Putting the carbon market to work

These collective efforts function on a framework known as the Nationally Determined Contributions (NDCs). Each participating country submits its NDC, which outlines the specific actions and emission reduction targets it will undertake.

|

| Dang Hong Hanh, Co-founder and managing director VNEEC |

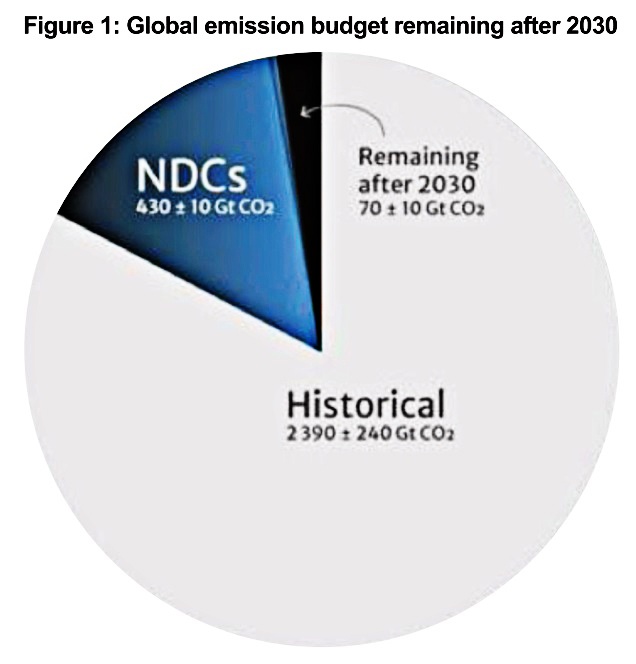

In April this year, the UN Framework Convention on Climate Change synthesised information from the 166 latest available NDCs shows an alarming fact that compared to the carbon budget consistent with 50 per cent likelihood of limiting warming to 1.5°C (500 gigatonnes of CO2 equivalent), cumulative CO2 emissions in 2020-2030 is equivalent to already 86 per cent of the remaining carbon budget, leaving a post-2030 carbon budget of around 60-80Gt of CO2eq, which is equivalent to approximately only two years of projected global total CO2 emissions by 2030.

The very slim remaining budget of GHG emission shows that achieving the global 1.5 degrees goal is an immensely challenging task. It primarily hinges on the effective implementation of measures and the availability of financial resources, technology transfer, technical cooperation, capacity-building, and the capacity of forests and other ecosystems to absorb emissions.

Additionally, the implementation of carbon market-based mechanisms play a pivotal role in this endeavour. According to Reuters, the value of traded global markets for carbon market reached a record €850 billion ($913.5 billion) last year and the demand for voluntary carbon credits could grow by 100 times by 2050.

Carbon markets are a set of mechanisms that enable the buying and selling of emissions allowances or carbon credits. Carbon markets, vital for the Paris Agreement objectives, enhance cost-effectiveness by giving carbon a monetary value, driving efficient emissions reduction. They boost NDC ambition, offering flexibility through international/domestic markets.

The carbon market roadmap

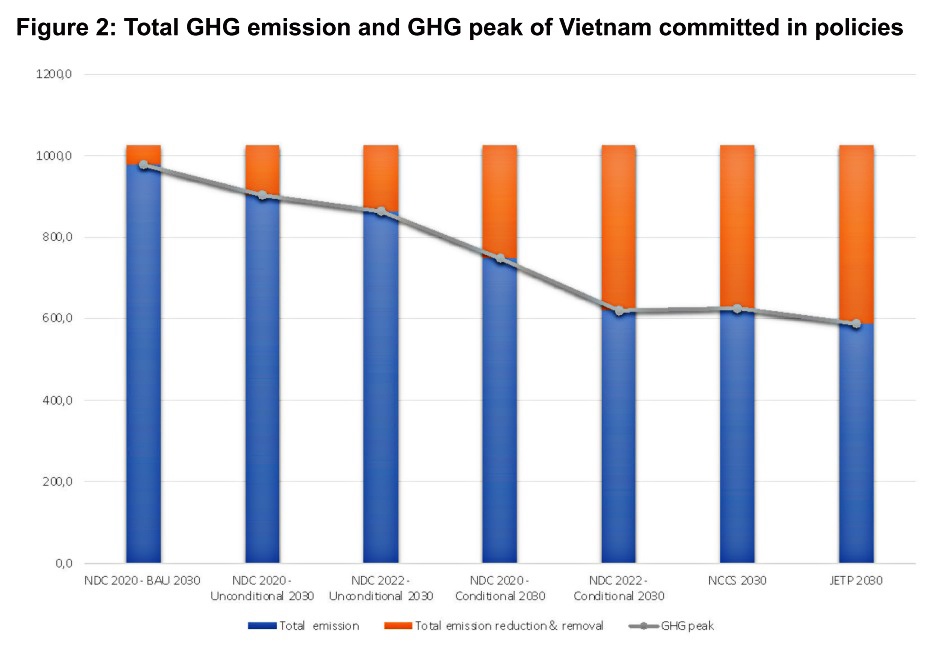

The total emissions by 2030 in Vietnam in a business-as-usual scenario (as in, no emission reduction efforts) was estimated at one billion tonnes of CO2eq in 2020. Then with the issuance of new national emission targets, the ambition of Vietnam’s climate commitment has been increased with its GHG peak is tightened and achieved it sooner.

The latest Just Energy Transition Partnership political declaration aimed to shift the peak target from 2035 to 2030 and the peak aimed in 2030 is 588 tonnes of CO2eq. That is lower than the 625 million tonnes of CO2eq stated in the NDC 2022 and National Climate Change Strategy in the same year.

The declaration explicitly mentioned the use of pricing and regulatory measures to promote investment in renewable energy, energy efficiency, and the strengthening of the country’s electricity grid. Carbon pricing is a potential and powerful climate financing policy to facilitate the transition towards cleaner energy and help the country achieve its climate targets in a cost-effective way.

The recognition of the potential benefits of carbon market instrument led the country to take various steps to accelerate the domestic carbon market. The development of the carbon market in Vietnam is regulated in the Law on Environment Protection 2020, Decree No.06/2022/ND-CP on emissions reduction and protection of the ozone layer, and in approval of tasks and solutions to implement the results of COP26.

As the party to the Paris Agreement, Vietnam committed to reducing GHG emissions with the unconditional target of 15.8 per cent (using domestic resources) and a conditional reduction of 43.5 per cent (with international support) by 2030 compared to a business-as-usual scenario in the NDC 2022.

Based on this national target, specific GHG reduction targets and measures have been established for the key sectors of energy, transportation, industrial processes, construction, and waste. Consequently, large emitters in these sectors are required to conduct GHG inventories and implement GHG reduction measures.

To assist emission entities in flexibly achieving the GHG reduction targets at low costs, the carbon market in Vietnam towards 2030 is stipulated under Decree 06, which comprises two mechanisms.

The first one is the Emissions Trading Scheme (ETS). The state sets an emissions cap on the total direct GHG emissions for specific emitters and establishes a market for trading emissions allowances. Each allowance is equivalent to one tonne of CO2eq, and the emission cap represents the total allowances allocated to an entity. Entities partaking in ETS can buy and sell allowances depending on their emission background and business decisions. If they fail to meet the caps at the end of the year, the government will impose penalties on non-compliance volumes.

The second aspect is carbon credit mechanisms. Investors in activities that result in reducing emissions or removing carbon from the atmosphere are allowed to claim carbon credits for emission reductions (one credit is equivalent to the right to emit one tonne of CO2eq). These activities can comprise clean energy, waste treatment, conservation, afforestation, or carbon sequestration projects.

|

|

Outlining key concerns

In Vietnam, carbon credits can be offset against the allocated emission cap (up to a maximum of 10 per cent of the cap).

The roadmap for the domestic carbon market in Vietnam consists of three phases, with the preparation phase extending towards 2025. It is anticipated that during the pilot phase (2025-2027), only enterprises in the cement production, steel production, and thermal power sectors will be subject to emission limits and allowed to trade on ETS. After the ETS matures and officially operates from 2028, the number of participating entities will expand.

While carbon markets offer significant potential, the policies in Vietnam must address concerns to ensure that carbon markets effectively contribute to the net-zero commitment by 2050. It needs an environmental integrity. Key concern is the risk of “double counting” for carbon credits where emissions reductions are counted twice by the seller (host country) and the buyer (purchasing country), potentially leading to an increase in global GHG emissions instead of a reduction. In parallel with the stringent standards for carbon credits, the transparent and efficient national registry system is vital to ensure this integrity.

Another factor is market volatility. Price fluctuations and speculation can undermine their long-term effectiveness and stability. For instance, despite a substantial rise in GHG reduction targets, the Korean ETS price has continuously decreased, which is typically not seen with increased demand. Incorporating price or supply stabilisation mechanisms as well as adjustment measures to ensure ambition or reduce price volatility is already applied in some schemes.

Another important factor is equity and transparency. Under the carbon market, allocated allowances and carbon credits have become valuable assets for enterprises and investors. Investors must plan the pathway to incorporate carbon markets as an asset class into their portfolios.

Meanwhile, it is important for the government to ensure oversight the compliance of the market, especially equity and transparency within the carbon market in order to foster confidence, accountability, and effective emission reduction measures.

As the world collectively strives to limit global warming and mitigate the impacts of climate change, carbon markets are an indispensable tool of climate actions. Although there is currently no domestic carbon market in Vietnam, the foundational steps are being taken.

However, the design and evolution of the domestic carbon market in Vietnam must be a well-coordinated effort, involving various stakeholders, aligning with international best practices to ensure its effectiveness and long-term success.

| Oil exec and climate champion? The man steering COP28 The Emirati oil boss preparing to take the helm of UN climate talks said he is stunned to hear that environmentalists suspect him of duplicity on climate change. |

| COP28 faces debate over controversy-mired carbon credits Controversial credits bought by corporations to offset their carbon emissions will be in the spotlight at UN climate talks next month. |

| Targets to end fossil fuel at COP28 crucial: EU climate chief A demand for targets for the phase-out of fossil fuels in the final agreement of COP28 in Dubai is not frivolous but an urgent request backed by "crystal clear" science, Europe's climate commissioner told AFP on Tuesday. |

| COP28 turns attention to potent methane emissions Climate talks often revolve around reducing the most dangerous greenhouse gas CO2. |

| First cross-border transport of CO2 expected in 2025: Yara Norwegian fertiliser group Yara International on Monday signed a contract to begin transporting CO2 produced at its Netherlands plant to Norway so it can be buried under the seabed, as of 2025. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Tag:

Tag:

Mobile Version

Mobile Version