Advanced search

Search Results: 211 results for keyword "FinTech".

Cash habit, poor infrastructure prevent to non-cash economy

02-12-2019 09:01

While non-cash payments are admittedly on the rise, the cash payment habit and limited development of technology infrastructure are big problems for the country’s non-cash economy, experts have said.

Vietnam’s booming fintech funding on Singapore’s heels

29-11-2019 15:43

Vietnamese financial technology startups are quickly catching up with Singapore in attracting Southeast Asian venture capital funding, according to the Japan-based Nikkei Asian Review.

Sharing economy rules required

15-11-2019 16:00

Sharing economy platforms have taken Vietnam by storm in recent years, especially in the fields of transportation, hotel bookings, and fintech. However, the rise of internet-based sharing services like Grab, FastGo, Airbnb, and Agoda has caused a headache for policymakers to adjust the regulations to manage disruptive businesses.

Appeals for sturdy sandbox direction

15-11-2019 09:00

The new economic models of transportation, lodging services, fintech, energy, and digital entertainment are expected to drive the sharing economy in Vietnam if regulatory sandboxes become more readily available. Bich Thuy reports.

Fintech could hold key to reducing cash reliance in Vietnam

14-11-2019 06:41

Fintech companies could hold the key to driving last mile adoption of digital payments and unlocking Southeast Asia’s vast cash displacement opportunity, according to Visa, the world’s leader in digital payments.

Billion-dollar fintech market awaits sandbox for breakthrough

10-11-2019 11:17

Regulators are working to finalise the experimental legal framework (sandbox) for healthy market development, accelerating economic growth. This exponential growth will help Vietnamese fintech companies to bloom.

PwC surveys how financial and tech firms navigate fintech landscape

28-10-2019 12:51

The Global Fintech Survey 2019 of PwC polled over 500 financial services (FS) and technology, media, and telecommunications (TMT) executives worldwide to figure out the factors that will determine the winners and losers in the race to develop and profit from fintech-driven business models.

Grab pushes ahead with $500 million expansion plan in Vietnam

29-08-2019 11:29

Grab will invest $500 million more over five years to tap into opportunities in fintech, new mobility solutions, and logistics. The investment follows strong growth in the first half in Vietnam in transport, food delivery, and payments. Jerry Lim, country head of Grab Vietnam, talks with VIR’s Thanh Van about Grab’s next investment in Vietnam.

Grab to inject $500 million into Vietnam in next five years

28-08-2019 11:07

Grab Holdings Inc. announced that it will invest $500 million into Vietnam over a period of five years to tap into opportunities in fintech, new mobility solutions, and logistics in order to spur the development of the country’s digital economy and create millions of income-opportunities that will elevate the quality of life for all Vietnamese.

Top lenders latch onto fintech future

15-08-2019 15:49

Banks and investment funds are racing to partner up with fintech businesses in their quest towards digitalisation.

VNLIFE bags$300 million investment from Softbank and GIC

28-07-2019 10:52

Dealstreetasia reported VNLIFE’s representatives as saying that Japan-based Softbank Vision Fund and Singapore-based sovereign wealth fund GIC have committed to proposing investment deals of $200 million and $100 million, respectively, to further the growth of the firm.

Fintech-driven lending to alleviate SME financing gap

22-07-2019 09:15

Vietnamese small- and medium-sized enterprises now have a new option for working capital loans, driven by a partnership between banks and fintech companies. Dr Sian Wee Tan and Vihang Patel, cofounders of Singaporean fintech firm Finaxar, which just launched its Vietnam subsidiary Finaxar VN LLC, talked to VIR’s Nam Phuong about this new lending model and why it is different from other offers in the Vietnamese financial market.

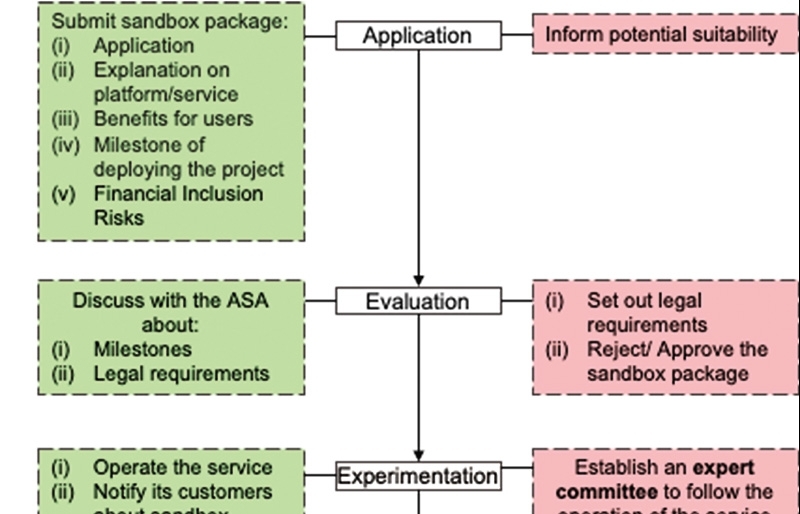

Pros of sandbox regulation for fintech

09-07-2019 13:36

With the development of the Fourth Industrial Revolution, the application of digital technologies for providing financial services has become the key driver in promoting financial inclusion. However, the industry’s growth will not only depend on investments, new technologies, or smartphone penetration, but will also require a robust legal framework. Le Net and Hoang Nhu Quynh from law firm LNT & Partners, listed as innovative lawyers by the Financial Times in 2015, 2016, and 2019, analysed how Vietnam can accelerate the development of companies within the fintech regulatory sandbox.

Vietnam’s Leading CEOs meet to discuss ways to improve financial inclusion at GoBear’s annual BearTalk event

06-07-2019 08:00

Ho Chi Minh City, 02nd July 2019, the second edition of the BearTalk event attracted over 30 senior executives from finance, insurance, and fintech industries in Vietnam. The event hosted by GoBear, continued to put emphasis on leveraging FinTech to improve financial inclusion and to provide an important platform for financial industry leaders to connect and collaborate. This year’s event also opened the discussion on the development of new technologies in the insurance industry.

BRG, VNPT, Sumitomo, and SeABank partner up in fintech and smart city

02-07-2019 17:30

The co-operation agreement on development of fintech and the application of high technology in smart cities between Vietnamese conglomerates BRG group, VNPT group, SeABank, and Japan’s conglomerate Sumitomo group was awarded under the witness of Prime Minister Nguyen Xuan Phuc and representatives of the governments of the two countries.

Mobile Version

Mobile Version