MoIT stake sale’s main lure: VEAM

|

| From now through 2020, MoIT will divest from six firms, and VEAM is first, Photo: Le Toan |

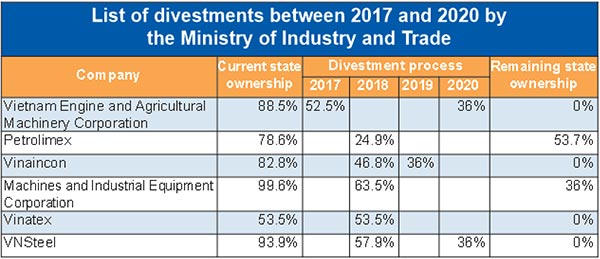

Last week, a list of six firms slated for partial and complete divestment was released by the Ministry of Industry and Trade (MoIT), in line with Decision No.1232/ QD-TTg signed by Deputy Prime Minister Vuong Dinh Hue on August 17.

This list includes industry giants such as seafood producer Seaprodex, oil retailer Petrolimex, textile firm Vinatex and steel group VNSteel.

The level of withdrawals varies from firm to firm, as noted in the accompanying table. Most notably, the ministry intends to sell its entire stake at Vinatex in one fell swoop next year, while dividing its sale at Vinaincon, VNSteel, and Vietnam Engine and Agricultural Machinery Corporation (VEAM) into two blocks.

Among those listed, VEAM stood out as the only firm scheduled for immediate divestment this year, aiming to slash the MoIT’s ownership to zero by 2020.

|

Established in 1990, VEAM is a major state-owned enterprise with 22 subsidiaries and 7,000 employees. The firm produces engines and agricultural machinery, including tractors and other water and inland transportation equipment. It conducted its initial public offering (IPO) last August, raising VND2.1 trillion ($92.3 million) in capital from 240 investors. This transaction went down in history as Vietnam’s biggest listing of 2016, with 30 million shares purchased by foreign investors.

Besides its divestment plans, VEAM is also scheduled to debut on the stock exchange in the third quarter of 2017, allowing investors to trade their shares publicly. When listed, VEAM is likely to become the 21st-largest public company, with 12.6 per cent of free-float shares for foreign ownership. So far, the firm is yet to find a strategic investor, even after holding four auctions post-IPO last year.

In 2016, VEAM reported VND2.3 trillion ($101 million) in revenue for the parent company, up 26 per cent from 2015. Its profit stood at VND3.8 trillion ($167 million), an increase of 13.4 per cent year-on-year. It is noteworthy that VEAM’s profit is bigger than its revenue, thanks to its holdings at various automobile firms in Vietnam. These affiliated companies have brought massive dividends throughout the years to the agricultural giant.

Specifically, VEAM currently holds a 30 per cent stake in Honda Vietnam, 25 per cent in Ford Vietnam, and 20 per cent in Toyota Vietnam. According to researchers at Saigon Securities Incorporation (SSI), without massive financial earnings from these profitable firms, VEAM’s business results in 2016 would have been even.

Analysts believed that VEAM’s dependence on lucrative dividend earnings, instead of its core agricultural business, may spell trouble for the firm in the long run. This can be a major concern for potential investors as they consider buying the MoIT’s stake at VEAM.

“Among VEAM’s 12 subsidiaries, only five reported profits last year, while three were roughly flat and four posted losses. It could be problematic for the parent company in the long term if no serious restructuring is done,” said Lien Le, head of institutional research at Maybank Kim Eng Securities.

This is more urgent as VEAM’s financial earnings from automobile firms can diminish in the coming years as these companies face stiff competition from cheaper imported cars – automobiles manufactured in the ASEAN region will enjoy zero tariffs in Vietnam from 2018 onwards.

Nguyen Ngoc Thach, head of the Retail Customer Department at SSI’s headquarters, noted that the use of machinery in agricultural production in Vietnam is expected to rise from 1.6HP to 3.2HP per hectare in 2020. VEAM then, stands a good chance to raise profits from its main business of agricultural machine production in the future, minimising its over-reliance on dividend earnings.

“Despite obvious opportunities for market expansion, VEAM still needs to ward off strong competitors China and Japan, so its growth prospects may be average,” said Thach. He expects VEAM’s share price to stabilise in the next three years.

Further details of the MoIT’s divestments at VEAM and five other firms will be updated very soon, subject to approval from the prime minister.

| RELATED CONTENTS: | |

| 406 SOEs under divestment: exciting opportunities for investors | |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Mobile Version

Mobile Version