Phat Dat reports 60 per cent rise in first-quarter profit

|

| Phat Dat Real Estate has reported a very strong financial performance in the first quarter |

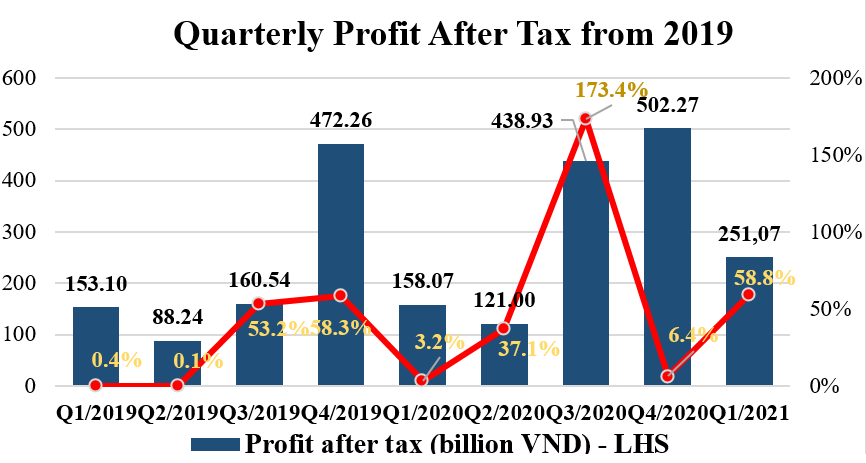

According to the quarterly consolidated financial statements of Phat Dat, the first quarter’s net revenue reached VND586.1 billion ($25.5 million) and profit increased sharply by 60 per cent on-year. Pre-tax and after-tax profit reached VND314.93 billion ($13.7 million) and VND251.07 billion ($10.9 million), respectively. Hence, although the market economy is greatly affected by the epidemic and many businesses have to narrow down or stop their business, the company remains one of the top 15 real estate enterprises by profit.

Such an impressive increase in profit comes from the accelerated implementation of infrastructure projects and the partial handover of land lot products of Zone 9 inside Nhon Hoi Ecotourism Area, Binh Dinh province.

Gross profit margin in the first quarter also increased to 65.7 per cent (from the 39.6 per cent in the first quarter of 2020), equivalent to the gross profit of VND384.97 billion ($16.74 million), up 54.4 per cent on-year.

|

| Quarterly after-tax profit and growth rate of Phat Dat Real Estate. Source: Consolidated Financial Statements – PDR |

Sales expenses dropped sharply by 84.9 per cent on-year to VND4.2 billion ($182,600) after not incurring brokerage costs during the period. General and administrative expenses increased by 84.2 per cent on-year, reaching VND43.1 billion ($1.87 million), mainly from the 62.9 per cent increase in salary expenses reaching VND22.6 billion ($982,600), resulting from growing personnel and operational scale. The cost of external service expenses increased by 3.7 times, reaching VND15.3 billion ($665,220). Net profit from business activities in the first quarter reached VND316.6 billion ($13.77 million), up 59.6 per cent on-year.

By the end of the quarter, PDR also recorded a negative VND1.7 billion ($73,910) in other income, while last year was negative VND400 million ($17,390). Total accounting pre-tax profit reached VND314.9 billion ($13.7 million), up 59.1 per cent on-year, and net profit reached VND251.1 billion ($10.9 million) up 58.8 per cent. Earnings per share reached VND558 (2 US cent) per share (up 16.5 per cent).

In the balance sheet, as of March 31, 2021, PDR’s total assets increased by 11.2 per cent compared to the end of 2020, reaching VND17.36 trillion ($754.8 million). Cash and cash equivalent of this decreased from VND53.2 billion ($2.3 million) to about VND7.8 billion ($339,130). The short-term financial investment was VND12.2 billion ($530,430) – the same level as at the end of 2020.

Short-term receivables increased by 67.4 per cent year-to-date to VND2.54 trillion ($110.43 million), mainly due to other short-term receivables increasing by 4.5 times on-year to VND1.23 trillion ($53.5 million). Short-term advances to suppliers and provision for doubtful short-term receivables remained unchanged compared to the end of 2020.

Inventories increased by VND1.3 trillion ($56.5 million) in the first three months of 2021, reaching VND10.63 trillion ($462.17 million) up 13.9 per cent year-to-date, including a rise of VND1.37 trillion ($59.57 million) of the new project of Phuoc Hai and a drop of VND80.9 billion ($3.5 million) deducted from the revenue recognition of Zone 9 in Nhon Hoi Ecotourism Area to VND1.39 trillion ($60.43 million).

Regarding the long-term assets, long-term receivables were VND989.4 billion ($43 million) while fixed assets increased by 6.1 per cent to VND36.2 billion ($1.57 million); investment properties slightly dropped to VND69 billion ($3 million). Long-term asset in progress increased slightly 2.5 per cent to VND920.7 billion ($40 million) due to the ongoing projects of the office building at 39 Pham Ngoc Thach (District 3, Ho Chi Minh City) and internal infrastructure construction of Zone I – Co Dai Area (District 9)

|

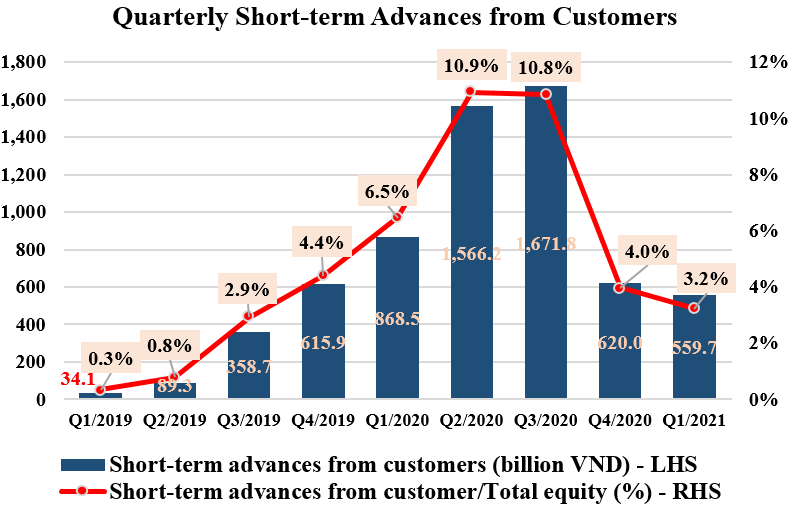

| (Source: Consolidated financial statements – PDR) |

As of March 31, 2021, total liabilities reached VND10.5 trillion ($456.5 million), relatively unchanged from the beginning of the year. In breakdown, VND5.55 trillion ($241.3 million) was recorded as long-term payables from the two transferred projects, The EverRich 2 and The EverRich 3, equivalent to 52.9 per cent of the total payable balance. The amount, in fact, is not a debt of PDR because PDR transferred the two projects to partners and received the corresponding amount in 2019. Upon completing legal procedures, the amount will be recorded in the revenue section.

Besides, short-term trade payables decreased slightly by 2.5 per cent to VND281 billion ($12.2 million). Short-term advances from customers dropped by 9.7 per cent to VND559.7 billion ($24.33 million) due to the customer’s prepayment of the Nhon Hoi Ecotourism City project. Also, an amount of VND407.25 billion ($17.7 million), recorded in the Statutory Obligations account, is due in April 2021 and expected to be paid on time.

Short-term loans fell by 7.8 per cent year-to-date to VND1.3 trillion. In detail, loans from banks decreased by VND101.2 billion ($4.4 million), issued bonds decreased by VND53.5 billion ($2.33 million), and loans from other parties increased by VND44.8 billion ($1.95 million).

Long-term loans increased by VND389.7 billion ($1.7 million), up 80.3 per cent year-to-date, standing at VND874.9 billion ($38 million) mainly due to an increase of VND396.7 billion ($17.25 million) in long-term bonds standing at VND643.9 billion ($28 million). This results from the two-year-term bond issuance on February 2, 2021 with a total value of VND400 billion ($17.4 million) and an interest rate of 13 per cent per year.

The issuance is to fund Zone 2 and Zone 9 inside Nhon Hoi Ecotourism City (Binh Dinh province) and subsidiaries to develop Binh Duong Tower Commercial and Apartment Complex and the internal technical infrastructure of Zone I (Co Dai Area Zone) in Ho Chi Minh City.

Also, PDR has built a roadmap for restructuring loans toward the end of May 2021. Accordingly, the total balance of short and long-term loans is estimated to be at VND1.5 trillion ($65.2 million), accounting for 27.7 per cent of the total equity of VND5.3 trillion ($230.43 million).

The company targets VND2.34 trillion ($101.74 million) in 2021's pre-tax profit and VND14.27 trillion ($620.43 million) in accumulated pre-tax profit of 2019-2023 (the residential real estate segment alone), corresponding to a compound annual growth rate of 51 per cent per year.

Also, Phat Dat aims to transform itself into a professional conglomerate with a diverse business portfolio, rooting from the core competency of project development. Besides the key sector of residential real estate, Phat Dat expands its business into industrial real estate and renewable energy sectors. This demonstrates flexibility in project strategy to diversify revenue sources, generating sustainable cash flow, and a stable financial foundation.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

Tag:

Tag:

Mobile Version

Mobile Version