New era opens for 5G commercialisation

|

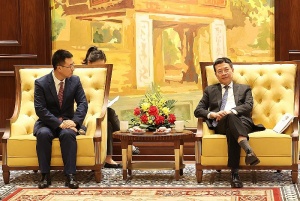

| Doan Quang Hoan, vice chairman, Vietnam Radio Electronics Association |

However, the price is not the issue. When setting the price, the Authority of Radio Frequency Management of the Ministry of Information and Communications consulted statistics on frequency band prices in the international market, and tried to come up with a relatively reasonable calculation for the Vietnamese market based on population conditions, GDP per capita and other market factors to create competition between network operators.

Currently, the market has four network operators, competing to get three frequency bands. When entering the auction, both the B1 and C2 bands witnessed really fierce competition through dozens of rounds. With such competition, I think the price is reasonable, especially compared to the total cost a network operator spends to operate the 5G mobile network over 15 years.

Network operators competed fiercely for the B1 band. The first reason for this is the value, which is much higher than the C2 band. Moreover, the coverage area of a base transceiver station (BTS) of the B1 band is 1.3-1.7 times wider than the C2 band, leading to a huge reduction in investment costs for network operators.

Secondly, the B1 band can be used for both 5G and 4G, while C2 can only be used for only 5G.

The current needs of the Vietnamese market and the world generally are mainly 4G services. According to forecasts, by 2028 about half of subscribers will be using the 4G frequency band, especially in developing countries like Vietnam.

This means that for major 4G operators, the B1 band is extremely valuable because it not only enables them to continue providing services, but also helps optimise the network, reduces business costs, and exploits 4G on the system, bringing tens of millions of US dollars in benefits to any winning network operator.

That is also why the starting price of the B1 band is twice as high as C2. This does not consider the difference when receiving and using the band of each business.

Currently, Viettel is the network operator with the largest number of data subscribers, accounting for more than half of the market share, with about 40 million subscribers. Calculating the cost of bandwidth per subscriber, Viettel has a much greater advantage. In addition, this is also the network operator with the largest number of BTS stations, so the bandwidth cost per station is also advantageous.

Viettel subscribers are based in all regions, with a much larger proportion of rural, mountainous, and island users than other networks. Users in these areas do not have the need to use 5G soon, and their demand for 4G is still high. Therefore, the B1 band is even more meaningful to Viettel, compared to other carriers.

Viettel, with their economic potential, cannot ignore this B1 band. However, not only Viettel wants to get this ‘golden frequency band,’ as other network operators do. This is the reason why we saw fiercer competition in the auction through dozens of bidding rounds. And a network operator only accepted to leave the game when the final bidding level reached the limit of effective bandwidth usage.

Vietnam still plans to commercialise 5G this year, so the auction is important for the information and communications industry, opening a new era for 5G, which is the basis for developing digital infrastructure and serving national digital transformation. The auction marked a historical milestone, as this was the first time it was implemented under the new regulations. Everything went well, and the state has obtained an appropriate budget.

For the network operator, calculating on technology, coverage, and market share, the successful auction of the two bands with two different prices is in accordance with their network deployment requirements and business conditions.

Frequency bands are an essential resource for telecommunications businesses, just like land is essential for real estate. Therefore, auctions are critical for investing in mobile networks. With a price of $104 million for 15 years, each network operator only has to pay $6.9 million each year. Compared to the vast amounts of investment annually in the network, the amount is good value.

| Huawei to develop 5G innovation centre in Vietnam Huawei is proposing the development of a 5G innovation centre in Vietnam as part of the Chinese tech giant's intention to support Vietnam's roll out of commercialised 5G services. |

| 5G network inches ever closer Investment returns may be some way off for telecoms groups, despite taking on ownership of 5G frequency bands via auction. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Digital Transformation

- Dassault Systèmes and Nvidia to build platform powering virtual twins

- Sci-tech sector sees January revenue growth of 23 per cent

- Advanced semiconductor testing and packaging plant to become operational in 2027

- BIM and ISO 19650 seen as key to improving project efficiency

- Viettel starts construction of semiconductor chip production plant

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version