National debt targets within reach despite precarious year

|

| Much of this year and last has seen focus on the government offering massive bailout packages to support enterprises, photo Le Toan |

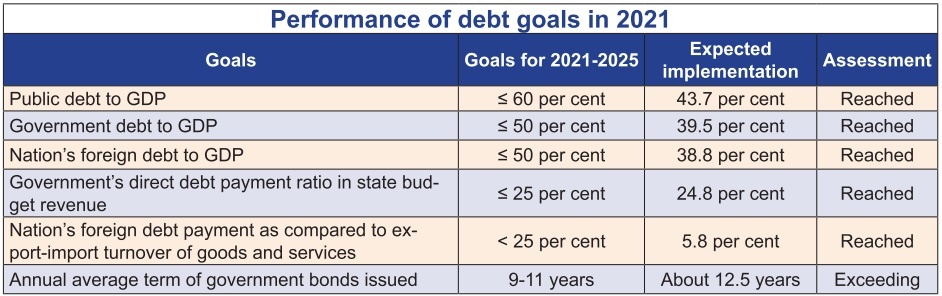

The government has reported that all debts goals for 2021 will be closely managed and stay within the permissible limits earlier set out by the National Assembly (NA). Effectiveness in management of public and government debts this year was kept stable (see box).

|

It is estimated that by the end of 2021, Vietnam’s total public debt will be around $160.87 billion or 43.7 per cent of GDP. The government’s debt will be about $145.65 billion or 39.5 per cent of GDP. Nearly 90 per cent of the debt is from domestic sources.

It is also estimated that total capital mobilised by the government in 2021 will be around $22.36 billion, including $20.13 billion from domestic loans – consisting of $16.21 billion from government bond issuance and the remainder from the state budget; and $2.23 billion from official development assistance (ODA) and concessional loans.

In the first nine months of 2021, the government inked only two ODA loan agreements worth $97.4 million with the World Bank and the Austrian government to formulate green growth and climate change policies, as well as build a hospital in the Mekong Delta province of Vinh Long.

“Amid negative impacts of COVID-19 and difficulties in legal procedures, it is expected that in 2021, Vietnam can ink nine loan agreements only – including the above-said deals and another seven whose negotiations have been concluded – with a total value of about $1 billion,” said Minister of Finance Ho Duc Phoc.

“This year, the government’s loan structure is largely focused on domestic sources, contributing to reducing possible risks from fluctuations of exchange rates,” said a report from the Ministry of Finance (MoF) on Vietnam’s public debt.

It is expected that the government’s domestic debt for 2021 will account for about 67.5 per cent of its total debt portfolio, up from 63.8 per cent recorded last year.

According to the MoF, up to 94.7 per cent of the government’s debts are subject to fixed lending rates until late 2021. All foreign loans of the government are subject to low lending rates, at an average of 1.6 per cent a year thanks to preferential conditions from ODA sums.

For domestic loans, it is estimated that until late 2021, the average lending rate will still be 4.7 per cent a year, down from 6.6 per cent a year in 2016.

“This factor has helped maintain the country’s ability in debt payment and prompted the International Monetary Fund and other rating organisations to positive assessments on Vietnam’s credit,” Phoc said.

The MoF cited international rating organisations which are cooperating with the Vietnamese government as saying that in this year, at least 16 nations have had their ranks lowered.

“However, for Vietnam, thanks to great efforts made by the whole political system since 2020, investors’ confidence in the Vietnamese market has been strengthened, and the country has been the only one that had its rank raised to ‘positive’ by the rating organisations,” Phoc elaborated.

Since early last year, the government and the NA have offered tens of billions of US dollars on supporting people and enterprises hit by the health crisis. The total value of all fiscal solutions that have and will be enacted by the NA’s Standing Committee and the government in 2021 will be about $6.08 billion.

In this year, total state budget revenue is estimated to be more than $59.34 billion, up 1.7 per cent against the initial estimates and equal to 90.6 per cent of the implemented figure of 2020. Meanwhile, total state budget spending will likely be $74.3 billion, tantamount to 101.3 per cent of the initial estimates.

Total state budget overspending for 2021 is estimated to be about 4 per cent of GDP, with public debt at the end of 2021 sitting at about 44-45 per cent of GDP. All these rates remain at a safety level stipulated by the NA.

Last year, the Vietnamese economy suffered from a total state budget deficit of $11.87 billion, with the total budget expenditure at more than $77.39 billion, including the recurrent spending of $42 billion or 54.2 per cent.

To have more resources for socioeconomic development and continue supporting enterprises and people, the government has asked the NA to allow it to issue government bonds and increase public debt, with overspending to be kept at a maximum level of 4 per cent of GDP.

Under Vietnam’s recently-approved public debt management programme for the 2021-2023 period, the total borrowing until 2023 will be $75.65 billion, of which $69.56 billion will go to the central budget. The local budget spending deficit is limited at 0.2 per cent of GDP, as stipulated in the 2015 Law on State Budget, and the debt repayment obligation of local governments is approximately $800 million.

With regards to foreign commercial loans by businesses and credit institutions, the growth rate for short-term credit is capped at 18-20 per cent per year and the net maximum medium-term and long-term loans are around $6.35-7 billion per year.

According to The Economist’s Global Debt Clock, by late last week, Vietnam’s public debt in GDP stood at 45.6 per cent, and per capita, public debt was $1,450, while total public debt was almost $94.85 billion.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

Tag:

Tag:

Mobile Version

Mobile Version