minister of Industry and Trade Nguyen Hong Dien assessed that the e-commerce sector in Vietnam has expanded fast in a short span of time, so there has not been sufficient time to draw from lessons and experiences.

“On the one hand, the ministry aims to assess the reality of the market situation. On the other hand, we will coordinate with relevant agencies to learn from other countries, to gain an understanding of policy implementation in this area,” the minister said.

According to general director of the GDT Cao Anh Tuan, the five banks of Vietcombank, VietinBank, BIDV, MBank, and Agribank have already cooperated with tax authorities to be connected to the eTax mobile app.

“We recommend that banks directly and closely coordinate with the GDT. At the same time, the Vietnam Chamber of Commerce and Industry and the Association of Small- and Medium-sized Enterprises should spread the news to the business community and taxpayers to promote the use of electronic tax services,” Tuan said at the portal’s launch event.

Although the tax collection mechanism seems like a late solution to the cross-border tax problems of the past few years, Vietnam is still a leading country in the ASEAN region in reacting to the e-commerce boom.

According to the Vietnam E-commerce White Book 2021, Vietnam’s e-commerce growth rate reached 18 per cent in 2020, totalling $11.8 billion. Google has also assessed that the scale of Vietnam’s digital economy will exceed the threshold of $52 billion to place third in the ASEAN region by 2025.

Parallel with this rapid growth are regulatory issues. In recent years, the global tax authority has had to quickly come up with appropriate adaptations of laws to create a level playing field between traditional and e-commerce businesses, and between in-country and cross-border business activities.

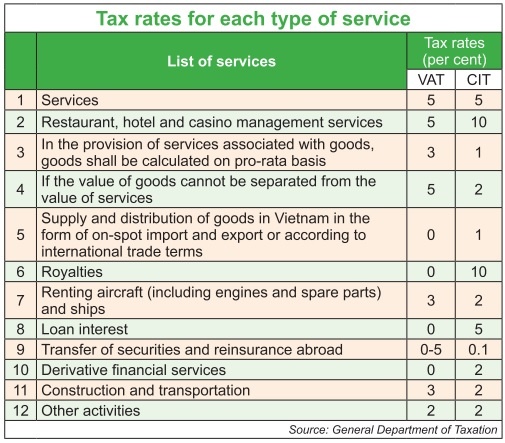

Dang Ngoc Minh, deputy general director of the GDT, said that it has begun working with a number of foreign providers and the feedback so far has been positive. “Tax on foreign providers is considered a new issue, and with the tax portal, Vietnam is leading this effort in the Southeast Asian region. In less than a month, businesses have registered to pay taxes, including corporate income tax (CIT) and VAT to ensure equal rights and opportunities for both traditional and e-commerce businesses,” he said.

Last month, Minister of Finance Ho Duc Phoc revealed that the ministry has been proactive in collecting and managing the tax revenue associated with cross-border e-commerce and multinational tech giants. Specifically, the MoF has amassed approximately VND5 trillion ($217 million) from business conducted online in the 2018-2021 period.

“Data compiled by the MoF shows that many significant multinational companies have paid taxes, including around $74 million from Meta, $70 million from Google, and $25 million from Microsoft,” the minister said.

With the new tax collection mechanism, the MoF calculated that the figure will continue to increase by up 20-30 per cent per year.

According to a report published by DataReportal, in 2021, the number of e-commerce users in Vietnam reached almost 51.8 million, making up over 50 per cent of the population.

As tech giants play a more crucial role in the e-commerce sector, some shop owners and consumers may become more worried about possible service cuts if their respective foreign service providers fail to register and pay taxes.

Hanoi Tax Authority said it collected just nearly $618.2 million in tax from businesses and individuals with e-commerce in 2021. However, such a small figure fails to reflect the actual size of business on online platforms, suggesting there are businesses and individuals involved in tax evasion.

At a recent meeting with 64 suppliers, the GDT underlined two options: either suppliers register to pay tax with the Vietnamese tax authority, or commercial banks can be responsible for declaring and paying tax if the foreign supplier fails to do so in a timely manner.

According to the provisions guiding the implementation of several articles of the Law on Tax Administration, if foreign service providers do not register, declare, and pay tax in Vietnam, banks and intermediary payment service providers are responsible for subtraction and payment on their behalf.

However, in current regulations, banks do not have the right to deduct from customer accounts without consent. Therefore, experts said, for cases where banks are forced to withhold money to fulfil tax obligations, the National Assembly must promulgate a law that allows local tax departments to authorise banks to do so.

Warrick Cleine, chairman and CEO of KPMG in Vietnam and Cambodia, told VIR while the portal is brand new, it demonstrates Vietnam’s audacious commitment. “It will take some time to observe how the mechanism evolves and how compliance develops. It should be viewed in the context of the broader digital strategy of the government,” he said.

| The GDT last week mandated local tax departments to thoroughly review, classify, and monitor the latest data about businesses conducting activities and generating income from e-commerce and digitally-based platforms. Specialised groups of subjects would be monitored, including businesses that collect from foreign organisations such as Google, Facebook, Apple, and Amazon; businesses that conduct online sales; businesses that operate online house rental through applications such as Booking.com and Agoda; enterprises that pay for electronic services provided by foreign contractors; enterprises that organise and operate on e-commerce platforms such as Sendo, Lazada, and Shopee; and businesses involving in intermediary payment providers, such as VNPAY and ShopeePay, as well as ride-hailing platforms. |

|

| Nguyen Van Phung - Director of Large Enterprise Taxation Agency, General Department of Taxation

In addition to the foregoing legislative papers, the Ministry of Finance has submitted to the government the tax management system for e-commerce. The project is being thoroughly developed. In particular, for overseas suppliers, we apply two different mechanisms simultaneously. One is a tax procedure for foreign contractors, while the other is the new online portal allowing foreign suppliers to report their tax status on their own. Foreign businesses that provide services in Vietnam will be able to report, declare, and pay their fair share of tax payment via this digitally-enabled portal. Previously, many international businesses had no idea where to file and pay taxes. This platform will address these lingering concerns. We believe overseas businesses, with or without permanent establishment in Vietnam, will benefit from the site. Additionally, the portal functions as a search engine for data maintained on the system, supporting the tax authority’s periodic inspection efforts. Throughout the process, we noted that significant multinational services providers such as Google and Facebook have stated willingness to pay taxes in accordance with the Law on Tax Administration and other regulations. Many agreed that this portal would assist all parties thanks to its straightforward rules, simple procedures, and tech-enabled tool for verifying, reporting, declaring, and fulfilling tax obligations. Additionally, international businesses are well aware that tax requirements must be met as a crucial part of their sustainable development in Vietnam. Furthermore, a variety of professional tax measures to inspect, regulate, and evaluate the duties of each party in the tax landscape would be used to comprehensively measure the effectiveness of this new scheme. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version