Minor foreign activity on the radar subdued

Scores of foreign investors are willing to walk into the market if the door is opened

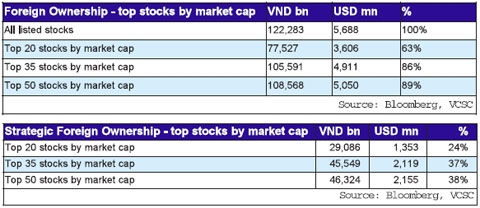

The type of investments foreigners make on the stock market tells us a lot about their strategies and what investment opportunities they see. Looking at data from Bloomberg, we find that foreigners currently own slightly more than VND122,000 billion ($5.7 billion) in Vietnamese listed equities with the vast majority of foreign funds invested in a handful of stocks.

Actually, Vietnam’s top 20 stocks by market cap captured 77 per cent of foreign investments. But, 84 per cent of all foreign investments in listed companies were in 50 stocks out of the 690 listed companies in Hanoi and Ho Chi Minh City, or 7 per cent of the listed market. Moreover, these 50 largest stocks represent an aggregate 80 per cent of the total market cap of Vietnam’s two stock markets, which means the remaining 20 per cent is divided among 640 very small companies.

Is Vietnam at risk of the flight of “hot money”?

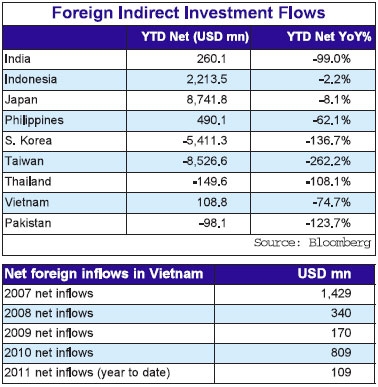

As fears over the European debt crisis and concerns of a global slowdown increased in the last few months, we heard a lot of talk about the fear of foreign hot money leaving the country. In reality, Vietnam has seen foreign net investments shrink this year. We feel the situation is not as dire as in other emerging markets where cheap money raced in last year. Year-on-year changes of year-to-date foreign capital flows are negative everywhere in Asia.

However, the year-on-year changes in Vietnam are relatively less bad and foreigners have actually continued to invest into Vietnamese capital markets. In contrast, markets like Taiwan, South Korea, Pakistan, Thailand and India have seen much larger decreases of capital inflows and some have even suffered net capital outflows.

If one was looking at the potential for hot money fleeing the country, you want to see how much strategic investors own. These kind of investors that have bought equity of larger banks, insurance and foor and beverage companies. The calculation is a bit tricky as it ultimately depends on one’s definition of what is a strategic investor.

Our methodology starts by looking at what a company classifies as a strategic investor in its annual report and by making a few subjective adjustments. We found that almost 40 per cent of foreign ownership in the largest 50 stocks belongs to strategic investors.

This is quite supportive for the market as they are typically long-term investors that could potentially increase their holdings should the opportunity arise. Foreign strategic investors continue to believe in the long-term prospects of the country, as the recent Mizhuo-Vietcombank deal reveals.

Open-ended vs closed-ended funds

Another factor when thinking of the flight of foreign investors is to realise that many funds investing here are captive and dedicated to investing in the country. Also, currently there is still a large portion of these foreign funds that are closed-ended funds. It is very difficult to calculate the attribution between open- and closed-ended funds as many of the funds invested in Vietnam are not public and do not disclose information outside their shareholder circle.

That being said, we estimate roughly that 70 per cent of funds are closed-ended, 20 per cent are open-ended and 10 per cent are exchange traded funds (ETFs). Although, this may change as we know several closed-ended funds could turn into open-ended funds in the next 18 months, these figures are still supportive for the markets.

So why aren’t there more foreign investors in Vietnam?

The short-term global investors are waiting for more concrete improvements in Vietnam’s macroeconomic picture before stepping in. Particularly, inflation controls and stability will need to be reached to compete with regional peers as a destination for foreign capital.

But, the level of concentration of foreign investments we see in a small portion of available listed companies is also an indication of the real opportunities Vietnam’s capital markets offer them.

Despite the fact that the markets have grown in terms of numbers of listed companies and in terms of total market cap, the growth in aggregate market cap came from only a few key companies, and the reality is that the vast majority of initial public offerings have been very small. What we have now in Vietnam’s capital markets is a disproportion of orphaned stocks, stocks that are largely ignored by research analysts because they are too small or in out-of-favour sectors.

Another limiting factor to foreign investment activity and the potential for new foreign funds coming into the country is the lack of liquidity, as either the shares available for foreigners are scarce or the available float is relatively small as the state continues to hold large positions. The size of investment opportunities and changes the foreign limit could help attract foreign capital into the stock market.

Hopefully the reform of state-owned enterprises, especially the equitisation of economic giants including Vietnam Airlines, MobiFone and Vinaphone will provide the size of investment opportunities foreigners are looking for. Concurrently, foreigners want to see the state selling larger stakes of these companies to help improve corporate governance and operational efficiencies.

*Director, Research Department, VietCapital Securities (VCSC)

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version