Public debt plan laid out towards 2026

Deputy Prime Minister Le Minh Khai last month signed Decision No.260/QD-TTg on the nation’s public debt management for 2024-2026 (see box). The scheme is based on expectations that the economy will grow 6-6.5 per cent in 2024, with a budget deficit of as much as 3.6 per cent of GDP.

|

In this year, the government will seek loans worth a maximum of $28.17 billion, higher than last year’s $26.85 billion, including loans for central budget balance of up to $27.5 billion, of which borrowing to offset the central budget deficit will be a maximum of $15.53 billion, borrowing to repay the principal will not exceed $11.96 billion, and on-lending will be $671.8 million.

Such loans will come from government bond issuance instruments, official development assistance loans and foreign preferential loans, and other financial sources.

The government’s debt repayment is scheduled for about $18.92 billion, of which the government’s direct debt payment is a maximum of $16.5 billion and the repayment of on-lending projects is $2.42 billion.

When it comes to loan and repayment plan of localities, borrowing from the government’s foreign loans and domestic loans is around $1.28 billion. Localities’ debt repayment is $291.38 million, including principal payment of $171.6 million and interest payment of $119.7 million.

As for foreign commercial loans of enterprises that are not guaranteed by the government, the limit of medium and long-term foreign commercial loans of enterprises and credit institutions by the self-borrowing and self-payment method is up to $6.56 billion; the growth rate of short-term foreign debt is as much as 18-20 per cent compared to the total debt as of December 31, 2023.

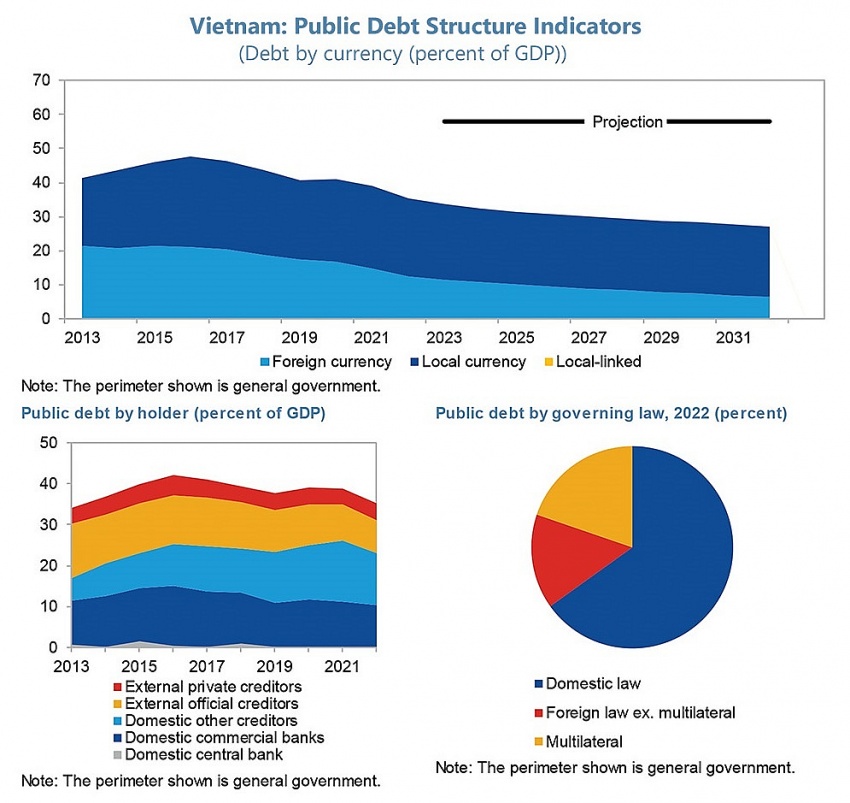

In the case of positive GDP growth that meets targets assigned by the National Assembly (NA), it is forecast that by the end of 2024, Vietnam’s total public debt will be about 39-40 per cent of GDP.

The government’s direct debt payment obligation compared to the estate budget revenue will stand at about 24-25 per cent, guaranteed to stay “within the cap and threshold allowed by the NA”, according to the Ministry of Finance (MoF).

According to The Economist’s Global Debt Clock, by late last week, Vietnam’s public debt in GDP stood at 45.6 per cent; per capita public debt was more than $1,000; while total public debt was $94.85 billion.

“The MoF is tasked to study new methods for loan mobilisation, ensuring that sufficient capital must be mobilised for development, providing sufficient funding for large-scale transport projects; projects for climate change response and supporting the country in its international commitment to achieving net-zero emissions by 2050; and projects about boosting digital transformation,” Decision 260 said. The MoF is also ordered to apply solutions to control public debt and the nation’s foreign debt within permissible limits.

In Vietnam, the nation’s foreign debt refers to total foreign debts of the government and government-guaranteed foreign debt, and foreign debts of businesses and credit institutions under the mode of self-borrowing and self-payment. The country succeeded in maintaining its public debt over the past few years. According to a government report released early this year on Vietnam’s public debt situation since 2021, all public debt safety indicators in 2021-2023 stayed within the limits allowed by the Politburo, the NA, and the government.

Specifically, the nation’s foreign debt in 2021-2023 was brought under control at a rate lower than the permissible limit set by the NA (not exceeding 50 per cent of GDP). It saw a slight reduction compared to the plan, at an estimated 37-38 per cent of GDP as of late 2023, largely thanks to a reduction in foreign loans of businesses and credit institutions under the form of self-borrowing and self-payment.

Total public debt last year was tantamount to 40 per cent of GDP, and the government’s direct debt repayment reached 21 per cent of the total state budget revenue.

The public sector’s foreign debt – including government debt and government-guaranteed debt – continued reducing from 14.7 per cent of GDP in 2021 to an estimated 10.8 per cent of GDP in 2023.

Meanwhile, foreign debts of enterprises and credit institutions under the form of self-borrowing and self-payment climbed from 23.4 per cent of GDP in 2021 to 26.2 per cent of GDP in 2023.

During 2021-2022, in the context of global tightened financial conditions and an increase in lending rates, enterprises in Vietnam almost sought no new loans, and instead they focused on debt repayment.

“Though enterprises obtained few new loans in 2022, they still continued increasing loans in 2023 to add more capital to their business and production activities in hope of recovery and implementation of new large-scale projects,” the MoF said.

For example, many businesses registered for big foreign loans at the State Bank of Vietnam, such as Formosa Ha Tinh Steel Corporation with $500 million, Jinko Solar Vietnam at $450 million, Masan Group with $308 million, Vietcombank with $300 million, PetroVietnam Power Corporation at $200 million, and Formosa Dong Nai with $200 million.

| Fiscal policy is disciplined and a follows a conservative approach, with a view on its impact over the medium- to long-term horizon. Fiscal consolidation is undertaken gradually, as reflected in the phasing out of pandemic-related measures and transitioning to more targeted policies while considering their implications on economic recovery. Public debt has decreased to 35 per cent of GDP, supported by an improved fiscal balance and strong nominal GDP growth. Government-guaranteed debt continues to decrease as more state-owned enterprises gain access to market financing without government guarantees. To mitigate the risks of potential economic slowdown, fiscal policy will play a counter-cyclical role through more expansionary measures, aligning with monetary policy. There is ample room for additional fiscal support if circumstances require it, given the successful prior fiscal consolidation efforts and debt reduction. The fiscal position has improved, and there is considerable room to utilise debt securities. Current public debt remains below the National Assembly’s 50 per cent debt threshold. Nonetheless, the authorities will exercise prudence and opt for a conservative approach, considering the variability in revenue collection. Source: International Monetary Fund --------------------------------------- In the 2024-2026 period, the government will have loans worth a maximum $77.6 billion, including loans for central budget balance of up to $75.76 billion, and on-lending of $1.83 billion. The government’s total debt payment for the 2024-2026 will be a maximum $45.95 billion, including $40.68 billion for direct debt payment and $5.27 billion for payment of on-lending debt. It is necessary to arrange resources for fully implementing the government’s debt obligations, not allowing any overdue debts that could badly affect the government’s international commitments. Source: Decision No.260/QD-TTg |

| Government looks ahead to financial security via debt plan Vietnam’s plan for borrowing and paying public debt for 2024 has been revealed, with public debt set to stay within the permissible limit and ensure the nation’s financial security. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version