Retailers pressured to adapt their tactics

After establishing a strong foothold in the Vietnamese market as a traditional retailer for over 10 years, Japanese-backed AEON is now investing more heavily in diverse business models and developing online shopping channels as a solution to stimulate consumer demand and realise their ambitious goal of making Vietnam its second key market after Japan.

|

| Retailers pressured to adapt their tactics |

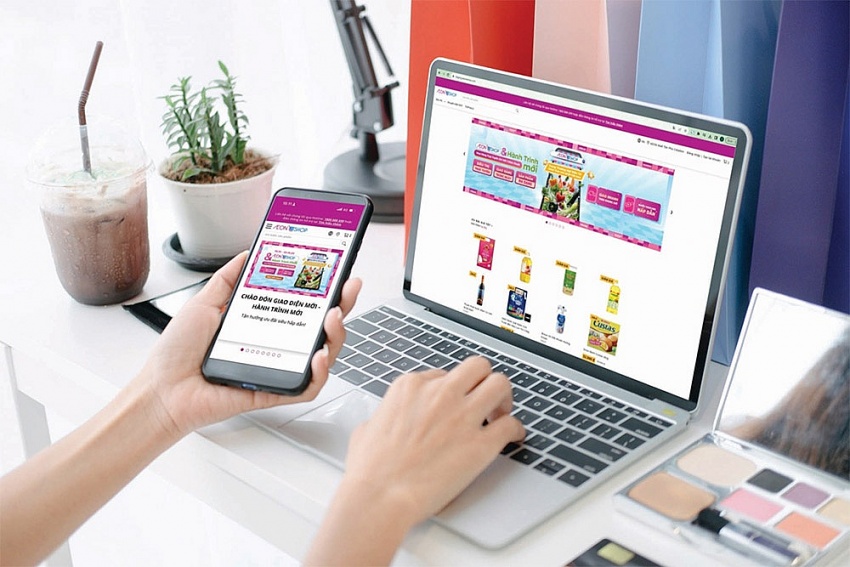

Nguyen Thi Ngoc Hue, corporate communications and external affairs general manager of AEON Vietnam, told VIR that AEON is developing multichannel shopping solutions to support customers. These solutions not only allow customers to shop directly at all AEON supermarkets but also enable them to easily place orders through the hotline, AEON EShop, AEON app, or official stores on partner applications.

“We are striving to improve the convenience and functionality that allow online shoppers to schedule delivery times. For daily grocery items, the company will have a dedicated delivery team to ensure the fastest and quality-assured delivery to customers,” Hue stated.

AEON currently owns nine shopping centres, general merchandise stores and supermarkets in Vietnam. According to a plan announced earlier this year, AEON will continue to open new and diverse shopping destinations with various models and scales. In addition to being present in AEON Mall shopping centres, the company is also expanding and developing further within the commercial centres of other partners.

Last year, AEON Vietnam recorded a growth of 4-5 per cent in sales revenue, with an increase of 3-4 per cent in the number of customers making purchases.

In the summary of the first half of this year, although the revenue of AEON’s shopping centres has recorded a slight growth compared to last year, Hue stated that the growth rate has not yet fully recovered to 2019 levels. “The overall economic situation is still challenging, and consumers are tightening their spending.

However, Hue remains optimistic about a strong industry rebound by the end of this year, as the government’s consumer stimulus policies begin to take effect from July 1. These policies include a 30 per cent increase in the minimum wage and a continued 2 per cent reduction in VAT until the end of the year, which will contribute to increasing consumer purchasing power.

According to the Vietnam Shopper Trends 2024 published by NielsenIQ in June, Vietnamese shoppers are becoming more discerning and price-sensitive, mainly when price changes occur.

The report said that changes in customer shopping trends are significantly influencing their decision-making, thereby indirectly impacting the current business models of retailers and creating pressure for them to change direction, if they do not want to lose market share.

“One of the emerging shopper behaviours observed is many shoppers are now frequenting convenience locations or channels offering the best prices and deals. Visits to supermarkets for fresh food purchases are seen to be declining, as an increasing proportion of shoppers move to prefer smaller-format stores like minimarts and online channels,” the report noted.

At the Masan Group AGM in the previous quarter, Nguyen Thi Phuong, CEO of WinCommerce, announced that the chain has successfully completed its restructuring process and will now resume its strategy of expanding sales points.

“However, instead of expanding the hypermarket or supermarket models, WinCommerce will focus on the multi-convenience store and mini supermarket model this year, including both urban and rural areas, to strengthen its position in the retail chain,” Phuong said.

As of the end of March, WinCommerce had almost 3,700 supermarkets and stores in Vietnam. The chain aims to raise the number to over 4,000 by the end of the year.

Meanwhile, CEO of Saigon Co.op, Nguyen Anh Duc, informed that it will prioritise resources to develop e-commerce as it is an essential trend that retailers must embrace.

“Saigon Co.op will utilise AI technology to analyse customer preferences and enhance their shopping experience. AI technology also contributes to increasing the connection between users and suppliers, driving our supermarket chain to increase revenue and compete more effectively with other retailers,” Duc said.

According to data from the General Statistics Office, the total revenue of retail sales of goods and consumer services in Vietnam, as of the end of Q2, increased by 8.6 per cent compared to the same period last year. However, this growth rate is lower by 2.7 percentage points compared to the corresponding period in 2023.

According to Bui Nguyen Cam Giang, head of consumer goods and retail analysis at Ho Chi Minh City Securities Corporation, consumer trends have led to fluctuations in the growth rate and profit margins of various business segments, resulting in some retail and fast-moving consumer goods companies tending to divest from non-core business areas, one of which is Unilever.

“Focusing on core brands has helped drive Unilever’s business growth. Unilever’s stock price has seen a significant increase since the announcement of its Q1 earnings, and it further surged after the planned $1.5 billion share buyback programme, expected to be executed in 2024,” Giang said.

Unilever in March announced the separation of its ice cream segment, which operates under a different business model from its core operations, to focus on its primary business areas. Prior to that, Unilever had also divested from Dollar Shave Club and Elida Beauty.

| Int'l retailers seek qualified Vietnamese suppliers Large international retailers including Aeon, Uniqlo, Walmart, Amazon, Safeway, Carrefour, Decathlon, Central Group and Ikea have been visiting Vietnam seeking partnerships in industrial, agricultural and handicrafts products, said industry insiders and officials. |

| Leading retailers join forces to reduce plastic bag usage Vietnam retailers unite in the No Plastic Bag Campaign, promoting changes in consumers' plastic bag consumption habits. |

| Retailers advocate for green habits Vietnamese retailers are leading efforts to promote eco-friendly shopping habits, with major companies implementing initiatives to reduce plastic waste and encourage sustainable consumption. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version