Ride-hailers race for market share after Gojek’s exit

On September 16, the ride-hailing company will exit Vietnam after six years of operation. GoTo Group, Gojek’s parent company, decided to withdraw after reassessing its market presence to optimise growth. This move reflects a shift in the business environment across Southeast Asia, where profitability and sustainability now take precedence over expansion at any cost.

|

| Tran Trinh Minh Huyen, international business advisory unit, Dezan Shira & Associates |

Despite aggressive efforts, including promotions and localisation strategies, Gojek struggled to achieve profitability in Vietnam. The company’s revenue from Vietnam reportedly accounted for less than 1 per cent of its total group revenue, a stark contrast to its dominant position in Indonesia.

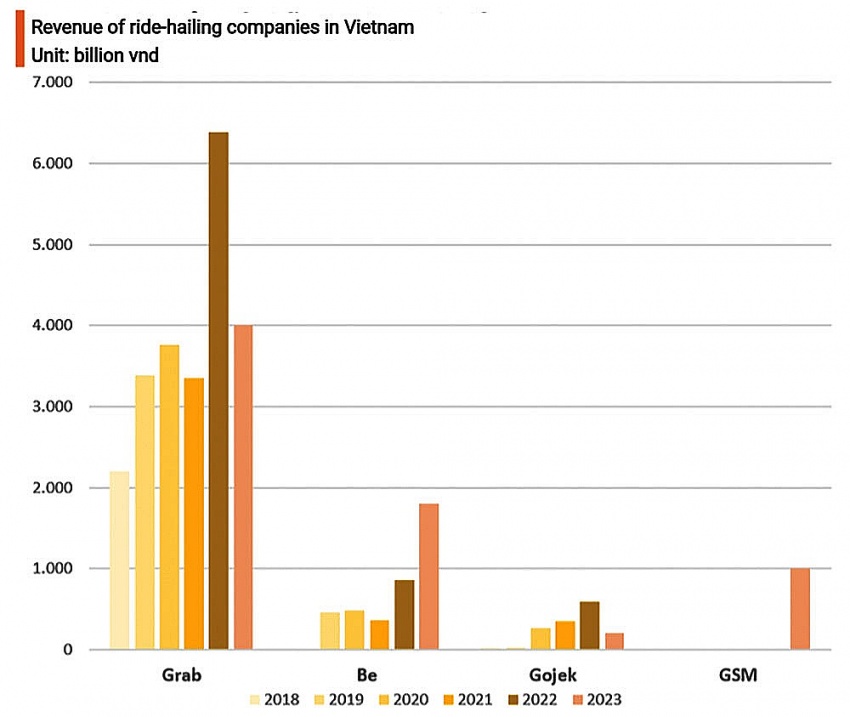

Gojek’s shrinking market share negatively impacted its financial performance. In 2023, the company’s revenue dropped to around $8.15 million, while competitors earned upwards of a thousand billion. Gojek’s accumulated losses over the past six years exceeded $272 million.

While both Grab and Gojek have incurred substantial losses, Grab turned a profit of over $40.7 million in 2023, showcasing a more favourable financial position. Notably, Xanh SM, Vingroup’s electric vehicle ride-hailing company, achieved nearly five times Gojek’s revenue shortly after entering the market.

With Uber’s exit from the market in 2018 (in exchange for a 27.5 per cent stake in Grab), Indonesia’s Gojek saw an opportunity to expand. At the time, Vietnam seemed like a logical choice for Southeast Asian expansion, with a population of 100 million, half of whom are under 30, and a strong motorcycle culture.

Vietnam became Gojek’s first expansion market as it sought to capitalise on Uber’s departure and appeal to investors. Following its launch in Vietnam, Gojek expanded to Singapore, Thailand, and the Philippines, with only Singapore remaining today.

Between 2020 and 2022, Gojek gained traction in ride-hailing, food delivery, and logistics, and rapidly expanded in major cities through aggressive promotions and discounts. However, the company struggled to maintain its market position as unsustainable price wars with Grab drained resources without securing a lasting market share.

Gojek’s exit is largely due to fierce competition from established players like Grab, Be, and Xanh SM. With its dominant market position and extensive service network, Grab created a network effect that hindered Gojek’s efforts to grow its user base, allowing Grab to dominate 42 per cent of Vietnam’s ride-hailing market. Local companies Be and Xanh SM follow closely with 32 and 19 per cent market shares, respectively. Both local competitors are gaining ground and offer drivers a more favourable revenue share than Grab.

Gojek’s departure from Vietnam presents a significant opportunity for existing ride-hailing companies.

Local firms like Be are showing resilience by offering services tailored to Vietnamese consumer preferences. Meanwhile, Xanh SM’s all-electric fleet aligns with growing concerns over air pollution and sustainability, attracting environmentally conscious customers. While Grab maintains its lead, it faces pressure to turn a profit. With Gojek gone, Grab has an opportunity to consolidate its position, but it will need more aggressive strategies to fend off new entrants and fully capitalise on the market.

Gojek’s exit provides valuable lessons for other players in Vietnam. Success in this market requires businesses to adapt their strategies and operations to meet the unique demands of Vietnamese consumers. A one-size-fits-all approach that works elsewhere is unlikely to succeed in Vietnam. Companies must develop a deep understanding of local consumer behaviour, regulatory frameworks, and the competitive landscape. This may require a slower, more sustainable growth model compared to rapid expansion.

|

| Source: Vietdata |

Despite the challenges, Vietnam offers significant opportunities, particularly in areas such as digital payments, logistics, and green technology. However, companies must be prepared to navigate complex regulations and potential market saturation in certain sectors.

| Gojek features GoFood on-demand delivery offering on MoMo On July 31, Gojek announced that its on-demand food delivery feature, GoFood, is now available on the MoMo platform, a partnership that continues to leverage the extensive and comprehensive synergies between the two brands. |

| Gojek partners with Selex Motors to expand e-bike scheme Gojek has announced a partnership with Selex Motors, a pioneering Vietnamese electric vehicle (EV) startup, to pilot the use of Selex's Camel e-bikes across Gojek’s transport, food-delivery, and logistics services in Vietnam. |

| Ride-hailing company Gojek to exit Vietnam Gojek, the on-demand, multiservice mobile platform, will close its Vietnam business effective September 16, according to an announcement made by its parent company GoTo Group on September 4. |

| Gojek exit leaves door open for ride-hailers to ascend The ride-hailing sector in Vietnam is facing a significant shift after Gojek announced its withdrawal, paving the way for local and international competitors to capture more market share. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version