Myriad of risks put pressure on inflation intentions

Brent crude futures early last week increased by 43 cents to $85.36 a barrel against a few days earlier. WTI crude futures were trading at $80.89 a barrel, up 47 cents.

Both benchmarks escalated over 6 per cent after the Organization of the Petroleum Exporting Countries rocked markets with an announcement of production cuts of 1.66 million barrels per day (bpd) from May until the end of 2023. This will bring the total volume of cuts to 3.66 million bpd, including a two million barrel cut last October, tantamount to about 3.7 per cent of global demand.

|

| Myriad of risks put pressure on inflation intentions |

As Vietnam’s fuel market largely depends on the global market, the domestic market last week saw a climb in petrol prices, the sixth increase this year, of between 2.6 and 5.5 cents per litre. According to Swiss energy giant Vitol Group, oil prices could reach $100 per barrel in the second half of this year as global demand is set to reach record levels.

One of the key drivers of a high hike in oil price this year is China’s economic recovery. According to the World Bank, nearly half of the growth in oil consumption in 2023 is expected to come from China.

The Bank of America has argued that with China reopened, more than a billion people will start travelling and spending, raising demand for energy and other commodities. Goldman Sachs has also estimated that China’s reopening will add one million barrels per day to global demand (about 1 per cent of world consumption), putting an extra $5 a barrel on oil prices.

All these oil-related factors will push inflation up, including in Vietnam, when the country wants to rein in the rate to 4.5 per cent.

“This estimation assumes that inflation in the first half of the year will be affected by the still-dissipating effects of the March 2022 fuel price shock and the withdrawal of the 2 per cent VAT tax break provided as part of the economic support package in 2021,” the World Bank said.

“In the second half of 2023, higher electricity prices and a salary increase for civil service workers will affect inflation. The consumer price index is expected to moderate to 3.5 per cent in 2024 and 3 per cent in 2025.”

Electricity of Vietnam (EVN) is asking permission from the Ministry of Industry and Trade to raise electricity prices for fear of continued financial losses. It estimated that if the existing power price applied since 2019 continues is kept, it will suffer from a financial loss of over $2.82 billion this year.

The agony comes from a high rise in input material prices since early 2022, while the selling price of electricity has been unchanged since 2019. In February, EVN produced a total of 20.2 billion kWh, up 9.4 per cent on-year. However, in the first two months, the volume hit 38.61 billion, down 2.2 per cent on-year.

Last year, EVN suffered from a financial loss of over $1.13 billion due to a high rise in input material prices.

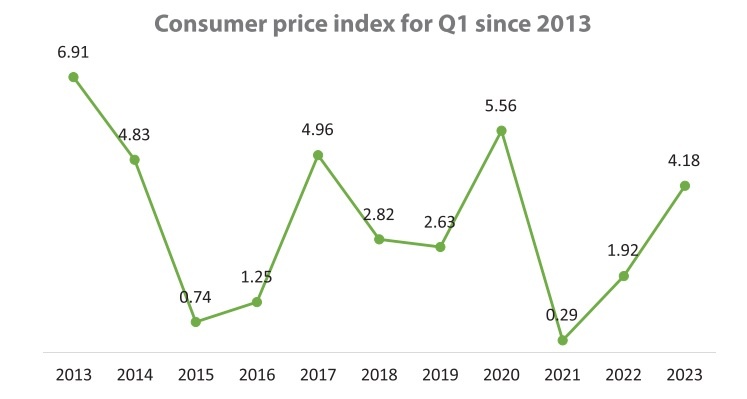

A 2.2 per cent on-year reduction in industrial production has contributed to Vietnam’s efforts to control inflation, which saw a decrease in on-month climb of 4.89 per cent in January, 4.31 per cent in February, and 3.35 per cent in March. The total on-year rate for Q1 reached 4.18 per cent, according to the General Statistics Office (GSO).

Analysts at the Economist Intelligence Unit said, “Consumer price inflation will begin to ease in the second quarter of 2023, from a peak of about 5 per cent in core inflation in the first three months of the year. A more rapid deceleration will take hold in the second half of 2023 as declining global energy prices translate into easing cost-push pressures across a range of goods and services, while a higher base of comparison from the year-earlier period will also come into play.”

The GSO also reported that a rise in consumption services will also act as a driver of inflation. In Q1, the total retail and consumption revenue in the country reached $65.43 billion, up nearly 14 per cent on-year.

Retail sales in Vietnam increased 11.3 per cent on-year in March, slowing from a 13.2 per cent rise in February and a 20 per cent gain in January. This was the softest rise in retail trade since April 2022, amid rising cost pressures and higher borrowing costs.

The Asian Development Bank (ADB) last week said that services are expected to expand by 8 per cent in 2023 on revived tourism and associated services.

“China initially left Vietnam off the list of the countries that could receive its outbound tourists. However, a revised list last month added Vietnam, allowing group tours from China to Vietnam to resume on March 15. As China is Vietnam’s largest tourist market, the country will benefit considerably from this development,” the ADB said.

Public investment will be the key driver for economic recovery and growth in 2023. A considerable amount of public investment is scheduled to be disbursed in 2023. The government is committed to disbursing $30 billion in the year, of which 90 per cent had been allocated to disbursing ministries and provinces as of January.

“On the demand side, domestic consumption will continue to rebound in 2023. Revived tourism, new public investment, and a salary increase effective in July 2023 are expected to keep domestic consumption on the rise,” the ADB added.

| In the near term, Vietnam faces heightened risks associated with external headwinds and domestic vulnerabilities. Persistent inflationary pressures and the prospects of more aggressive monetary tightening, especially in the US and other advanced economies, could induce volatility in global financial markets and hamper economic growth at a time when a slowdown is already underway. Uneven or incomplete recovery in China could affect its growth and trade dynamics with Vietnam. Additionally, the risk of de-globalisation looms, with heightened geopolitical tensions and conflicts raising uncertainty about the future path of global trade and growth and would substantially affect small open economies such as Vietnam. Domestically, higher inflation and heightened financial risks could affect growth prospects. Persistent price-increases could cause inflation expectations to rise, feeding into destabilising pressures on nominal wages and production costs. Higher and more persistent inflation tends to discourage domestic consumption due to the higher prices of products and discourage domestic investment due to higher uncertainty about economic conditions. Weaknesses in the policy and supervisory framework of the financial sector and the balance sheet in the corporate, banking, and household sectors could amplify risk, affecting domestic investor and consumer sentiments. On the upside, improved growth prospects in China, the US, or EU and stronger than expected global demand could lift exports and hence growth above the baseline projection.Source: World Bank |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Mobile Version

Mobile Version