Review of Vietnam’s economy 2022: Global & local headwinds have just begun

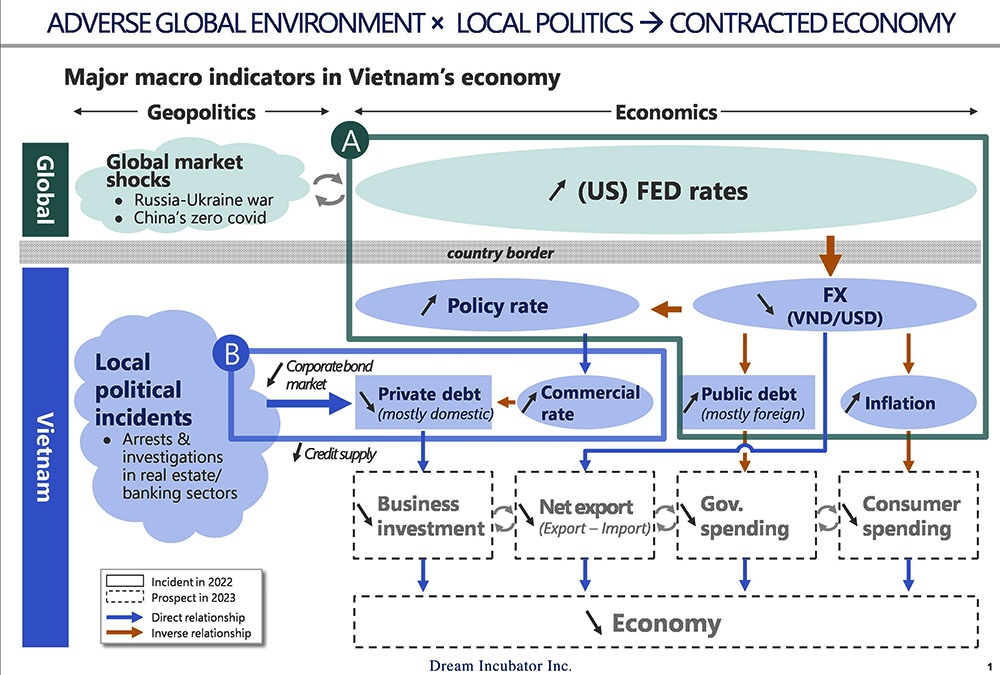

In 2022, a series of major incidents took place both internationally and domestically, which in turn had a substantial impact on the Vietnamese economy. Specifically, at a global level, the Russian-Ukraine conflict broke out in early February. Soon after that, energy shortages and supply chain disruptions triggered soaring inflation in the US and other countries. The US government responded with a series of rate hikes, putting pressure on the monetary policies of countries around the world, including Vietnam.

Domestically, the above series of events put strong pressure on Vietnam to control exchange rates and inflation. At the same time, an array of arrests – mostly in the real estate sector – such as Van Thinh Phat and Tan Hoang Minh took an additional toll on the local economy. The negative impact was mostly manifested through fluctuations in interest rates and the government’s effort to revamp the local corporate bond market.

|

| A challenging year ahead |

The local economy is likely to experience disturbances, not only in 2022 but also 2023. The outlook is grey across all core components of the local economy including business investments, imports and exports, and government and consumer spending.

Firstly, a series of Fed rate hikes in 2022 triggered central banks around the world, including Vietnam, to increase policy rates accordingly in order to keep inflation and exchange rates in check. Consequently, capital became more expensive and harder to access for local enterprises.

Secondly, in terms of trade, the steep appreciation of the USD against the VND inflated the cost of imported inputs from overseas, thus posing major challenges to local manufacturing firms and inflation control.

Thirdly, as the value of existing public foreign debt would surge as a result of exchange rate fluctuations, public spending was likely to be cut back.

Lastly, given the shrinking income and low confidence in the future of the economy, local consumers would have no other choice but to tighten their belts.

In light of the uncertainty, the government has taken drastic measures both in terms of monetary policy and regulatory adjustments to recover the local economy. Regarding monetary policy, the State Bank of Vietnam continuously adjusted upward policy rates in the latter half of 2022 to control inflation and exchange rate fluctuations. In December 2022, the local government raised the credit growth target by 1.5 to 2 per cent (equivalent to $10.4 billion in new money supply). This was applicable to all financial institutions, lifting the previous credit limit from 14 to 16 per cent. The purpose was to incentivise certain prioritised sectors including agriculture, exports, and real estate (particularly within the social housing segment).

The Vietnamese government also took a firm hand on the revamp of the local corporate bond market, which had been notoriously known for its lack of transparency and default risk. However, solely relying on monetary supply will not suffice. Many more actions are to be needed to allow better money absorption from the development to sales, thus allowing more liquidity and reinvestments in the new year.

Read the full report on the Review of Vietnam’s Economy 2022 here

| The Dream Incubator (DI) consultant team: Managing director Tuan-Anh (Andy) Nguyen D. D., senior associate Duc-Anh Dao, associate Phuong-Anh Vu, and associate Thu-Thao Do. More than a traditional consulting firm, DI is a business-producing company. DI’s services, which originally focused on strategy consulting and venture incubation, have currently evolved to provide a wide range of support for client companies to create their businesses. DI is also committed to exploring new business fields with the management of group companies and the investment and incubation of innovative venture firms. |

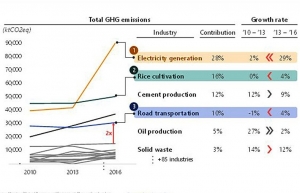

| Innovating towards net zero: energy, rice, and transportation in Vietnam Vietnam is striving to hit its net zero targets by 2050, and there are certain industries which should be focused on. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

- French Communist Party highlights 14th National Party Congress as strategic milestone (January 23, 2026 | 09:19)

- Leaders must rediscover discipline of engagement (January 22, 2026 | 11:08)

- IP alterations shape asset strategies for local investors (January 22, 2026 | 10:00)

- 14th National Party Congress: Vietnam - positive factor for peace, sustainable development (January 22, 2026 | 09:46)

- Japanese legislator confident in CPV's role in advancing Vietnam’s growth (January 22, 2026 | 09:30)

- 14th National Party Congress: France-based scholar singles out institutional reform as key breakthrough (January 21, 2026 | 09:59)

- 14th National Party Congress: Promoting OV's role in driving sustainable development (January 20, 2026 | 09:31)

- 14th National Party Congress affirms Party’s leadership role, Vietnam’s right to self-determined development (January 20, 2026 | 09:27)

Tag:

Tag:

Mobile Version

Mobile Version